by Calculated Risk on 8/29/2007 12:05:00 PM

Wednesday, August 29, 2007

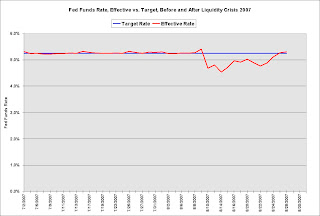

Effective Fed Funds Rate

For about two weeks this month, the Fed allowed the effective Fed Funds rate to drift below the target rate. The effective rate is now back to the target rate. Click on graph for larger image.

Click on graph for larger image.

These two graphs compare the effective Fed Funds rate vs. the target rate for the recent liquidity crisis, and for 9/11/2001.

The scales are the same on both graphs (2 months and 0% to 6% on the y-axis). Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Some people have suggested this has been a "stealth" rate cut by the Fed. If it was, it is over.

Note: According to Fed President Poole, the Fed will only cut rates in September if there is clear evidence that the economy is slowing (looking at employment, retail sales and industrial production). Right now the market expectations for a Fed rate cut in September are pretty high (see Cleveland Fed: Fed Funds Rate Predictions).

This does raise the question: Is the worst of the liquidity crisis over? Note: it is important to distinguish between the ongoing credit crunch and the recent liquidity crisis. The credit crunch is far from over.