by Calculated Risk on 11/02/2007 08:48:00 PM

Friday, November 02, 2007

Citi CEO to Resign

Time for a new thread ...

From the WSJ: Citigroup CEO Plans to Resign As Losses Grow (hat tip many!)

MarketWatch version: Citi board gathering for emergency meeting

Special hat tip to Barley who broke the news:

Prince at Citi cancels speaking engagements on Sunday

Barley | 11.02.07 - 3:43 pm |

UPDATE: By popular request ... the following is from one of my original posts (in Feb 2005):

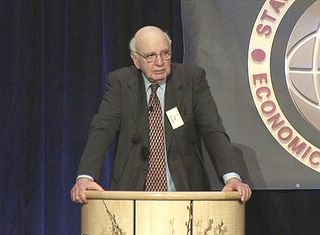

Former Fed chief Paul Volcker spoke last week at the second annual summit of the Stanford Institute for Economic Policy Research. In his keynote speech he warned that the nation is facing 'huge imbalances and risks'.

Here is a video of the speech.

Paul Volcker, Stanford, Feb 11, 2005

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."