by Calculated Risk on 8/27/2007 06:12:00 PM

Monday, August 27, 2007

Credit-card defaults on rise

From the Financial Times: Credit-card defaults on rise in US

US consumers are defaulting on credit-card payments at a significantly higher rate than last year ...As an aside, business bankruptcy filings are rising too, from Barron's Business-Bankruptcy Blues (hat tip Viv)

Credit-card companies were forced to write off 4.58 per cent of payments as uncollectable in the first half of 2007, almost 30 per cent higher year-on-year. Late payments also rose, and the quarterly payment rate ... fell for the first time in more than four years.

...

But Moody’s said the rate of losses remained well below the 6.29 per cent average seen in 2004 ...

Recent increases in credit card losses can in part be ascribed to a steady rise in personal bankruptcy filings since 2005. According to the Administrative Office of the US Courts, quarterly non-business bankruptcy filings have been rising since the first quarter of 2006.

For the second quarter, such bankruptcies rose 38% from the same quarter in 2006, and first-half bankruptcies were up a full 45% from the 2006 half, to 12,985. That's according to ... data from the U.S. Bankruptcy Courts.The new bankruptcy law in October 2005 caused some distortions in the data, but it appears the trend is negative.

Update: Just a few months ago we saw this Bloomberg story: Subprime Borrowers More Apt to Pay Card Debt, Ignore Mortgages (hat tip BR)

"The number of people with subprime credit ratings whose home payments were overdue by 30 days or more rose 13.2 percent in the past four years, while bank-card delinquencies among the group dropped 25.4 percent."And from the Chicago Tribune: As home loan market tightens, mounting credit card debt could spur new crisis (hat tip Gort)

More: July Existing Home Sales and Contest

by Calculated Risk on 8/27/2007 11:50:00 AM

For more existing home sales graphs, please see the previous post: July Existing Home Sales

Contest on Inventory and Months of Supply:

For fun (winner will be announced in a January post), predict:

1) The maximum existing home inventory number for 2007 (NAR report).

2) The maximum "months of supply" for 2007 (NAR report).

The months of supply metric is calculated by dividing the total inventory by the seasonally adjusted annual sales rate, then multiply by 12 months. As an example, the current existing home inventory is 4.592 million units, and the SAAR of sales is 5.750 million units.

The formula is: Months of Supply = (4.592 / 5.750) * 12 = 9.6 months.

Please enter your prediction in the comments to this post. Good luck!

To help with the contest, here are a few more graphs on inventory and months of supply.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly inventory levels for the last four years. There is somewhat of a seasonal pattern, with inventory peaking in the summer months.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

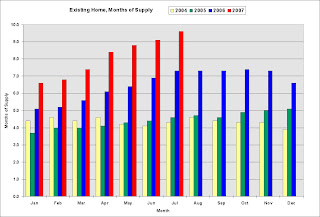

The second graph shows the monthly 'months of supply' metric for the last four years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the July inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the July inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.The current inventory of 4.592 million is the all time record. The "months of supply" metric is 9.6 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units.

Forecasts

The following graph shows the actual cumulative existing home sales (through July) vs. three annual forecasts for 2007 made at the beginning of the year (NAR's Lereah, Fannie Mae's Berson, and me).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).NSA sales are 3.498 million units through July. In a typical year, sales through July are about 59% of the sales for the year. So at the current pace, sales will be around 5.9 million. It appears that sales will slow, perhaps significantly, in the second half of 2007, so the risk to my forecast is most likely on the downside.

To reach the NAR forecast, revised downward again on Aug 8th to 6.04 million units, sales would have to be significantly above the 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say that even the August NAR forecast was too optimistic.

July Existing Home Sales

by Calculated Risk on 8/27/2007 10:00:00 AM

Update: for more on existing home sales (and a fun contest), please see July Existing Home Sales and Contest

The National Association of Realtors (NAR) reports Existing-Homes Sales Stable In July

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – slipped 0.2 percent to a seasonally adjusted annual rate1 of 5.75 million units in July from an upwardly revised pace of 5.76 million in June, and are 9.0 percent below the 6.32 million-unit level in July 2006.

