by Calculated Risk on 11/02/2007 08:48:00 PM

Friday, November 02, 2007

Citi CEO to Resign

Time for a new thread ...

From the WSJ: Citigroup CEO Plans to Resign As Losses Grow (hat tip many!)

MarketWatch version: Citi board gathering for emergency meeting

Special hat tip to Barley who broke the news:

Prince at Citi cancels speaking engagements on Sunday

Barley | 11.02.07 - 3:43 pm |

UPDATE: By popular request ... the following is from one of my original posts (in Feb 2005):

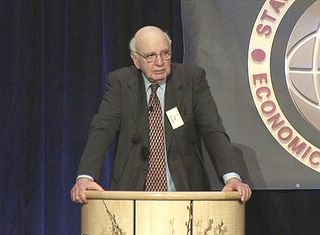

Former Fed chief Paul Volcker spoke last week at the second annual summit of the Stanford Institute for Economic Policy Research. In his keynote speech he warned that the nation is facing 'huge imbalances and risks'.

Here is a video of the speech.

Paul Volcker, Stanford, Feb 11, 2005

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."

Citi to Hold Emergency Board Meeting

by Calculated Risk on 11/02/2007 04:29:00 PM

From WSJ: Citi to Hold Emergency Board Meeting

Citigroup Inc. board members are expected to gather for an emergency meeting this weekend ...The music has stopped.

It wasn't immediately clear what the meeting would address, but the subject of further writedowns could come up.

S&P cuts D.R. Horton, Pulte Debt to Junk

by Calculated Risk on 11/02/2007 01:02:00 PM

From Reuters: S&P cuts D.R. Horton, Pulte debt into junk territory

Standard & Poor's ... cuts its ratings on D.R. Horton Inc and Pulte Homes Inc into junk territory, citing the vulnerability of the home builders to the deteriorating housing market and macroeconomic conditions.No surprise.

...

The outlook for both companies is negative, indicating an additional cut is likely over the next two years.

Chrysler: Long Walk on a Short Pier

by Calculated Risk on 11/02/2007 10:44:00 AM

From The Economist: Chrysler: That shrinking feeling

WHEN private equity and America’s ailing car industry meet there is only one likely outcome. On Thursday November 1st, just days after hourly workers narrowly ratified a new contract, Chrysler announced plans to drop four slow-selling models, slash overall production and trim perhaps some 12,000 hourly and salaried jobs. The job cuts amount to as much as 15% of the carmaker's total workforce.Chrysler's future is clearly uncertain, but not mentioned in the article are the $10 Billion in pier loans (bridge loans that couldn't be sold) sitting on the balance sheets of Goldman Sachs, Bear Stearns, Morgan Stanley and Citigroup. If Chrysler defaults, the pain will be significant.

...

Whether the latest round of cuts is enough to stabilise Chrysler is uncertain. Not only is its market contracting but Chrysler has also failed to score any significant hits with its recent new products other than with a four-door version of the small Wrangler SUV. If anything the carmaker will have to eliminate even more products, if sales don’t pick up. That, in turn could lead to still more job cuts in the future. And so the cycle is set to continue.

MMI: Elevated Threat

by Tanta on 11/02/2007 09:44:00 AM

It has been a while since we measured distress level in the credit markets by a shallow survey of goofiness in the news. Since we have already noted solemnly the important news of the day--jobs report didn't smell bad--let us descend to news of the weird:

Mark to model? How about mark to flea market? "Prepare for the credit drama sequel" by stocking up on beaver pelts and glass beads.

Put on your blast goggles before you read this blinding flash of obvious: "Jump in foreclosure could hurt prices." Also, "contagion" is back.

But not to worry, it's not that contagious:

The soaring price of oil has yet to have a crippling effect on the economy, and inflation and unemployment figures remain in check, suggesting the economy is relatively healthy, despite the disastrous effects of the subprime collapse in the housing and lending arenas.I don't know; what that means either, but fallout from the quagmire of the bad bets doesn't sound good.

Bad bets on subprime mortgages have placed the financial sector in its current quagmire, not a lack of liquidity, and in the midst of sorting out the fallout from those decisions; it does not appear that Fed rate cuts are having the desired effect of propping up the flagging industry.

October Employment Report

by Calculated Risk on 11/02/2007 08:33:00 AM

From MarketWatch: October job growth strongest since May

Shaking off fears about weakness in housing and credit, the U.S. economy created 166,000 net jobs in October, the best job growth since May, the Labor Department reported Friday.Here is the BLS report. The unemployment rate was steady at 4.7%.

...

However, a separate survey of 60,000 households showed a loss of 250,000 workers, the third decline in the past four months. Economists say the payroll survey is more accurate, while acknowledging that it may not work as well when the economy is at a turning point.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 21,500 in October, and including downward revisions to previous months, is down 221.9 thousand, or about 6.5%, from the peak in March 2006. (compare to housing starts off 30%+).

Note the scale doesn't start from zero: this is to better show the change in employment.

The initial benchmark revision shows the loss of an additional 8,000 construction jobs, but the initial report doesn't breakout residential construction.

