by Calculated Risk on 3/16/2009 03:21:00 PM

Monday, March 16, 2009

Report: Mortgage Fraud Increased in 2008

Update: Housing Wire has more: Mortgage Fraud at All-Time High: Report

This report appears to deal with Fraud for Housing, and not Fraud for Profit (what most people think of as mortgage fraud).

From Dina ElBoghdady at the WaPo: Mortgage Fraud Rises Even as Loans Decline

Mortgage fraud rose last year even though fewer loans were issued nationwide ... Fraud jumped by 26 percent in 2008 from the previous year, the study concluded, based on data collected from roughly 70 percent of the nation's lenders as well as mortgage insurance companies and mortgage investors. The study was prepared by the Mortgage Asset Research Institute, an arm of LexisNexis, for the Mortgage Bankers Association.Historically there have been two types of mortgage fraud: fraud for housing, and fraud for profit. The MBA/MARI report focuses on fraud for housing (and that probably includes refinance fraud because borrowers are desperate).

...

"With fewer loan originations today, the data suggest that the economic downturn may have created more desperation, causing more people than ever before to try to commit mortgage fraud," said Denise James, one of the study's authors.

The most common type of fraud continues to be application misrepresentation, which includes falsifying a borrower's income. That kind of fraud represented about 61 percent of all the reported cases last year, followed by fraud on tax returns and financial statements. The volume of reported fraud related to credit reports dropped from 9 percent to 4 percent in the past year.

...

The study noted that the spike in fraudulent activity cases can be partially attributed to more vigorous reporting and investigations.

Tanta explained this well: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. It may require some collusion by the loan originator or appraiser, but it may not. It is usually the least expensive kind of fraud to lenders and investors, since the goal is getting (and keeping) the property, so the borrower is at least usually motivated to make the payments. The problems come about, of course, because these borrowers failed to qualify honestly for a reason. Borrower-initiated fraud loans may be considered “self-underwritten,” and such loans do have a much higher failure rate than the “lender-underwritten” ones. Their only saving grace is that the lender tends to recover more in a foreclosure than in a fraud for profit case. Penalties to the borrower rarely ever come in the form of prosecution; losing the home and becoming a subprime borrower for the next four to seven years—with the credit costs that implies—are the borrower's punishment.As Tanta noted, during the housing bubble, these two frauds merged, and that is probably not happening now. I suspect most of the fraud today is "fraud for housing" by homeowners desperate to refinance.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. If it is borrower-initiated fraud, it’s not a borrower who wants a house; it’s a borrower who wants to flip a piece of real estate or launder money or in some other way grab the cash and leave the lender holding the bag. Most of it, however, is initiated by a seller, real estate broker, lender, or closing agent (or all of them in collusion). It generally requires additional collusion by bribable appraisers, although it can certainly be initiated by a corrupt appraiser looking for a kickback, or can merely take advantage of a trainee or gullible appraiser. This is the flip scam, straw borrower, equity skimming, misappropriation of payoff funds, identity theft kind of fraud. It may not be as common as fraud for housing, at least in some markets, but it’s much, much more expensive to the bagholder. At minimum, the fraud-for-housing borrower wants to take clear, merchantable title to the property and maintain it at an acceptable level. That’s either unnecessary expense or (in the case of title) a hurdle to be gotten over by the fraud-for-profit participant.

NAHB Housing Market Index Still Near Record Low

by Calculated Risk on 3/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Unchanged In March

Builder confidence in the market for newly built single-family homes remained unchanged in March as economic woes continued to take their toll on potential buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI held steady at 9 in March, marking a fifth consecutive month of single-digit readings.

“Home builders are hopeful that the recent economic stimulus package, and particularly the first-time home buyer tax credit that it included, will have a positive impact on consumer behavior and home sales as the prime home buying season gets underway,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “But it’s still too soon to tell how much of an impact that will be, especially as builders find potential buyers are reluctant because of uncertainty about their future job security and the overall economic outlook.”

