by Tanta on 8/30/2007 11:48:00 AM

Thursday, August 30, 2007

Loan Modification Data

Credit Suisse's report on the August remittance data for the ABX basket of mortgage securities (no publically available link) includes information, for the first time as far as I know, about loan modifications.

Of the 80 deals surveyed, only 42 include modification information in the remittance reports. That does not necessarily mean there were no mods in the 38 deals; it just means their deal documents do not require that this information be included in the remittance reports. That may change, as more and more servicers are providing this information voluntarily.

For the 42 deals reporting modification activity, 47 loans from 10 different deals were modified. One deal, GSA06HE3, accounted for 21 of the total 47. Of those 21, 20 involved a rate reduction and 11 involved capitalization of principal and interest (past due payments). The average rate reduction was 2.20%. (I note that 2/28 ARMs increase at least 2.00% at their first adjustment.) CS notes that 5 of these loans actually ended up with an increase in the monthly payment (because capitalization offset the rate reduction).

The remaining 9 deals reporting mods involved 4 reporting 1 mod, 1 reporting 2, 2 reporting 3, 1 reporting 5, and 1 reporting 9.

CS does not speculate on why the Goldman deal reports so many more mods than the others. I, on the other hand, speculate that it has to do with the clarity on the subject provided in the prospectus for that deal:

Each servicer will be required to act with respect to mortgage loans serviced by it that are in default, or as to which default is reasonably foreseeable, in accordance with procedures set forth in the applicable servicing agreement. These procedures may, among other things, result in (i) foreclosing on the mortgage loan, (ii) accepting the deed to the related mortgaged property in lieu of foreclosure, (iii) granting the mortgagor under the mortgage loan a modification or forbearance, which may consist of waiving, modifying or varying any term of such mortgage loan (including modifications that would change the mortgage interest rate, forgive the payment of principal or interest, or extend the final maturity date of such mortgage loan) or (iv)accepting payment from the borrower of an amount less than the principal balance of the mortgage loan in final satisfaction of the mortgage loan. These procedures are intended to maximize recoveries on a net present value basis on these mortgage loans.The claim has been bandied about lately that the servicing agreements for these deals just don't permit mods. That is clearly false as a generalization. Some obviously do. I see nothing in this prospectus that limits workouts (any of them listed here) to some stated percent of the deal balance.

However, it is clear that some deals do have language that restricts modifications, or at least is sufficiently ambiguous that servicers are unable to process with them without investor approval of the workout. Therefore, I for one proceed with great caution in looking at reported numbers on modifications for any sort of "trend" or reflection of the broader market of RMBS outside of the ABX buckets. It is likely to be a matter of "those who can, do, and those who can't, don't," and no one to my knowledge has attempted yet to quantify precisely how many can and how many can't. Given that just over half of the ABX deals report on modifications, I'd think it reasonable to speculate that at least half do allow mods, but that is speculation in the absence of digging through all those prospectuses, and I don't actually care about all of this that much.

OFHEO: House Prices Slow

by Calculated Risk on 8/30/2007 10:01:00 AM

OFHEO House Price Index Shows Smallest Quarterly Increase Since 1994

U.S. home prices increased only slightly in the second quarter of 2007 according to the OFHEO House Price Index (HPI). The HPI, which is based on data from sales and refinance transactions, was 0.1 percent higher in the second quarter than in the first quarter of 2007. This is below the revised growth rate of 0.6 percent for the previous quarter and the lowest since the fourth quarter of 1994. Prices in the second quarter of 2007 were 3.2 percent higher than they were in the same quarter of 2006, the lowest annual price change since the 1996-97 period.More later.

OFHEO’s purchase-only index, based solely on purchase price data, indicates less appreciation for U.S. houses over the past year than does the all transactions HPI. The purchase-only index increased 2.6 percent between the second quarter of 2006 and the second quarter of 2007, compared with 3.2 percent for the HPI. However, for the second quarter, the purchase-only index increase was slightly higher at 0.5 percent (seasonally-adjusted).

The figures were released today by OFHEO Director James B. Lockhart as part of OFHEO’s quarterly report analyzing housing price appreciation trends. “House prices were basically flat in the second quarter despite tightening credit policies, rising foreclosure rates, and weakening buyer sentiment,” said Lockhart. “Significant price declines appear localized in areas with weak economies or where price increases were particularly dramatic during the housing boom.”

