by Calculated Risk on 6/03/2008 10:01:00 PM

Tuesday, June 03, 2008

Hovnanian Reports Huge Loss

Here are some words that shareholders hate:

"We expect to persevere ..."Expect? Oh yeah, that inspires confidence.

CEO Ara K. Hovnanian, June 3, 2008

From Reuters: Hovnanian reports 2Q loss grows tenfold (hat tip barely)

[T]he company reported a net loss of $340.7 million, or $5.29 per share, for the quarter that ended April 30. This compared with a loss of $30.7 million, or 49 cents per share, for the same period a year ago.Ouch. That is much worse than expected.

And the little bit of good news:

Hovnanian's contract cancellation rate, excluding the joint ventures, improved to 29 percent from 38 percent last quarter and 32 percent in last year's second quarter.

Click on graph for larger image in new window.

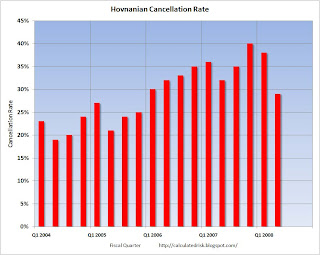

Click on graph for larger image in new window.This graph shows the Hovnanian cancellation rate by quarter since 2004 (note that Hovnanian just finished fiscal Q2 2008).

The cancellation rate is now declining after peaking last year at 40%. One of the key reasons to track cancellation rates is to estimate the error in the Census Bureau numbers. Since it takes about 6 months to build a home, the usual comparison is current quarter vs. 6 months ago. The cancellation rate is declining (from 40% to 29%) and that suggests that the Census Bureau is currently underestimating sales.

Note that Hovnanian's cancellation rate was in the 20% range during the boom years (Toll Brothers' cancellation rate was running around 4.5% in 2004). The cancellation rate tends to be builder specific because of different down payment and pre-qualification requirements.

Northern Ireland: Bursting the Bubble

by Calculated Risk on 6/03/2008 06:22:00 PM

Here is an update on the Ireland housing market from UTV Insight:

Part I: (8 minutes)

Part II: (8 minutes)

Part III: (8 minutes):

A "Tsunami of REOs"

by Calculated Risk on 6/03/2008 04:11:00 PM

From Peter Tong at the LA Times: Foreclosures lead a town's downturn

It wasn't long ago that Andy Krotik was selling houses to out-of-town investors who would sometimes buy two at a time.For some of these fairly isolated communities, it will probably take years to absorb all the excess inventory built during the boom.

Now, Krotik spends his days warily entering abandoned houses, checking for angry holdouts or startled squatters. He wants to make sure the properties are empty and secure so he can sell them for the banks that have repossessed them.

"We're experiencing a tsunami of bank-owned properties," said Krotik, who has been selling real estate in this Central Valley town since 1989.

Few places in California flew as high in the real estate boom and crashed as hard as Merced.

The lead in this story reminds me of commercials on TV (circa 2005) urging homeowners to take equity out of their homes and "build an empire". I can just imagine these equity rich homeowners as "out-of-town investors", driving to Yosemite, and stopping at Merced to buy "two at a time". Ouch.

Ford, Toyota Report Lower Sales

by Calculated Risk on 6/03/2008 02:35:00 PM

This is a followup to the post this morning about GM significantly cutting production.

From the WSJ: GM, Ford Sales Plunge As Truck Demand Wanes

In May, GM sales of cars and light trucks totaled 268,892, down from 371,056 a year earlier. There were 27 selling days in May, compared with 26 a year ago. ...There is some good news: people are buying more fuel efficient cars - and the roads are noticeably less crowded where I live in SoCal.

Toyota sold 257,404 vehicles in May, compared with 269,023 a year earlier. Toyota's passenger car sales inched up 0.4% to 168,942 while light-truck sales slid 12% to 88,462. ...

Ford reported May sales of 217,268 light vehicles, compared with 258,123 a year earlier. Sales of Ford trucks and sport-utility vehicles were down 26% to 126,364, with F-series truck sales tumbling 31%.

Soros Warns on "commodity bubble"

by Calculated Risk on 6/03/2008 01:12:00 PM

From MarketWatch: Soros says commodity bubble echoes '87 climate

The investment flood into commodity indexes bears eerie similarities to the craze for portfolio insurance which led to the stock market crash of 1987, said hedge fund investor George Soros, who warned the rush into commodities has created a "bubble."

"In both cases, the institutions are piling in on one side of the market and they have sufficient weight to unbalance it," said Soros in testimony prepared for a Senate panel on energy manipulation.

"If the trend were reversed and the institutions as a group headed for the exit as they did in 1987, there would be a crash," he said.

Bernanke Concerned about Weak Dollar, Inflation

by Calculated Risk on 6/03/2008 10:49:00 AM

From Fed Chairman Ben Bernanke: Remarks on the economic outlook

On the sources of the financial turmoil:

Although the severity of the financial stresses became apparent only in August, several longer-term developments served as prologue for the recent turmoil and helped bring us to the current situation.And on the dollar and inflation:

The first of these was the U.S. housing boom, which began in the mid-1990s and picked up steam around 2000. Between 1996 and 2005, house prices nationwide increased about 90 percent. During the years from 2000 to 2005 alone, house prices increased by roughly 60 percent--far outstripping the increases in incomes and general prices--and single-family home construction increased by about 40 percent. But, as you know, starting in 2006, the boom turned to bust. Over the past two years, building activity has fallen by more than half and now is well below where it was in 2000. House prices have shown significant declines in many areas of the country.