“The economy continues to be the main drag on home sales activity right now, in terms of consumer confidence across most of the country,” acknowledged NAHB Chief Economist David Crowe. “What’s more, home builders report that tight credit conditions are posing a further hurdle, especially for potential first-time buyers, while potential trade-up buyers are finding it very tough to sell their existing homes so they can make a move.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of three of the HMI’s component indexes were unchanged in March, with the index gauging current sales conditions holding at 7 and the index gauging sales expectations in the next six months holding at a record-low 15. Meanwhile, the index gauging traffic of prospective buyers declined two points to 9.

Three out of four regions saw no change in their HMI reading in March. The Midwest, South and West each held at near-record lows of 8, 12, and 5, respectively. The Northeast rose a single point from a record low of 8 in February to 9 in March.

Industrial Production and Capacity Utilization: Cliff Diving

by Calculated Risk on 3/16/2009 09:22:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Federal Reserve reported that industrial production fell 1.4% in February, and output in February was 11.2% below February 2008. The capacity utilization rate for total industry fell to 70.9%, matching the historical low set in December 1982.

This is a very sharp decline in industrial output. Industrial production is a key to the depth of the economic slowdown. Up until late last Summer the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Empire State Manufacturing Survey: "conditions deteriorated significantly"

by Calculated Risk on 3/16/2009 09:15:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated significantly in March. The general business conditions index fell to a fresh low of -38.2. The new orders and shipments indexes also dropped sharply to new record lows, and the inventories index declined to its lowest level since 2001. The indexes for both prices paid and prices received remained negative for a fourth consecutive month. Employment indexes remained close to their recent lows. Future indexes were somewhat higher than in February, but the six-month outlook continued to be very subdued, with capital spending and technology spending indexes falling to record lows.More record lows ...

Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002), so all these record lows aren't that significant.

Sunday, March 15, 2009

Sunday Night Futures

by Calculated Risk on 3/15/2009 11:59:00 PM

AIG released (pdf) a list of counterparties.

Bernanke was on 60 Minutes.

Hamilton asked "What will recovery look like?"

And CNBC reported Obama Plan for Bad Bank Assets Could Come This Week

Just another Sunday ... here is an open thread, a few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

AIG Discloses Counterparties

by Calculated Risk on 3/15/2009 08:53:00 PM

AIG released a list of Counterparties to CDS, GIA and Securities Lending Transactions (PDF) (ht David)

And from the Financial Times: AIG publishes counterparty list (ht Dwight)

AIG caved in to political pressure Sunday and released a list of some of the financial counterparties that benefited from its $160bn US government rescue, including some of Europe’s largest banks.

...

IG paid out $22.4bn of collateral related to credit default swaps, $27.1bn to help cancel swaps and another $43.7bn to satisfy the obligations of its securities lending operation. The payments were made between September 16 and the end of last year.

Goldman Sachs, which has also accepted US government support, received payments worth $12.9bn. Three European banks – France’s Société Générale, Germany’s Deutsche Bank and the UK’s Barclays – were paid the next-largest amounts. SocGen received $11.9bn; Deutsche $11.8bn; and Barclays $7.9bn.

Bernanke: The End is Near

by Calculated Risk on 3/15/2009 07:48:00 PM

Fed Chairman Ben Bernanke was interviewed on 60 Minutes tonight.

Fed Chairman Ben Bernanke was interviewed on 60 Minutes tonight.

Here is a picture of Bernanke from his college days ... his forecasting skills weren't much better then (Ok, slightly edited!)

From CBS 60 Minutes: Ben Bernanke's Greatest Challenge

"Mr. Chairman, I'm gonna start with a question that everyone wants me to ask: when does this end?" 60 Minutes correspondent Scott Pelley asked Bernanke.The transcript is available at 60 minutes.

"It depends a lot on the financial system," he replied. "The lesson of history is that you do not get a sustained economic recovery as long as the financial system is in crisis. We've seen some progress in the financial markets, absolutely. But until we get that stabilized and working normally, we're not gonna see recovery. But we do have a plan. We're working on it. And I do think that we will get it stabilized, and we'll see the recession coming to an end probably this year. We'll see recovery beginning next year. And it will pick up steam over time."