The data in this release only include price information through June. To the extent that recent mortgage market instability may have affected housing demand and prices, those effects would be evident in OFHEO’s next HPI release.

Stories From the Credit Crunch

by Tanta on 8/30/2007 09:25:00 AM

The LAT reports: "Sub-prime borrowers not alone" (why they are still hyphenated in the LAT style manual after all these years is not clear):

It's not just sub-prime borrowers who are having trouble getting affordable home loans.I do not wish to be insulting or injurious, but I think it may be a while before non-owner-occupied jumbo IO refis in California get back to that 5.50% thing.

Because mortgage investors stung by growing defaults in the sub-prime sector are shunning all but the most traditional loans, creditworthy borrowers are getting hammered if they want mortgages with payment options or the "jumbo" loans used routinely in Southern California and other high-priced home markets.

If you get such a loan, you'll pay a higher rate than before. And to add insult to injury, it's taking more time for all mortgages to get approved and funded, market experts say.

Rancho Palos Verdes marketing consultant Steve Ammons discovered the new jumbo reality after he began shopping for a mortgage on a Manhattan Beach home that he and his daughter own and rent out.

Ammons and his daughter have credit scores of 750 to 760, he said Wednesday, making them prime borrowers, the most creditworthy. What's more, the house is worth an estimated $1.6 million and has a current $650,000 mortgage, so there is plenty of equity to serve as a cushion for the lender.

Ammons is looking for a 30-year, fixed-rate mortgage, but with a twist -- the option to pay only the interest on the loan during the first 10 years. Such loans have been widely used by landlords seeking to maximize their cash flows. Ammons said a jumbo loan with an interest-only option that he took out just last year on another rental property had an interest rate of 5.5%.

But the story was different this time: A loan officer at Washington Mutual Inc. quoted him a rate of 9.75%, saying that the lender "had to charge such high rates so that they could sell off the loans," said Ammons, who has since put off refinancing.

"It's rough out there," said Doug Duncan, chief economist for the Mortgage Bankers Assn. . . .

San Diego mortgage banker John Robbins, chairman of the national mortgage bankers group, said he saw hope for the jumbo loan market's recovery. But he said borrowers such as Ammons were going to "have to be patient for a month or two."

"This market is going to come back," Robbins said. "For a gentleman like this with a lot of equity in his house, just trying to stabilize his mortgage payments, I don't think help is too far away."

Wednesday, August 29, 2007

Goldman Sachs Housing Forecast

by Calculated Risk on 8/29/2007 08:08:00 PM

The following is excerpted with permission from a Goldman Sachs research note on housing: Home Price Declines: Accelerating and Around for a While

Excerpts:

... we expect housing activity to continue to decline as:The following table shows the GS forecast for key housing indicators - Starts, Prices, New and existing home sales, and change in Residential Investment (RI) - for 2007 and 2008.

Nonconforming mortgage rates are rising and credit is being rationed. Mortgage rates for subprime loans, indeed for all loans that Fannie Mae and Freddie Mac will not purchase, have risen sharply since the beginning of July. Along with this price increase, credit is being rationed as many loans that previously would have occurred are no longer being made. The reduction in credit availability will adversely affect the demand for housing.

Substantial excess supply remains. Perhaps most tellingly, in the second quarter the homeowner vacancy rate was a high 2.6%, far above its long-term average and only slightly below the record level of the first quarter. Furthermore, measures of inventories of new and existing homes remain high, both with nearly 8 months of supply at current sales rates. This excess inventory will require time to be worked off, and while this is occurring will serve as a disincentive to new construction.

Residential investment as a share of GDP is still high. A substantial fall has already occurred, with the share of output devoted to it falling from a peak of 6.3% to 4.9%. But that 4.9% is still above the 4.6% average of the last 30 years and well above lows reached during housing downturns in the early 1980s and 1990s when the share dipped below 3.5%.

Foreclosure rates are increasing. Subprime and Alt-A loans originated over the last several years often called for unrealistic mortgage payments relative to the borrower’s income once mortgage rates reset to higher levels. As these resets have started occurring, delinquency and foreclosure rates on these loans have increased. If even more of these homes enter foreclosure, as appears likely, they will add to the inventory problem outlined above.