...

The national median existing-home price for all housing types was $228,900 in July, down 0.6 percent from July 2006 when the median was $230,200, the highest monthly price on record. The median is a typical market price where half of the homes sold for more and half sold for less.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now well over 8 months, we should expect falling prices nationwide.

The 9.6 months of supply is the highest since 1982 - when mortgage rates averaged 16% (see Freddie Mac)!

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,592,000 in July.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,592,000 in July.Total housing inventory rose 5.1 percent at the end of June to 4.59 million existing homes available for sale, which represents a 9.6-month supply at the current sales pace, up from an upwardly revised 9.1-month supply in June.More on existing home sales later today.

Note: For existing homes, the sales data is compiled at the close of escrow. So this report is mostly for homes were the sales agreements were signed in June or even May. This is all pre-turmoil, and even the August existing home report will be mostly pre-turmoil.

Those Other Incomprehensible Ratings

by Tanta on 8/27/2007 09:17:00 AM

Being a mortgage and bond weenie, I have never claimed to fully understand equity analyst ratings. However, I must say I understand them less lately than I used to not understand them.

"Market underperform" means "maybe not quite worthless"?

NEW YORK (AP) -- A JMP Securities analyst upgraded Luminent Mortgage Capital Inc. late Friday, saying the deal the mortgage investment fund cut to rescue itself shrinks the chances the stock will end up worthless.

Analyst Steven C. DeLaney upgraded Luminent Mortgage Capital to "Market Underperform" from "Sell."

Whether the San Francisco-based real estate investment trust's shares have value is open to debate. A number of analysts -- including DeLaney himself -- have predicted the company will go bankrupt.

With $8.61 billion in assets at the beginning of the year, Luminent Mortgage Capital borrows money to invest in home loans and other types of mortgage debt. Luminent earns profit when the yields on the mortgage debt outpace how much the company pays to borrow money.

With the mortgage market in distress and investors fleeing from risky loans, Luminent has had to pay more to borrow and the mortgage debt the company invests in is worth less.

The company's stock has fallen from more than $10.80 late last year to as low as 36 cents this month.

Earlier this month, Luminent announced a deal with Arco Capital Corp. Luminent is granting Arco Capital the option to buy a 51 percent stake in the company at 18 cents per share, a discount even for a stock that had lost more than 90 percent of its value this year.

In exchange for this option, Arco Capital is lending Luminent $60 million and agreed to buy $65 million of the company's mortgage debt.

"This lifeline financing provided by Arco improves the possibility that some value may be preserved for Luminent's shareholders," DeLaney said.

DeLaney's price target on Luminent is $1. The stock closed Friday at $1.34.

The Global Credit Crunch Scrambles the Picture

by Tanta on 8/27/2007 07:50:00 AM

From the Washington Post, we learn that the credit crunch is impacting local construction and lending employment, as builders struggle to sell homes to extremely unqualified buyers, in the absence of merely unqualified buyers, and lenders hire the "top dogs" from cratering subprime and Alt-A outfits who no longer have money to lend, because there's a lot of money to lend.

Kilby, a member of the fourth generation in his family to work in the building industry, has cut prices on his homes in subdivisions of Prince George's and Charles counties. The new homes are built with luxury finishes like granite countertops, crown molding and large spa tubs -- the kinds of bells and whistles people were demanding when credit was easy to come by and his sales offices were full of prospective buyers. Now that it's become harder for home buyers to obtain loans, he's stuck with expensive houses on expensive lots that he is struggling to sell.

"We're doing just about anything we can do to get people into a house, said Kilby, a 50-year veteran of the home-building business. "And these are people we would have told to take a hike last year or the year before last."

