by Tanta on 8/25/2007 12:22:00 PM

Saturday, August 25, 2007

Saturday Rock Blogging

Certain persons have expressed some curiosity about the Real Identities® of CR and Tanta.

I can see why you'd wonder about that. I regularly wonder about you all.

Anyway, here's some home movies.

This is CR:

This is Tanta:

This is our merry band of regular commenters:

Credit Crunch, Yet Monitor Litter Continues

by Tanta on 8/25/2007 08:04:00 AM

The Washington Post reports that some lenders still have sufficient operating cash to run deceptive mortgage advertising. I guess it can't be as bad as we thought.

My favorite part:

LendGo.com, another Internet company that sends information to lenders, declared: "Bad Credit OK!" in an ad on Time magazine's Web site. "Refinance Rates at 5.8% Fixed!" the ad said earlier this week.Remember that every time we bring up fiduciary requirements for brokers, we are told that consumers have the responsibility to assure they are getting a "market" interest rate.

But in an interview, Cyrus Zahabian, a manager at the California company, said, "We don't necessarily target those types of people. We look for more of the prime and Alt-A type credit here." Alt-A borrowers are in between prime and subprime.

He also acknowledged that it would be a challenge for a person with bad credit to get a rate as low as 5.8 percent. "Yeah, I don't have anybody that would offer a good rate for those types of people," he said.

A consumer reading this advertisement would possibly get the impression that someone with bad credit could get a rate of 5.80%. So that consumer goes to a broker who can't get that rate for him or her, but can get 8.50%.

Why should the consumer believe he is not getting ripped off by the broker? Why do brokers think consumers have realistic ideas about what a current "market rate" is? If the borrower who thought 5.80% was reasonable will accept 8.50%, will he also accept 9.50% if someone just wants to pick up some spiff? Once it's a matter of the broker saying "trust me, this is the rate you get," then, well, it's a matter of "trust me."

"Bait and switch" advertising is already illegal, and if the FTC had a few spare minutes, busting this LendGo.com outfit would be a no-brainer. My point is that lenders are flouting those advertising regulations right out in front of everyone's nose, and then they're turning around and claiming that increased regulation of brokers would ruin the business.

The Truth-in-Lending Act, which dates from the seventies, requires lenders to quote an "APR" as well as the simple contract interest rate. The APR is an effective or "construct" rate that takes into account the total cost of financing over the stated loan term, including fees and points. The idea, originally, was that a consistent APR calculation allowed a consumer to compare Lender A's offer of 5.80% note rate with 2.00 points and $375 in fees with Lender B's 6.00% note rate with 1.00 point and $800 in fees. Or Lender A's 5.80% fixed rate with Lender B's 4.80% 3/1 ARM. The APR for each of these loans gives you the "total cost of credit" of each of those loans (over the stated term), so that you are comparing apples to apples.

That regulation was, obviously, written long before the internet and current competitive practices in the industry involving rate quotes. I'd personally like to see the APR requirement supplemented with a requirement that a lender also disclose some industry-standard market comparison rate (such as Freddie Mac's or FHFB's national average actual, not "advertised," contract rate) for a fixed or ARM loan. It would be fine with me if the regulators forced OFHEO or HUD or someone else to start collecting a national average actual jumbo and subprime rate, too, instead of just the conforming conventional rate.

This doesn't make for a perfect comparison, and disclosures should have conspicuous language saying that. But it would give consumers at least some kind of reality check on an interest rate that is substantially higher (and possibly predatory) or lower (and possibly a deceptive teaser) than a rough approximation of "market." If the reason the borrower's rate differed so widely from the national average is the borrower's specific credit profile or down payment or selected property, this would be an excellent "teachable moment" for making sure that borrower understands that he or she is taking on more than average risk. No?

As someone who has been involved rather intimately with the nuts and bolts of meeting regulatory requirements like this from the lender's side, I'll be the first to admit it sounds like a thorough-going pain in the butt from the lender's operational perspective. I weigh that against the social and economic costs to the whole world of crazy lending, and I suspect that lenders could take some Advil for the butt pain. Certainly there may be more operationally efficient alternatives, like, say, forcing lenders to make their rate sheets available on demand, but I'm guessing that won't be popular with the industry either.