Case Shiller | Home Sales | Housing Starts | Real |

| |||

|

| % change, | millions, | millions, | Residential |

| |

|

| end of | annualized | annualized | Investment |

| |

|

| year | New | Existing | Total | % chg |

|

|

|

|

|

|

|

|

|

| 2006 | 3.2 | 1.05 | 6.51 | 1.81 | -4.6 |

|

| 2007 | -7 | 0.81 | 5.77 | 1.40 | -14.7 |

|

| 2008 | -7 | 0.67 | 4.90 | 1.14 | -13.3 |

|

|

|

|

|

|

|

|

|

| 2006Q1 | n.a. | 1.13 | 6.86 | 2.13 | -0.7 |

|

| Q2 | n.a. | 1.09 | 6.63 | 1.86 | -11.7 |

|

| Q3 | n.a. | 0.99 | 6.29 | 1.70 | -20.4 |

|

| Q4 | n.a. | 0.99 | 6.26 | 1.55 | -17.2 |

|

| 2007Q1 | n.a. | 0.85 | 6.42 | 1.46 | -16.3 |

|

| Q2 | n.a. | 0.88 | 5.91 | 1.47 | -9.2 |

|

| Q3 | n.a. | 0.80 | 5.50 | 1.43 | -10.0 |

|

| Q4 | n.a. | 0.70 | 5.25 | 1.25 | -15.0 |

|

| 2008Q1 | n.a. | 0.65 | 5.00 | 1.10 | -20.0 |

|

| Q2 | n.a. | 0.65 | 4.90 | 1.10 | -15.0 |

|

| Q3 | n.a. | 0.68 | 4.80 | 1.15 | -5.0 |

|

| Q4 | n.a. | 0.70 | 4.90 | 1.23 | 0.0 | |

Note: Excerpted with permission.

Notice that GS expects the decline in residential investment to accelerate again. This is exactly what we've been discussing. Also note that GS expects housing starts to decline to 1.1 million seasonally adjusted annual rate (SAAR), existing home sales to fall to 4.8 million SAAR, and New Home sales to 650K (SAAR).

Goldman Sachs on Housing

by Calculated Risk on 8/29/2007 06:53:00 PM

In a research note today (no public link), GS forecast house prices to decline 7% in 2007, and another 7% in 2008 (based on the Case-Shiller index). They believe the OFHEO index will show smaller price declines.

In addition, GS forecasts New Home sales to drop to 650K in Q1 '08, at a seasonally adjusted annual rate (SAAR). This is even below the BofA forecast of 700K for later this year.

For existing homes, GS forecasts 5.25 million SAAR in Q4 '07 and a lower rate in '08.

I'll try to get permission to excerpt from the research note.

Bernanke writes to Schumer

by Calculated Risk on 8/29/2007 03:39:00 PM

Text from the WSJ:

The Honorable Charles E. Schumer

United States Senate

Washington, D.C. 20510

Dear Senator:

Thank you for your recent letters of August 8 and 22, in which you express concern about the potential effects of volatility in financial markets and the tightening of credit conditions on homebuyers, consumers, and the economy as a whole.

I want to assure you that the Federal Reserve, in cooperation with other federal agencies, is closely monitoring developments in financial markets. As you recognized, the Federal Reserve has also taken steps to increase liquidity in the markets. In particular, our changes to our discount window program are designed to assure depositories of the availability of a backstop source of liquidity so that concerns about funding do not constrain them from extending credit and making markets. Also, the Federal Open Market Committee has stated that it is monitoring the situation and is prepared to act as needed to mitigate the adverse effects on the economy arising from the disruptions in financial markets.

I share your concern about the potential impact of scheduled payment resets on homeowners with variable-rate subprime mortgages. Over the next several years, many such homeowners will face significantly higher monthly payments and, consequently, an increased risk of losing their homes to forced sale or foreclosure. The federal banking regulators have encouraged banks and thrifts to work actively with troubled borrowers to modify loans or to refinance as needed to avoid default or foreclosure and have jointly issued guidances to address underwriting and disclosure practices related to subprime mortgage lending.