A second critical development was an even broader credit boom, in which lenders and investors aggressively sought out new opportunities to take credit risk even as market risk premiums contracted. Aspects of the credit boom included rapid growth in the volumes of private equity deals and leveraged lending and the increased use of complex and often opaque investment vehicles, including structured credit products. The explosive growth of subprime mortgage lending in recent years was yet another facet of the broader credit boom. Expanding access to homeownership is an important social goal, and responsible subprime lending is beneficial for both borrowers and lenders. But, clearly, much of the subprime lending that took place during the latter stages of the credit boom in 2005 and 2006 was done very poorly.

A third longer-term factor contributing to recent financial and economic developments is the unprecedented growth in developing and emerging market economies. From the U.S. perspective, this growth has been a double-edged sword. On the one hand, low-cost imports from emerging markets for many years increased U.S. living standards and made the Fed's job of managing inflation easier. Moreover, currently, the demand for U.S. exports arising from strong global growth has been an important offset to the factors restraining domestic demand, including housing and tight credit. On the other hand, the rapid growth in the emerging markets and the associated sharp rise in their demand for raw materials have been--together with a variety of constraints on supply--a major cause of the escalation in the relative prices of oil and other commodities, which has placed intense economic pressure on many U.S. households and businesses.

...

The current economic and financial situation reflects, in significant part, the unwinding of two of these longer-term developments--the housing boom and the credit boom--and the continuation of the pressure of global demand on commodity prices.

The challenges that our economy has faced over the past year or so have generated some downward pressures on the foreign exchange value of the dollar, which have contributed to the unwelcome rise in import prices and consumer price inflation. We are attentive to the implications of changes in the value of the dollar for inflation and inflation expectations and will continue to formulate policy to guard against risks to both parts of our dual mandate, including the risk of an erosion in longer-term inflation expectations.It unusual for a Fed Chairman to comment so directly on the dollar, and this probably means rate cuts are off the table for now - even if the economy weakens further.

GM Reduces Production

by Calculated Risk on 6/03/2008 10:06:00 AM

“Since the first of this year, however, U.S. economic and market conditions have become significantly more difficult. Higher gasoline prices are changing consumer behavior, and they are significantly affecting the U.S. auto industry sales mix.”From the NY Times: G.M. Closing 4 Plants in Shift From Trucks Toward Cars

GM Chairman Rick Wagoner, June 3, 2008

General Motors said Tuesday that it would stop making pickup trucks and big S.U.V.s at four North American assembly plants and would consider selling its Hummer brand.More bad news for the auto industry (although shifting away from large SUVs is probably good news in the long run).

... the company ... will slash 500,000 units from the automaker’s overall production ...

"House of Pain"

by Tanta on 6/03/2008 08:31:00 AM

Several readers have sent me the link to this Milwaukee Journal Sentinel story about a wretched tale of mortgage fraud. It's worth reading, both for an understanding of how many parties need to be complicit for such a blatantly fraudulent transaction to occur, but also for the way it tracks the hardening of attitudes of the lender over time, from an initial spontaneous recognition that this borrower got fleeced but good to a later tendency to blame the victim. Kudos to the Journal Sentinel for digging into the details of this one.

Monday, June 02, 2008

Home Builder Quote of the Day

by Calculated Risk on 6/02/2008 08:47:00 PM

"We've always said we were a home builder and not a land speculator. We probably got a little bit off our basics because we were being a little greedy."A little greedy?

Larry Seay, COO, Meritage Homes, June 1, 2008

Minneapolis: Price Distribution of Distressed Homes

by Calculated Risk on 6/02/2008 04:51:00 PM

This morning I posted some graphs on the price distribution of distressed homes (short sales, REOs) in Orange County.

Here is some similar data on the Minneapolis area, from a recent report by MAAR Research Manager Jeff Allen and Aaron Dickinson: Foreclosures and short sales in the Twin Cities Housing Market (hat tip Jeff) Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just like for Orange County, there are many more distressed homes for sale at the low end; over 50% of inventory priced below $120,000 is distressed. Many of these distressed homes were probably purchased with subprime loans.

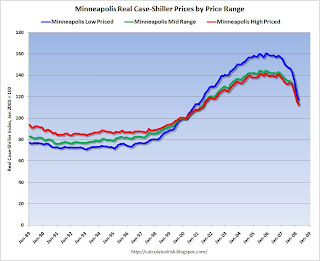

Naturally the areas with a higher percentage of distressed properties have seen faster price declines. Of course - just like for Orange County - those areas also saw the most appreciation because of loose underwriting for subprime lending. Here is a graph showing the real Case-Shiller prices in Minneapolis for three price ranges. This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

The low price range is less than $176,486 (current dollars). Prices in this range have fallen 27.0% from the peak in real terms.

The mid-range is $176,486 to $250,300. Prices have fallen 21.9% in real terms.

The high price range is above $250300. Prices have fallen 20.8% in real terms.

This is the common pattern: the low end saw the most appreciation, the most foreclosures, and now the fastest price declines. This higher distressed property activity at the low end is also distorting some of the median price measures, as Jeff and Aaron report:

[The] higher market share places a heavy downward weight on aggregate sales price figures, giving many the erroneous impression that the housing market in its entirety is seeing massive declines in value. In reality, the lender-mediated market and the traditional seller market are experiencing stark differences.I spoke with Jeff Allen today, and just like for some REOs in Oceanside, the low end REOs in Minneapolis are seeing a significant pickup in buyer interest, possibly from investors, as the lenders have started to price these homes aggressively. This suggests that prices are approaching a bottom in some of these low end areas.

As has been widely reported in recent months (including in our own research products), the median sales prices of Twin Cities homes in the first quarter of 2008 were 10.3 percent below the first quarter of 2007—a sizeable and conspicuous decline. But lost in the hub-bub—and partly because no one had the data until now—is that the traditional sales market that does not include foreclosures and short sales saw only a 3.9 percent decline in median sales price during the same time period.