It's worth going to these lenders' 10-Ks sometimes, and looking at what they claim to have invested in software and hardware and administrative staff, and then asking why they can't manage to accomplish something like what I'm proposing. From the Washington Post article, here's a Countrywide flack commenting on the advertising issue:

Asked about the ad, a spokeswoman e-mailed a statement saying: "Countrywide operates a highly-sophisticated marketing system for both on- and off-line advertising with a wide variety of marketing messages available to the broad array of customers that the company's products and services are designed to assist. The company monitors and adjusts advertisements to help ensure that the leads generated are likely to be within our underwriting parameters."Wow. And I can remember the days when loan officers had to dig out the paper copy of Statistical Release H-19, fire up the Monroe, and pencil in that APR on a hand-written Good Faith Estimate. If CFC can do all that mind-blowing sophistication with the "marketing system," I'm guessing they could print an "average contract rate" on a TILA disclosure. It's funny sometimes how inconsistently those computers work.

This is the point where the put-upon small business-owner brokers who can't even afford to buy a 10-key solar calculator at OfficeMax can pipe up in the comment section about how hard it is to make a living in this country. You get bonus points if you argue that consumers are obligated to have a better internet connection than you are.

Friday, August 24, 2007

Condo Troubles

by Calculated Risk on 8/24/2007 08:06:00 PM

From the WSJ: Condo Troubles Further Squeeze Property Lenders

For the nation's real-estate lenders, the other shoe may be about to drop: condominiums.So many shoes are dropping, the turmoil will be named Imelda!

Already plagued by rising home-loan defaults and foreclosures among overstretched consumers, major markets across the country -- including parts of Florida, California and Washington, D.C. -- are seeing rising foreclosures and bankruptcies of entire condo projects.Kudos to WSJ journalist Alex Frangos for not blaming the problems on subprime loans. These "loose" lending standards were pervasive in C&D (construction and development) and CRE (commercial real estate) lending, in addition to residential real estate.

...

Typically, condo developers are required to pay off construction loans shortly after construction is completed. But with sales stalled, more developers are defaulting, creating headaches for banks and real-estate funds that financed the projects.

Delinquencies on condo-construction loans have already jumped to 4% from 1% over the past year. ...

Underlying the defaults was a loosening of lending standards.

Fed Clarifies using Commercial Paper as Collateral

by Calculated Risk on 8/24/2007 03:16:00 PM

From the WSJ: New York Fed Takes Step To Bolster Credit Market

... the Federal Reserve Bank of New York clarified its discount window rules with the effect of enabling banks to pledge a broader range of commercial paper as collateral.

...

"We are comfortable taking investment-quality asset-backed commercial paper for which the pledging bank is the liquidity provider. This is a clarification of something that has become, over time, accepted practice at the Federal Reserve Bank of New York," said New York Fed spokesman Calvin Mitchell.

...

Several market sources however interpreted the action more as a change in, than a clarification of, policy. "Previously banks could not post such ABCP as collateral, that is ABCP for which the bank is a liquidity backstop," said Michael Feroli, economist at J.P. Morgan Chase, in a note to clients.

New Home Sales, Revisions

by Calculated Risk on 8/24/2007 01:58:00 PM

Please see my earlier posts on New Home sales too: July New Home Sales and More on July New Home Sales.

The Census Bureau revises the New Home sales number three times (plus annual revisions). During a housing down turn, most of the revisions from the Census Bureau are down. This is important to keep in mind when looking at a new monthly report. Click on graph for larger image.

Click on graph for larger image.

This chart shows the cumulative revisions for each month since sales activity peaked in July 2005 (annual revisions are not shown). The last time there was a positive cumulative revision (red column) was in September 2005.

The median change for the first revision is a decline of 1.6% (average decline of 1.8%) over the last two years.

The cumulative median change for the second revision is a decline of 3.6%.

The cumulative median change for the third revision is a decline of 4.8%. Since the last upward cumulative revision (Sept 2005), the range has been from a small decline of 0.2% in Dec '05, to a decline of almost 11% for May '06.

The new homes sales number today will probably be revised down too. Applying the median cumulative revision (4.8%) suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 828 thousand for July (was reported as 870 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.

Pearlstein on Commercial Real Estate

by Calculated Risk on 8/24/2007 11:41:00 AM

Steven Pearlstein writes in the WaPo: Commercial Real Estate, Come On Down

Here's the next shoe to drop as a result of the bursting of the credit bubble: commercial real estate.As a reminder, in a typical business cycle, investment in non-residential structures follows investment in residential structures with a lag of about 5 quarters.

...

In markets like Washington, New York, Boston and San Francisco, the last four years have been among the best the industry has ever seen -- falling vacancy rates, rising rents, soaring values and a ton of new development. Now, that's all about to come to a grinding halt as financing becomes more expensive and more restrictive, the economy slows and a big slug of new inventory hits the market.

Click on graph for larger image.

Click on graph for larger image. This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In a typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for five straight quarters. So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

Right now it appears the lag between RI and non-RI will be longer than 5 quarters in this cycle. Although the typical lag is about 5 quarters, the lag can range from 3 to about 8 quarters.

