by Calculated Risk on 2/04/2009 12:27:00 PM

Wednesday, February 04, 2009

Say what? (funny things politicians say)

Here are a couple of quotes that are making the rounds:

"Every month that we do not have an economic recovery package 500 million Americans lose their jobs."Obviously she meant 500 thousand (she corrected herself later). And it appears likely that another 500,000+ jobs were lost in January.

Speaker of the House Nancy Pelosi

“We should agree, as a world, on a monetary and fiscal stimulus that will take the world out of depression.”Mr. Brown's office issued a correction later (recession, not depression). Here is a short video:

Prime Minister Gordon Brown, Feb 3, 2009

Forecast: San Diego Office Vacancy Rate to Top 20%

by Calculated Risk on 2/04/2009 11:30:00 AM

From the San Diego Union-Tribune: Offices' vacancy outlook gloomy

[T]he latest prediction from a survey conducted by the UCLA Anderson Forecast and real estate law firm Allen Matkins ... are grim. UCLA's computer models predict that office rents will continue to decline all the way through 2010. When adjusted for inflation, they are expected to be at levels seen in the mid-1990s.This still might be too optimistic.

Occupancy also is expected to fall over the next few years. UCLA's computer models have vacancies topping out at 22 percent by the end of 2010.

Today, office vacancies range from 14 percent to 17 percent, according to reports from local commercial brokers.

ISM Non-Manufacturing Index Shows Contraction

by Calculated Risk on 2/04/2009 10:03:00 AM

From the Institute for Supply Management: January 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 42.9 percent in January, 2.8 percentage points higher than the seasonally adjusted 40.1 percent registered in December, indicating contraction in the non-manufacturing sector for the fourth consecutive month, but at a slightly slower rate. The Non-Manufacturing Business Activity Index increased 5.3 percentage points to 44.2 percent. The New Orders Index increased 2.7 percentage points to 41.6 percent, and the Employment Index decreased 0.1 percentage point to 34.4 percent. The Prices Index increased 6.4 percentage points to 42.5 percent in January, indicating a decrease in prices from December. According to the NMI, two non-manufacturing industries reported growth in January. Respondents are concerned about the global economy and the continued decline in business and spending."This is a weak report. The service sector is still contracting but at a slightly slower pace than in December. The employment numbers remain especially weak.

Corus: One-third of Outstanding Loans Nonperforming

by Calculated Risk on 2/04/2009 09:23:00 AM

From the WSJ: Condo King Corus Weighs Its Options (hat tip James)

Corus Bankshares ... reported a $260.7 million quarterly loss late Friday and said that more than one-third of its $4.1 billion in outstanding loans were nonperforming. Amid what it called a "precipitous decline" in property values, the Chicago lender also warned that banking regulators may soon strip Corus of its standing as a well-capitalized bank and impose higher cash requirements.Another candidate for Bank Failure Fridays. Corus is heavily exposed to condos and Construction & Development (C&D) loans. When the interest reserves run dry, these deals blow up. And down goes the lender ...

...

Corus is one of the few lenders to report that the Treasury Department intends to reject the bank's application for funds from the ... TARP.

...

While it has been clear for months that thousands of condo projects were doomed, the full impact on financial institutions is only now being felt. Construction loans were structured with "interest reserves," provisions that gave developers funds to pay interest until the projects were complete. Now that projects are completed and failing to sell, the loans are going into default.

...

Corus has about $2 billion in unfunded construction commitments and that in the event of a federal takeover, regulators wouldn't be obligated to fund these commitments.

Late Night Thread

by Calculated Risk on 2/04/2009 12:10:00 AM

An open thread and a few posts today you might want to read:

With graphs on the rental vacancy rate, homeowner vacancy rate, and homeownerhip rate.

The economic outlook is grim. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but a few areas will probably finally hit bottom.

An update from bacon_dreamz. Check it out. And check out the map of where the Mortgage Pigs have gone!

Tuesday, February 03, 2009

Update: Tanta Scholarship Fund

by Calculated Risk on 2/03/2009 09:28:00 PM

A word from bacon_dreamz:

I would like to thank everyone for the very generous response we have received to Tanta’s memorial scholarship and bench fund at ISU. There have been a large number of donations totaling just over $20,000 to date, and all of them are very greatly appreciated. The bench has already been purchased and will be placed on the ISU campus this spring (where Tanta’s parents will be able to visit it whenever they like), and the scholarship itself is very nearly fully endowed, so I’m hopeful that the first award will be next spring.Note from CR: To be fully endowed, The Doris Dungey Endowed Scholarship Fund at Illinois State University needs another $1,500 or so (I've dropped a few bills in the kitty today).

Tanta’s family has been very touched by the kindness and generosity of everyone here (as have I), and I know they have found comfort in the fact that she touched so many lives so deeply. My sincerest thanks to all of you for helping to make this happen in her memory.

Tanta_Vive!

Donations can be made at the link below by entering "Doris Dungey Endowed Scholarship" in the Gift Designation box. Checks made out to the ISU Foundation with “Doris Dungey” in the memo can also be mailed to:

attention: Mary Rundus

Illinois State University, Campus Box 8000

Normal, IL 61790.

http://www.development.ilstu.edu/credit/credit.phtml?id=8000

Also here is map of where the Mortgage Pigs are (from Tanta's brother-in-law):

Click on graph for larger image in new window.

Click on graph for larger image in new window.No Pigs in Florida?

A special thanks to bacon_dreamz for setting up the Scholarship Fund.