Slower sales and lower prices have translated into smaller budgets for salaries. From a staff of 17, Kilby has cut a carpenter, a project superintendent, a building laborer and a punch-out clerk.

While construction jobs have been the most visibly affected, workers in related industries are dusting off their resumes as the global credit crunch scrambles the employment picture.

Capital One said it would close its mortgage banking unit, GreenPoint, which has 31 locations in 19 states, including one in Silver Spring that employs about 28 people and another in Baltimore with 29 workers.

Those losses have created opportunities for others.

Bank of America's mortgage lending office in Annandale is trying to hire more lending agents, targeting seasoned veterans laid off from troubled competitors.

"There's still a lot of money out there to lend and people who want those loans so my phone has been ringing off the hook since the other shops closed down," said Rick Eul, assistant vice president of the Annandale office. "We're picking the top dogs out of those offices."

Sunday, August 26, 2007

Home Depot Unit: $1.8 Billion Haircut

by Calculated Risk on 8/26/2007 08:35:00 PM

Update: For those without access to the WSJ, the NY Times has the details: Home Depot Unit Sold for Far Less in Tight Market. And this great anonymous quote:

“Study what just happened here. You’ll see this movie again soon.”The WSJ is reporting that Home Depot has agreed to a $1.8 Billion haircut on the sale of their supply unit. See the WSJ: Buyout Firms Reduce Price For Home Depot Unit to $8.5 Billion. The initial price was $10.3 Billion!

The buyout firms that agreed to buy Home Depot's supply unit a few months ago have slashed the price of the deal to $8.5 billion ...Just a few days ago, the Home Depot's haircut was reported to be $1.2 Billion. This shows just how desperate Home Depot was to sell the unit.

... the Atlanta-based retailer is guaranteeing $1 billion of the debt and will take an equity stake. By guaranteeing part of the debt, Home Depot will enable the banks to avoid marking down the entire value of the debt on their own balance sheets ...

With a deluge of even-bigger upcoming deals, worth upwards of $400 billion, the stakes for both sides were too great ... the banks were so desperate to avoid taking a hit on the debt that they offered to pay the private-equity firms' $300 million "walkaway" fee to Home Depot if the deal was scuttled.

I believe these pier loans (failed bridge loans), getting stuck on the balance sheets of the IBs, is a significant part of the current liquidity crisis. And it appears this is just the beginning ...

Construction Employment

by Calculated Risk on 8/26/2007 07:22:00 PM

Most of my focus on employment has been related to potential residential construction job losses. Unfortunately the BLS only started breaking out residential specialty trade contractors starting in 2001, so there is no data available to analyze residential construction employment during prior downturns in the housing market.

However we can look at trends in total private construction employment.

From Reuters: Construction job losses could top 1 million (hat tip Houston)

Job losses in the construction sector could top 1 million if a housing downturn tips the economy into recession and tighter access to credit dampens business investment.

...

"The ability of nonresidential to continue absorbing additional workers is going to be limited, and that's going to put downward pressure on construction employment overall," [Bernard Markstein, director of forecasting at the National Association of Home Builders] said, adding that cuts may be deeper than in the 1990s.

Click on graph for larger image.

Click on graph for larger image.This graph shows total construction employment since 1970 according to the BLS. As noted in the article, total private construction employment fell about 18% in the mid-'70s recession, and about 15% in both the early '80 and '90s recessions.

Construction employment only fell 3% in the '01 recession, as residential construction employment offset most of the declines in commercial construction employment. In the current construction slowdown, total employment has only fallen 1% (residential construction employment is off about 4%) according to the BLS.

Note: there are several reasons why the BLS is potentially understating the residential construction job losses (see here). One of the possible reasons - and relevant to this article - is that some workers have probably moved from residential construction to non-residential construction, but these employees are still being reported as residential construction employees.

A 15% decline in construction employment, from the peak last year, would be about 1.1 million total construction jobs lost.