Here is the interview:

Hamilton: "What will recovery look like?"

by Calculated Risk on 3/15/2009 06:10:00 PM

Professor Hamilton provides a number of graphs on the temporal order of a recovery: What will recovery look like?

This adds to my post: Business Cycle: Temporal Order

Here is the table I provided of a simplified temporal order for emerging from a recession. The table shows when each area typically starts to recovery relative to the end of the recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

And this graph from Professor Hamilton shows the average pattern for all the recessions since 1947.

And here is what the current recession looks like. The record slump in RI has changed the scale of the graph, but the order appears the same.

For recovery, we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

Unfortunately there are reasons that RI (excess supply) and PCE (too much debt) won't rebound quickly, but they are still the areas to watch.

And here is an excerpt from a research note by Jan Hatzius, Chief Economist at Goldman Sachs, sent out this afternoon:

"Although we still think real GDP will fall by about 7% annualized in Q1 and the labor market numbers remain awful, the good news is that the weakness is shifting from more leading to more lagging sectors."(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Domestic Oil Investment to Decline Sharply in 2009

by Calculated Risk on 3/15/2009 12:18:00 PM

Here is another area of domestic non-residential investment that will slump in 2009.

From the NY Times: As Oil and Gas Prices Plunge, Drilling Frenzy Ends

The great American drilling boom is over.The following graph compares real domestic investment in petroleum and natural gas with real gasoline prices.

The number of oil and gas rigs deployed to tap new energy supplies across the country has plunged to less than 1,200 from 2,400 last summer, and energy executives say the drop is accelerating further.

Click on graph for larger image in new window.

Click on graph for larger image in new window.After the oil shock of 1973, oil exploration investment (real dollars) has tracked real gasoline prices pretty closely.

This graph shows oil investment in 2000 dollars. Investment in 2008 was $138 billion in nominal dollars.

The recent rapid decline in gasoline prices suggests investment in petroleum and natural gas exploration and wells could decline by 1/3 or more in 2009 from the $138 billion invested in 2008. This is another area of non-residential structure investment that will decline sharply in 2009 - along with investment in offices, malls and hotels.

Note: Real gasoline prices are annual prior to 1980. The gasoline data is from the EIA.

FSA urges Global Crackdown on Shadow Banking System

by Calculated Risk on 3/15/2009 10:22:00 AM

From The Times: Lord Turner demands global crackdown on bank excess

A BLUEPRINT for international financial regulation will be unveiled this week, leading the way for a global crackdown on the shadow banking system and high-risk trading strategies.

Lord Turner, chairman of the Financial Services Authority (FSA), will publish a paper on Wednesday outlining the regulator’s responses to the global financial crisis.

The proposals are expected to form the cornerstone of international efforts to overhaul the global regulatory system ... [Turner] wants more co-ordination between regulators and central banks to spot signs that economies are overheating.

He will launch a clampdown on the shadow-banking system — including the off-balance-sheet funding vehicles set up by banks in tax havens.

Further regulation of hedge funds is expected ...

Banks that offer big bonuses to traders who deal in risky assets could be obliged to hold more capital. Retail banks, which hold savers’ money, could also face restrictions on the investments they make through their treasury operations.

...

“You are going to see a massive change in the supervisory system. It’s going to include tax havens and institutions where it didn’t before,” [Prime Minister Gordon Brown] said.

Saturday, March 14, 2009

Roubini: "Reflections on the latest sucker’s rally"

by Calculated Risk on 3/14/2009 09:45:00 PM

The linked post is very long ... long even by Roubini standards! This is actually a short excerpt ...

From Nouriel Roubini: Reflections on the latest dead cat bounce or bear market sucker’s rally

It is déjà vu all over again. We have already seen this Groundhog Day movie at least six times over and over again in the last year or so: the market starts to rally – this time around about 8% in a week - and the chorus of optimists starts to say that this is the bottom of the economic and financial crisis and that we are at the beginning of a sustained stock market rally that signals the true end of this bear market.Next Roubini outlines what he sees as the arguments of the optimists:

[H]ere are the arguments of the optimists:My main interest is in point #1 - economic activity - and Roubini quotes a post he wrote on March 2nd. (See Roubini's post for his discussion of the other 3 points.