... in markets like Washington, the pace at which buildings have been leasing has slowed even as a large number of new buildings are about to come on line.Pearlstein also discusses tighter lending impacting commercial real estate (CRE). This fits with the recent survey from the Fed: The July 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices

According to the latest data from CoStar Group, for example, office vacancy rates along the I-270 corridor have risen to 11.6 percent from a low of 9.7 percent a year ago. Buildings under construction will add another 5 percent to supply over the next two years, with roughly a third of it pre-leased.

The market in the Dulles corridor is also beginning to weaken. There, the vacancy rate is up to 14.2 percent from 13 percent in the past year, with nearly 4 million square feet of space under construction, equal to about 8 percent of current supply. After four years of steady growth, rents are beginning to flatten out.

Commercial Real Estate LendingAnd that survey was pre-turmoil. I also suspect Pearlstein is correct and that CRE is the 'next shoe to drop'.

Lending standards for commercial real estate loans were reportedly tightened further over the past three months: About one-fourth of domestic institutions—a slightly smaller net fraction than in the previous survey—and about 40 percent of foreign institutions indicated that they had tightened lending standards on commercial real estate loans in the July survey. Regarding demand, approximately one-fourth of domestic and foreign institutions reported that demand for commercial real estate loans had weakened over the past three months.

More on July New Home Sales

by Calculated Risk on 8/24/2007 10:32:00 AM

For more graphs, please see my earlier post: July New Home Sales Click on graph for larger image.

Click on graph for larger image.

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through July.

Typically, for an average year, about 61% of all new home sales happen before the end of July. Therefore the scale on the right is set to 61% of the left scale.

At the current pace, new home sales for 2007 will probably be in the mid 800 thousands - about the same level as in 1998 through 2000. This is significantly below the forecasts of even many bearish forecasters.

If sales slow in the coming months - as I expect - New Home sales might be in the low 800s - the lowest level since 1997. My forecast is for 830 to 850 thousand units in 2007.

July New Home Sales

by Calculated Risk on 8/24/2007 10:00:00 AM

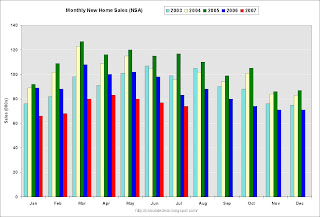

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 870 thousand. Sales for June were revised up to 846 thousand, from 834 thousand. Numbers for April and May were revised down.

Click on Graph for larger image.

Sales of new one-family houses in June 2007 were at a seasonally adjusted annual rate of 870,000 ... This is 2.8 percent above the revised June rate of 846,000 and is 10.2 percent below the July 2006 estimate of 969,000.

The Not Seasonally Adjusted monthly rate was 74,000 New Homes sold. There were 83,000 New Homes sold in July 2006.

July '07 sales were the lowest July since 2000 (74,000).

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in July 2007 was $239,500; the average sales price was $300,800.

The seasonally adjusted estimate of new houses for sale at the end of July was 533,000.

The 533,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 7.5 months at the current sales rate.

This is another weak report for New Home sales. And the data for July is pre-turmoil. These numbers will probably be revised down, and the in-turmoil numbers for August will likely be much lower.

More later today on New Home Sales.

Short Sales and Short Arms

by Tanta on 8/24/2007 09:21:00 AM

The Boston Globe has a story out on short sales. There is the requisite anecdote about some borrowers in trouble. The soylent details:

Jeffrey Finch spelled out the problem in a hand-written letter: He'd lost his job as a minister, and his wife's take-home pay as a teacher, $3,100 a month, did not cover their $3,300 mortgage payments. . . .

Lenders "are not in the business of owning real estate," said Fran Yerardi, president of Bay State HomeVestors in Newton, who negotiated the short sale on the Finch's behalf. HomEq and investors who held their mortgages forgave $168,500 of the couple's $440,000 total debt, allowing HomeVestors to buy their house for $271,500, renovate it, and resell it for a profit. . . .

In the case of the Finches in Jamaica Plain, it took Bay State HomeVestors three months to negotiate the discount purchase. Bay State is a franchise of a Dallas company, HomeVestors, whose stock-in-trade is buying houses in poor shape, fixing them up, and reselling them. Its yellow billboards that state, "We Buy Ugly Houses," dot the Boston area. Profits on individual deals can be anywhere from $10,000 up to, in rare cases, $100,000.

In anticipation of a declining market, Yerardi opened HomeVestors' first New England franchise last year and has about 30 short sales in progress. Franchises are now in Braintree, Worcester, Connecticut, and Rhode Island, he said. The entire company has submitted more than 200 short-sale plans to lenders this year, he said. "Two years ago, you never heard of short sales."