For much more on Tanta - tributes, charities, her writing - please see Tanta: In Memoriam

All my to best to everyone, CR

Looking for the Sun

by Calculated Risk on 2/03/2009 06:47:00 PM

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.

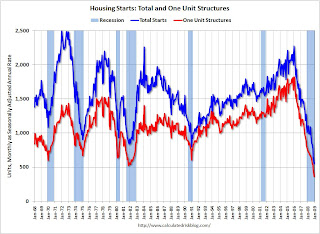

Look at these three charts of Cliff Diving: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

Based on the sales reports today from Ford, GM, Toyota and Chrysler, it looks like vehicle sales were below 10 million units (SAAR) for the first time since the early '80s. My estimate is vehicle sales were at a 9.2 million SAAR in January. Ouch! The second cliff diving graph shows New Home Sales for the last 45 years.

The second cliff diving graph shows New Home Sales for the last 45 years.

Sales of new one-family houses in December 2008 were at 331 thousand (SAAR). This is the lowest level ever recorded by the Census Bureau (data collection started in 1963).

And the third graph shows total and single family housing starts since 1959.  Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

And none of this data is adjusted for changes in population.

No sunshine here. But wait ... we all know this cliff diving will stop sometime, and probably not at zero.

First, look at auto sales ... This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

The estimated ratio for January is 27 years, by far the highest ever. The actual in December was close to 24 years. This is an unsustainable level, and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of an increase in sales. (For more analysis, see: Vehicle Sales)

This suggests vehicle sales have fallen too far. And if vehicle sales just stablize, the auto companies can stop laying off workers, and the drag on GDP will stop.

New home sales is a little more difficult because of the huge overhang of excess inventory that needs to be worked off. But some people will always buy new homes, and we can be pretty sure that sales won't fall another 270 thousand in 2009 (like in 2008), because that would put sales at 60 thousand SAAR in December 2009. That is not going to happen.

So, at the least, the pace of decline in new home sales will slow in 2009. More likely sales will find a bottom - to the surprise of many.

And we know for certain that single family starts will not fall as far in 2009 as in 2008, because starts can't go negative! So, once again, the pace of decline will at least slow. And more likely starts will find a bottom too (although any rebound will be weak because of the excess inventory problem).

Even though most of the economic news will be ugly in 2009, my guess is all three of these series will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

Markopolos's Testimony to Congress on Madoff and the SEC

by Calculated Risk on 2/03/2009 06:17:00 PM

Harry Markopolos will testify before Congress tomorrow regarding his many attempts to get the SEC to investigage Madoff.

From the WSJ: Madoff Whistle-Blower Cites 'Abject Failure' by Regulatory Agencies

Harry Markopolos, an independent fraud investigator, said in more than 300 pages of testimony before a House committee that he was repeatedly ignored or given the brush-off by SEC officials.Here is Markopolos' prepared testimony. Fascinating reading.

...

In the documents provided to the committee, he describes his efforts, which began as early as 1999, like a military intelligence operation. Mr. Markopolos said he and his team of investigators collected "intelligence reports from field" operatives and developed networks of contacts to provide information on Mr. Madoff's operation and the feeder funds that allegedly contributed to the Ponzi scheme.

The Residential Rental Market Update

by Calculated Risk on 2/03/2009 03:01:00 PM

Last month I provided an overview of the Residential Rental Market. Here is an update based on the Q4 2008 housing data from the Census Bureau.

See this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been almost 4.1 million units added to the rental inventory. Note: please see caution on using this data - this number is probably too high, but the concepts are the same even with a lower increase.

This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 10.1% in the most recent quarter).

Where did these approximately 4.1 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.05 million units completed as 'built for rent' since Q2 2004. Although we don't have the Q4 2008 data yet, we know completions were pretty low in Q4, so this means that another 3.0 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Although there are several factors increasing the supply, I believe the main factors are a surge in REO sales to cash flow investors, and frustrated sellers putting their homes up for lease. This is increasing the supply of rental properties, and is finally pushing down rents in many areas.

A caution on Housing Vacancies and Homeownership report

by Calculated Risk on 2/03/2009 02:59:00 PM

This morning the Census Bureau released the Housing Vacancies and Homeownership for Q4 2008. This is a very useful report, and earlier I posted graphs of the decline in the homeownership rate, and changes in the homeowner and rental vacancy rates.

Nerd alert: I've mentioned this before, but as a reminder readers should use caution when using the Estimates of the Housing Inventory. The homeownership and vacancy rates come from a survey of a sample of households, but the inventory data is based on two year old housing unit controls. See the discussion at the bottom of Table 4. Estimates of the Total Housing Inventory

The totals shown above have a two-year time lag (4Q2007 uses 2005 housing unit controls from Population Division, which are projected forward and 4Q2008 uses 2006 housing unit controls from Population Division which are projected forward).We can clearly see the inventory increases are too high for 2007 and 2008. First, the inventory each year increases by the number of housing units completed, minus scrappage and net manufactured homes added (a few scrapped housing units may be rehab'd, but that is minor).

The Census data shows inventory increased by 1.998 million in 2007, and 2.191 million in 2008. These numbers are based on two year old housing unit controls and are clearly way too high. Total completions in 2007 were 1.502 million (plus 95 thousand manufactured homes) and completions were 1.116 million in 2008. Add in some scrappage, and the housing inventory probably increased by less than 1 million in 2008 (less than half the amount the Census Bureau reported this morning).

This is just a reminder that users should use caution when using the inventory numbers.