Overall this is a stronger than expected report.

Thursday, November 01, 2007

Advance Q3 MEW Estimate

by Calculated Risk on 11/01/2007 10:00:00 PM

Based on the Q3 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $520 Billion (SAAR) or 5.1% of Disposable Personal Income (DPI). This would be slightly higher than the Q2 estimates, from the Fed's Dr. Kennedy, of $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

The actual Q3 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for December 6th for Q3).  Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.90, R2 = 0.81) but there are differences quarter to quarter. This does suggest that MEW was at about the same level in Q3 as Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the Q4 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a slowdown in consumption expenditures is likely.

Here are the Seasonally Adjusted Annual Rate (SAAR) Kennedy-Greenspan estimates of home equity extraction through Q2 2007, provided by James Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Music for the Market

by Calculated Risk on 11/01/2007 03:59:00 PM

| Steely Dan "Black Friday" "When Black Friday comes I'll stand down by the door And catch the grey men when they Dive from the fourteenth floor When Black Friday comes I'll collect everything I'm owed And before my friends find out I'll be on the road" |

NY AG sues First American

by Calculated Risk on 11/01/2007 11:53:00 AM

Here is the NY AG press release: NY ATTORNEY GENERAL SUES FIRST AMERICAN AND ITS SUBSIDIARY FOR CONSPIRING WITH WASHINGTON MUTUAL TO INFLATE REAL ESTATE APPRAISALS (hat tips Londonernow, REBear)

Attorney General Andrew M. Cuomo today announced that he is suing one of the nation’s largest real estate appraisal management companies and its parent corporation for colluding with the largest savings and loan in the country to inflate the appraisal values of homes.

In a scheme detailed in numerous e-mails, eAppraiseIT (“EA”), a subsidiary of First American Corporation (NYSE: FAF), caved to pressure from Washington Mutual (“WaMu”) (NYSE: WM) to use a list of preferred “Proven Appraisers” who provided inflated appraisals on homes. The e-mails also show that executives at EA knew their behavior was illegal, but intentionally broke the law to secure future business with WaMu.

“The independence of the appraiser is essential to maintaining the integrity of the mortgage industry. First American and eAppraiseIT violated that independence when Washington Mutual strong-armed them into a system designed to rip off homeowners and investors alike,” said Attorney General Cuomo. “The blatant actions of First American and eAppraiseIT have contributed to the growing foreclosure crisis and turmoil in the housing market. By allowing Washington Mutual to hand-pick appraisers who inflated values, First American helped set the current mortgage crisis in motion.”

As First American acknowledged in its 2006 annual report, appraisal fraud can damage the entire housing market, including consumers and investors alike. Consumers are harmed because they are misled as to the value of their homes, increasing the risk of foreclosure and hindering their ability to make sound economic decisions. Investors are hurt by such fraud because it skews the value and risk of loans that are sold in financial markets.

In April 2006, EA began providing appraisal services for WaMu, which became EA’s biggest client. Within weeks, WaMu began complaining to EA that its appraisals were not high enough. WaMu pressured EA to employ exclusively a new panel of appraisers that WaMu hand-selected as “Proven Appraisers.” This set of appraisers was chosen by WaMu specifically because they inflated property appraisals. WaMu profited from these higher appraisals because they could close more home loans, at greater values. Over the course of their relationship, between April 2006 and October 2007, EA provided approximately 262,000 appraisals for WaMu.

Attorney General Cuomo’s investigation uncovered a series of e-mails between executives at EA, First American, and WaMu that show EA officials were willingly violating state and federal appraisal independence regulations to comply with WaMu’s demands:On February 22, 2007, in response to a description of the WaMu “Proven Appraiser” program as one in which “we will now assign all Wamu’s work to Wamu’s ‘Proven Appraisers’… [and] Performance ratings to retain position as a Wamu Proven Appraiser will be based on how many come in on value,” eAppraiseIT’s president told senior executives at First American: “we have agreed to roll over and just do it...”

On April 4, 2007, eAppraiseIT’s executive vice president stated in an e-mail to First American: “we as an AMC [Appraisal Management Company] need to retain our independence from the lender or it will look like collusion… eAppraiseIT is clearly being directed who to select. The reasoning… is bogus for many reasons including the most obvious – the proven appraisers bring in the values.”

On April 17, 2007, eAppraiseIT’s president wrote an e-mail to First American explaining why its conduct was illegal: “We view this as a violation of the OCC, OTS, FDIC and USPAP influencing regulation.”

E-mail evidence also shows that WaMu pressured EA to inflate appraisals as a condition for doing future business together:

On September 27, 2006, First American’s vice chairman reported that a WaMu executive told him: “if the appraisal issues are resolved and things are working well he would welcome conversations about expanding our relationship…”

GMAC: $1.6B Loss

by Calculated Risk on 11/01/2007 11:14:00 AM

From Reuters: GMAC posts $1.6 bln third-quarter loss

GMAC, ... on Thursday reported a $1.6 billion third-quarter loss, hurt by mortgage losses at its home lending unit amid difficulties in the housing and credit markets.