The twelve Federal Reserve Banks around the country are working closely with community and industry groups dedicated to reducing the risks of foreclosure and financial distress among homebuyers. The Board is also engaged in these issues; for example, Governor Randall Kroszner serves as the Federal Reserve’s representative on the board of directors of NeighborWorks America, which has a program to encourage borrowers facing mortgage payment difficulties to seek help by making early contact with their lenders, servicers, or trusted counselors. And as I noted in my testimony in July, in order to strengthen consumer protections, the Federal Reserve Board is currently undertaking a comprehensive review of the rules regarding loans subject to the Home Owner Equity Protection Act as well as some rules pertaining to mortgage-related disclosures under the Truth in Lending Act.

It might be worth considering at this juncture whether the private and public sectors, separately or in collaboration, could help the situation by developing a broader range of mortgage products which are appropriate for low-and moderate-income borrowers, including those seeking to refinance. Such products could be designed to avoid or mitigate the risk of payment shock and to be more transparent with respect to their terms. They might also contain features to improve affordability, such as variable maturities or shared-appreciation provisions for example. One public agency with considerable experience in providing home financing for low-and moderate-income borrowers is the Federal Housing Administration (FHA). The Congress might wish to consider FHA reforms that allow the agency more flexibility to design new products and to collaborate with the private sector in facilitating the refinancing of creditworthy subprime borrowers facing large resets.

As you note, the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac are currently assisting in subprime refinancings. However, the GSEs’ charters limit their ability to take on higher-risk mortgages and their programs are relevant only to a relatively small share of subprime borrowers. The GSEs should be encouraged to provide products for subprime borrowers to the extent permitted by their charters. The current caps on GSE portfolios–which were imposed for safety and soundness reasons-need not be lifted to allow them to accommodate new borrowers. Currently, the GSE portfolios include substantial holdings of GSE-guaranteed mortgage products, which are easily placed in the private secondary market even under current conditions. Thus, the GSEs could readily sell these securities to make space for new mortgages if they wished to do so. Policymakers may also want to encourage the GSEs to increase their mortgage securitization efforts, which are not constrained by their portfolio caps.

We will continue to keep the Congress informed of developments in the subprime markets and in the credit markets more generally. As you know, Federal Reserve governors and staff have made numerous appearances before the Congress and in other forums on subprime-related issues. Board staff members have continued to brief members of Congressional staffs on these matters. Board staff members are also assisting the Government Accountability Office in the report that they are preparing that will provide a comprehensive review of developments in the subprime mortgage market.

Again, thank you for your interest and please be assured that we are following these issues closely.

Sincerely,

Ben S. Bernanke

Non-Agency Mortgage Market: "Worst Ever"

by Calculated Risk on 8/29/2007 02:06:00 PM

From Bloomberg: Non-Agency Mortgage Market Is the Worst Ever, Wakefield Says (hat tip Brian). A few excerpts:

K. Terrence Wakefield ... comments on the home-loan market. Wakefield is a former Salomon Brothers executive ...These is no returning to the insanity of the last few years.

...

On the market for U.S. mortgages not expected to be packaged into bonds guaranteed by government-chartered companies Fannie Mae and Freddie Mac:

"This is unquestionably the worst it's been. I've never seen a secondary market, since it was founded back in the late 1970s, where you couldn't sell loans. Where there was no bid."

On the future for bonds without guarantees from government-linked entities:

"I'm not suggesting the non-agency mortgage-backed securities market is dead. It will resuscitate but under a very different set of rules, because the rules of the past do not work."

On underwriting:

"All of these practices that are imprudent -- such as stated income loans where you'll lend somebody 95 percent of a property's value without lifting a finger to verify they can pay you back -- that's over. And that was a big piece of the business over the last couple of year."

"I would say 30 to 40 percent of the business done in the last couple of years was done under imprudent lending standards. I just see no circumstance in which those types of practices return."

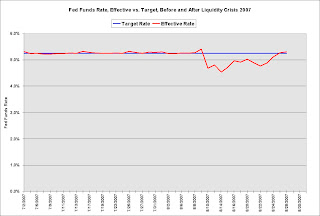

Effective Fed Funds Rate

by Calculated Risk on 8/29/2007 12:05:00 PM

For about two weeks this month, the Fed allowed the effective Fed Funds rate to drift below the target rate. The effective rate is now back to the target rate. Click on graph for larger image.