1. While the first derivative of economic activity is still negative the second derivative is becoming positive around the world: i.e. output, employment, demand etc. are still contracting but they are – or will soon be - contracting at a slower rate than in Q4 of 2008. As long as the second derivative is positive rather than negative economic activity will bottom out some time in H2 of 2009 and the recession will be over sooner rather than later.

2. The policy stimulus, both monetary but especially fiscal, in the US, China and the rest of the world is starting to have traction and will contribution to the slowdown in the rate of economic decline and eventually –sooner rather than later – contribute to the economic recovery

3. Stock markets have already fallen in the US and globally by over 50% and are now way oversold. Earnings have fallen a lot but will recover soon as economic activity will soon stabilize. And since stock markets are forward looking and bottom out 6 to 9 months before the end of the recession we must be now at the bottom if the economy will recover by H2 or, at the latest, by year end.

4. Banks and financial stocks are way oversold; Citi, JP Morgan, Bank of America and other banks are now saying that they will be profitable this year and that they will not need any further injection of capital by the government. The financial system is solvent and the undershooting of banks’ equity prices was way too excessive.

Let us explain again – as we discussed most of these points here before – and flesh out in more detail why each of these optimistic arguments is incorrect or, at least, too early and exaggerated.

"For those who argue that the second derivative of economic activity is turning positive (i.e. economies are contracting but a slower rate than in Q4 of 2008) the latest data don’t confirm this relative optimism. In Q4 of 2008 GDP fell by about 6% in the US, 6% in the Eurozone, by 8% in Germany, by 12% in Japan, by 16% in Singapore and by 20% in South Korea. So things are even more awful in Europe and Asia than the US ...As usual Professor Roubini makes some strong arguments. And I agree that economic activity is contracting in Q1 2009 at about the same pace as in Q4 2008. However, I think the composition of the contraction is different in Q1 (and following the normal business cycle). Most of the real GDP decline in Q1 will be from slumping investment and an inventory correction, whereas in Q4, declines in personal consumption (PCE) were an important contributor to the economic slump.

First, note that most indicators suggest that the second derivative of economic activity is still sharply negative in Europe and Japan and close to negative in the US and China: some signals that the second derivative was turning positive for US and China (a stabilizing ISM and PMI, credit growing in January in China, commodity prices stabilizing, retail sales up in the US in January) turned out to be fake starts. For the US, the Empire State and Philly Fed index of manufacturing are still in free fall; initial claims for unemployment benefits are up to scary levels suggesting accelerating job losses; the sales increases in January is a fluke (more of a rebound from a very depressed December after aggressive post-holiday sales than a sustainable recovery).

For China the growth of credit in China is only driven by firms borrowing cheap to invest in higher returning deposits not to invest; and steel prices in China have resumed their sharp fall. The more scary data are those for trade flows in Asia with exports falling by about 40 to 50% in Japan, Taiwan, Korea for example. Even correcting for the effect of the new Chinese Year exports and imports are sharply down in China with imports falling (-40%) more than exports. This is a scary signal as Chinese imports are mostly raw materials and intermediate inputs; so while Chinese exports have fallen so far less than the rest of Asia they may fall much more sharply in the months ahead as signaled by the free fall in imports.

With economic activity contracting in Q1 at the same rate as in Q4 a nasty U-shaped recession could turn into a more severe L-shaped near-depression (or stag-deflation) as I argued for a while (most recently in my Sunday New York Times op-ed). The scale and speed of syncronized global economic contraction is really unprecedented (at least since the Great Depression) with a free fall of GDP, income, consumption, industrial production, employment, exports, imports, residential investment and, more ominously, capex spending around the world. And now many emerging market economies – as argued here for a while- are on the verge of a fully fledged financial crisis starting with Emerging Europe."