"We may be in a period where there may be larger losses because growth was so steep," said John Challenger, chief executive of Chicago-based outplacement consulting firm Challenger Gray & Christmas. "(Compared with) that 15 percent that we saw then, this may be a steeper, more volatile cycle."When the BLS releases their annual revision later this year, there will probably be a significant downward revision in construction jobs for the last 4 quarters. The Business Employment Dynamics (BED) report showed there were about 100K more construction jobs lost in the 2nd half of '06 than the BLS reported. The BLS has probably understated job losses in the 1st half of '07 too, as housing completions have fallen off a cliff, but BLS reported residential construction jobs has remained steady.

Still, if non-residential investment spending slows (especially CRE), than there will probably be many more construction jobs lost in the coming year.

Sunday Gross Blogging

by Tanta on 8/26/2007 01:30:00 PM

Yves at naked capitalism and P. Jackson at Housing Wire both go after Bill Gross of PIMCO and his recent arguments for a homeowner bailout. I recommend both of these fine examples of clock-cleaning.

Saturday, August 25, 2007

Saturday Night Stories

by Calculated Risk on 8/25/2007 09:05:00 PM

Here are a few stories to discuss with your dates tonight:

Fortune: Fed bends rules to help two big banks (hat tip John, Bob, and others!)

In a clear sign that the credit crunch is still affecting the nation's largest financial institutions, the Federal Reserve agreed this week to bend key banking regulations to help out Citigroup and Bank of America, according to documents posted Friday on the Fed's web site.MarketWatch: Muni bond funds hit by 'perfect storm' (hat tip Mike and others!)

... muni bond prices have fallen in recent weeks, pushing yields higher, as investors moved money into the safest securities, such as short-term Treasury bonds.And from Barron's, a story on 'pier loans': For Banks, a $300 Billion Hangover

Investment and commercial banks, ranging from Citigroup and JP Morgan to Goldman Sachs and Merrill Lynch , agreed to finance deals that might not close for six months, and at very low interest rates -- and without any escape clauses to protect them if market conditions deteriorated. Why? Because bankers were in hot pursuit of the next underwriting or merger-and-acquisition advisory fee. The private-equity shops knew it and they pushed through some of the most aggressive financing terms ever seen.Haver: Borrowings at the Federal Reserve Largest in 6 Years; Big Drops in Commercial Paper Outstanding. The second chart on the left shows the sharp drop in commercial paper outstanding - after an incredible increase over the last few years.

AP: Mortgage Mess Hurts Main Street, Beyond

Telegraph: Brace yourself for the insolvency crunch (hat tip Kendall)

Your date will find you fascinating tonight!

UPDATE: From Gretchen Morgenson at the NY Times: Inside the Countrywide Lending Spree

Next week should be interesting, from existing home sales on Monday (inventory is the most interesting number) to Bernanke's speech on Friday: "Housing and Monetary Policy".

Drop Foreseen in Median Price of U.S. Homes

by Calculated Risk on 8/25/2007 02:25:00 PM

ALSO: see this great interactive graphic from the NY Times: Home Prices Across the Nation, and a video with David Leonhardt.

From the NY Times: Drop Foreseen in Median Price of U.S. Homes

The median price of American homes is expected to fall this year for the first time since federal housing agencies began keeping statistics in 1950.In the video (at the graphic link above), Leonhardt explains that the "official" price hasn't declined - in nominal terms - since the federal agencies started keeping statistics, but prices have declined in real terms - and in nominal terms according to the Standard & Poor's/Case-Shiller index.

Economists say the decline, which could be foreshadowed in a widely followed government price index to be released this week, will probably be modest — from 1 percent to 2 percent — but could continue in 2008 and 2009. ...There is much more in this article by Leonhardt and Vikas Bajaj. Check it out.

The reversal is particularly striking because many government officials and housing-industry executives had said that a nationwide decline would never happen, even though prices had fallen in some coastal areas as recently as the early 1990s.

The OFHEO House Price Index will be released on Thursday, Aug 30th.