Click on graph for larger image.

These two graphs compare the effective Fed Funds rate vs. the target rate for the recent liquidity crisis, and for 9/11/2001.

The scales are the same on both graphs (2 months and 0% to 6% on the y-axis). Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Some people have suggested this has been a "stealth" rate cut by the Fed. If it was, it is over.

Note: According to Fed President Poole, the Fed will only cut rates in September if there is clear evidence that the economy is slowing (looking at employment, retail sales and industrial production). Right now the market expectations for a Fed rate cut in September are pretty high (see Cleveland Fed: Fed Funds Rate Predictions).

This does raise the question: Is the worst of the liquidity crisis over? Note: it is important to distinguish between the ongoing credit crunch and the recent liquidity crisis. The credit crunch is far from over.

Weiling About Modifications, Again

by Tanta on 8/29/2007 11:02:00 AM

Bloomberg's Jonathan Weil is a menace to society.

Last time I bothered to read any of his hysterical Emily Latella-style ravings on the subject, he was completely missing the point about the accounting rules involved in the "modification problem," but making up for his ignorance in inflammatory rhetoric.

He's at it again.

Aug. 29 (Bloomberg) -- It's bad enough when a company's outside auditor is a pushover for management. Equally galling would be for the auditor to try telling management how to run the company. Yet that's what U.S. Senator Charles Schumer has asked the Big Four accounting firms to do at the subprime lenders they audit, pronto.Schumer, just like the SEC, is telling auditors that they should stop telling their clients that accounting rules forbid modifications of defaulting and soon-to-default loans in securitizations, because the SEC and FASB have determined that this does not violate accounting rules.

``One of the most promising solutions to the anticipated foreclosure crisis is the voluntary modification by lenders of existing unsustainable subprime loans,'' Schumer, a New York Democrat, said in an Aug. 23 letter to the firms' top executives.

The chairman of Congress's Joint Economic Committee then called on the firms to ``assist this country's mortgage crisis'' and ``urge your clients to do their part to keep our housing markets afloat, by modifying subprime loans that are at risk of default.''

In so doing, Subprime Chuck made a blithering fool of himself, though he probably doesn't realize why.

Weil then spends much ink assuming that we're talking about lenders' balance sheet loans, and waxing horrified over the idea that an accounting firm might give advice about accounting rules. It all ends up involving apple pie, somehow.

I have no idea why Weil is so spastic on the subject of accounting rules. Maybe he had a mean accounting teacher in the fourth grade who scarred him for life. But of all the criticisms of Schumer I've heard recently, I must say this is the most clearly lunatic.

IndyMac Hires Retail Loan Officers

by Tanta on 8/29/2007 10:00:00 AM

From Bloomberg via NYT:

One mortgage lender announced that it was hiring yesterday as it tried to take advantage of the turmoil in the market, while another said it was cutting jobs.Why is this interesting? Well, I have no idea whether Indy's approach is going to work here. My own experience is that changing the corporate culture of "acquired" origination offices is always harder than people think it's going to be. And there seem to be some questions about some of the culture at some American Home Mortgage offices.

IndyMac Bancorp said it had hired more than 600 former employees of the American Home Mortgage Investment Corporation and might hire 250 more.

IndyMac will also assume the leases on more than 90 offices where the employees worked.

Last month, IndyMac eliminated 400 back-office processing jobs, about 4 percent of the work force.

That said, my own argument for years uncounted has been that wholesale origination models--loans originated by brokers who have no capital in the game and are not under the control of the lenders--are a large part of the problem we have been experiencing. Wholesale lending always looks cheap, since you don't have to pay loan officers and assume brick and mortar overhead in down cycles of the business. But it always ends up expensive, what with fraud, sloppiness, price-gouging, lack of warranties, and so on.

So it's encouraging, on one hand, to see IndyMac beefing up its retail origination capacity at the expense of its wholesale and correspondent capacity. On the other hand, I'd be looking for some real serious discipline from Indy were I a regulator, and I'd be rather cautious about valuing these "acquisitions" were I an investor. I'd further be mildly concerned about laying off the back office indiscriminately. It doesn't seem like a good time to short the risk-management side and beef up the sales side to me, so I'd want to know just what back office jobs got eliminated.