Maybe PCE will start cliff diving again, but so far the recession (no matter how severe) is still following the normal temporal pattern. Note: Even the Great Depression followed the normal pattern - just more so! Although there are still severe economic problems ahead, I think the shift in the composition is a potential positive. (See: Business Cycle: Temporal Order)

It is still way to early to call the bottom - and even after the economy bottoms, I think the recovery will be very sluggish for some time - but I am watching for the signs (see Looking for the Sun). Roubini concludes:

So, in conclusion and caveat emptor for investors: Dear investors, do enjoy this dead cat bounce and bear market sucker’s rally ... don’t wait too long until you jump ship while the financial Titanic hits the next financial iceberg: you may get squeezed and crashed in the rush to the lifeboats.

Inventory Correction

by Calculated Risk on 3/14/2009 05:35:00 PM

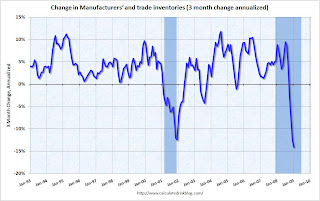

The recent data suggests there is a significant inventory correction in progress. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is based on the Manufacturing and Trade Inventories and Sales report from the Census Bureau.

This shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

This change in inventories will probably have a significant impact on GDP for the next few quarters. This is common in a recession. The contribution of changes in inventory to GDP have been pretty wild at times - in the early '80s there were a few quarters where the change in inventory subtracted more than 5% from GDP (annualized) in just one quarter! Something like that could happen in Q1 or Q2 too - and this is difficult to predict - and that could contribute to a horrible GDP number in Q1.

This inventory correction is probably also impacting imports and could be part of the reason import traffic has fallen off a cliff (see LA Port Import Traffic Collapses in February)

The good news is a significant inventory correction will help with GDP later in the year. Even with some evidence of stabilization in personal consumption, I expect a horrible GDP number for Q1 due to this inventory correction and also because of the sharp decline in all categories of investment (especially non-residential investment).

G20: Key is Value of Assets on Banks’ Balance Sheets

by Calculated Risk on 3/14/2009 03:22:00 PM

Here is the G20 statement. Excerpt:

Our key priority now is to restore lending by tackling, where needed, problems in the financial system head on, through continued liquidity support, bank recapitalisation and dealing with impaired assets, through a common framework (attached). We reaffirm our commitment to take all necessary actions to ensure the soundness of systemically important institutions.And from the "common framework":

We, the G20 Finance Ministers and Central Bank Governors, agreed the need to continue working together to maintain and support lending in our financial systems. We are committed to taking decisive action, where needed, and to use all available tools to restore the full functioning of financial markets, and in particular to underpin the flow of credit, both domestically and globally.The rest is general, but it keeps coming back to how to value the toxic assets on the banks' balance sheets.

Actions to achieve this may include where necessary:providing liquidity support, including through government guarantees to financial institutions’ liabilities; injecting capital into financial institutions; protecting savings and deposits; and, strengthening banks’ balance sheets, including through dealing with impaired assets.

Our key priority now is to address the uncertainties around the value of assets held on banks’ balance sheets, which are significantly constraining banks’ lending. This uncertainty, and the extent to which banks are holding capital to protect themselves from further potential extreme losses, is preventing them from restoring lending to business and households, with damaging consequences to our economies.

emphasis added

G-20: No Call for Stimulus

by Calculated Risk on 3/14/2009 09:15:00 AM

From the WSJ: G-20 Won't Call for More Stimulus

Finance ministers and central bank heads from the group of 20 leading economies won't make a joint call for further fiscal stimulus at the end of their two-day meeting here ...The G-20 Finance Ministers are meeting today in preparation for the April 2nd summit of national leaders in London. Geithner is expected to hold a briefing around mid-day ET after the G-20 talks.

Separately, officials will lay out a set of principles on how to address the toxic assets weighing on banks' balance sheets ... The person said the principles will likely be included in an annex to the communique officials will release after today's meeting.

The U.S. plans to release details of its plan to use public and private money to ease the burden of toxic assets in the coming weeks, but European governments are likely to want more detail even sooner ...

It doesn't sound like there will be a coordinated fiscal stimulus policy as some had hoped for.