The Finches' undoing was a subprime refinancing with WMC Mortgage, which they used last August to take $10,000 out of their home equity for renovations. Two WMC subprime mortgages were used to refinance a 30-year fixed mortgage obtained in 2005 to buy the house from Denise Finch's mother. Their payments immediately jumped $900.

While Denise Finch lost the house in which she grew up, the couple bought a newer one -- from HomeVestors -- for $152,000 in Charlotte, N.C., where both have family.

That’s all the information about the Finches that you get in this article.

The current total loan amount is $440,000, but apparently $10,000 was cash taken out in August of 2006. So we’ll assume they borrowed $430,000 in 2005 for an in-family (non-arm’s-length) transaction, buying Denise’s mother’s home for at least $430,000. If this was the home Denise grew up in, it wasn’t built in ’05. It’s possibly not surprising you’d need a $10,000 renovation loan. We aren’t told how much, if any, Denise’s mother owed on it.

If the payment on the total $440,000 is $3,300, they were paying an effective blended rate of about 8.25% on the total refinanced loan balance, assuming amortization, or 9.0% on an IO. We are told that the $3,300 payment is $900 more than the old payment on $430,000. That would imply that the old loan carried a payment of $2,400, which implies an interest rate of 5.50% on the old loan, if it was an amortizing fixed, or 6.625% if it was IO. (I’m ignoring T&I for the moment.) Damned good deal on that $10,000, huh?

If they got a 100% subprime loan to buy the new house in NC, we’ll guess they might be paying 10% on it. That would be a new house payment of $1,333.91, or 43% of their last verified income of $3,100. You can add taxes and insurance if you want to. You can assume that the new loan isn’t “subprime,” even though the borrowers now have prior mortgage delinquencies/short sale on their credit report, and you can assume they had some money for a down payment, if you want to. Hey! Maybe mom gave them some money out of the “capital gains” cookie jar! Maybe a down payment came from a builder or this HomeVestor outfit. Beats me. The problem with non-arm’s-length transactions is not just finding the “skin,” it’s figuring out what the game is.

You can assume that in the current environment such a loan would be offered at a much lower rate than 10%, if you feel like it. I think you can guarantee that the new loan involved “stated income” of the sort that involves how they need not just schoolteachers but more ministers in NC than in MA and so they pay them at least as much and so “replacement income” is virtually guaranteed you see. Or, possibly, those family members in NC are supplying “stable monthly income.” Whatever.

So one non-arm’s-length deal got replaced with a new non-arm’s-length deal. Denise’s mom and HomeVestors appear to have made profits. WMC took a nasty write-off. The Finches are on their way to being subprime borrowers for the rest of their days. I’m pretty sure they’ll get a 1099 for the taxes on $168,500, and given their track record I wouldn’t be shocked to find them going to a payday lender to borrow it. Quite the work-out, I’d say.

Please note, you workout-haters, that I am not suggesting that WMC should have modified this loan somehow, at least not based on the facts we are presented with. I merely want to suggest that I have my reasons, at times, for thinking that short sales are not these pristine rational free-market “rapid clearing” devices some folks would like to think they are. I am also, of course, hinting to a reporter (again) that it sometimes helps to try to “work out” the numbers you are given before you report on them. They might suggest a slightly different story.

In any case, I will leave you all to ponder the due diligence you would require of a servicer if you were the noteholder and you were being asked to accept a short sale. What would you want to know about the bid or bids submitted?

Thursday, August 23, 2007

Home Depot Close to Accepting Less for Unit

by Calculated Risk on 8/23/2007 10:12:00 PM

From WSJ: Home Depot Is Close to Accepting $1.2 Billion Less for Wholesale Unit

Home Depot was Thursday night close to accepting about $1.2 billion less for the sale of its wholesale distribution business to three private-equity firms ... But there were still substantial doubts about whether the deal will actually close before a Thursday deadline, as three major banks continued to balk over the financing.How many pier loans can these IBs carry? Most likely some of these deals will collapse. This is quite a haircut for Home Depot, and it is still not a done deal.

The situation was becoming increasingly ugly, with some of the most senior figures on Wall Street trying to manage their exposure to a deal beset by twin crises in both the housing and credit markets. The banks -- J.P. Morgan Chase, Lehman Brothers Holdings Inc. and Merrill Lynch & Co. Inc. were last night preparing for the possibility of lawsuits over the matter.

...

Pinched by the current credit crisis, the banks are toughening their stance against the private-equity firms. With a backlog of some $300 billion of U.S. private-equity deals still to be funded, the banks are now facing significant writedowns on their balance sheets. That's why they are weighing how to extract themselves from as many buyout transactions as possible.