Friday, March 13, 2009

Friday is Cancelled

by Calculated Risk on 3/13/2009 09:19:00 PM

I guess the FDIC needed a break!

David Letterman: Andy Kindler visits with Maria Bartiromo and Paul Krugman

Enjoy the evening ...

LA Port Import Traffic Collapses in February

by Calculated Risk on 3/13/2009 06:03:00 PM

Earlier today the Census Bureau reported that both imports and exports continued to decline in January. But February is looking even worse. Last week China reported exports had collapsed in February. And from the Journal of Commerce Online today: St. Petersburg TEU Traffic Plunges

The First Container Terminal in St. Petersburg, Russia’s biggest box terminal, reported traffic in February plunged 27.3 percent from a year ago as imports collapsed.Now we have data from the Port of Los Angeles for February (usually I wait until Long Beach reports too and combine the two ports, but this collapse is stunning).

The terminal handled 61,301 TEUs in February, taking volume for the first two months of the year to 124,608 TEUs, a drop of 24.7 percent on the same period in 2008.

The decline “is a direct result of the unfolding economic downturn which is affecting Russian importers in every possible way,” said Egor Govorukhin, vice president sales and marketing at National Container Co., the terminal’s owner.

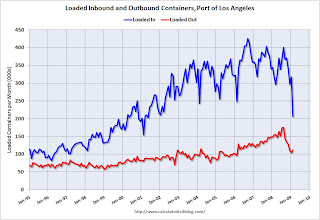

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 35% below last February and 35% below last month.

The Port of Los Angeles put up a special message explaining the collapse:

Contributing factors:We have to be careful because of the impact of the Chinese New Year on trade, but it does appear trade collapsed in February.Continued worldwide economic crisis contributing to a decline in trade volumes.

Consumer sales are down due to high unemployment rates. 15 less vessel calls this February due to this decline and the consolidation of services in order to fill up the existing services. Chinese factories closed for an extended periods of time (beyond the normal time period) for Chinese New Year. Due to the lack of volume and Chinese New Year, Maersk 6700 TEU/week vessel did not make any calls in LA during the month of February (which is traditionally a low volume month). Anticipate this year’s volumes will continue to be below last year’s volumes because sales are still slow with most economists predicting there will not be any recovery before the second half of the year.

Stock Market: Another Up Day

by Calculated Risk on 3/13/2009 04:21:00 PM

While we wait for the FDIC on Friday the 13th ... the S&P 500 is now up 11.8% from the lows. Here are a couple of graphs: Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P is just above the closing low of last November.

Report: BankUnited Halts Attempts to Raise Capital

by Calculated Risk on 3/13/2009 02:27:00 PM

Another Bank Failure Friday tease ...

BankUnited has apparently halted efforts to find a buyer or raise capital according to TheDeal.com (ht Brian) citing unnamed sources. According to the story, the move suggests the FDIC is preparing to seize BKUNA.

Report: 200 FDIC Agents Arrive in Puerto Rico

by Calculated Risk on 3/13/2009 12:33:00 PM

Since it is Bank Failure Friday, this is just an early tease ...

From the Caribbean Business: FDIC agents here checking several banks (ht David)

Financial Commissioner Alfredo Padilla admitted Friday that some 200 Federal Deposit Insurance Corp. (FDIC) agents were in Puerto Rico but said it was not to close a bank but to check several of them.Maybe the FDIC agents just need a vacation.

Padilla said a decision was made to investigate several banks at the same time, which is why so many more agents than usual were in town.

Philly Fed State Coincident Indexes: Widespread Recession

by Calculated Risk on 3/13/2009 11:06:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 49 states in January (Louisiana was the one exception). Here is the Philadelphia Fed state coincident index release for January.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for January 2009. The indexes decreased in 49 states and increased in one, Louisiana, for the month (a one-month diffusion index of -96). For the past three months, the indexes have increased in one state, Wyoming; stayed flat in one state, Louisiana; and decreased in the other 48 states (a three-month diffusion index of -94).

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Last month (December) the number of states with increasing activity was reported as zero, but that has been revised to two. So the current month - with only one state showing increasing activity - is the record for fewest states with increasing activity.