by Calculated Risk on 10/05/2006 11:37:00 AM

Thursday, October 05, 2006

Retail Sales and Initial Unemployment Claims

Occasionally I like to look at initial weekly unemployment claims. Click on graph for larger image.

Click on graph for larger image.

The Department of Labor announced weekly unemployment claims decreased to 302K last week.

The graph shows the 4 week moving average for unemployment claims. There is still no evidence of a significant slowdown from this data series.

And the AP reports: Retailers Report Strong Gains for September, Aided by Cooler Weather and Falling Gas Prices

Shoppers, encouraged by cooler temperatures and falling gasoline prices, went on a shopping spree in September, giving many retailers better-than-expected gains and lifting the industry's spirits two months before the holiday season. A notable exception was Wal-Mart Stores Inc.Yesterday Fed Vice Chairman Donald Kohn had some comments on the housing market, and he noted:

As retailers reported their results Thursday, the winners crossed many categories, with department stores and teen merchants including Bebe Stores Inc., J.C. Penney Co. Inc. and Federated Department Stores Inc. among the leaders.

"This is a really strong month," said Ken Perkins, president of RetailMetrics LLC, a research firm in Swampscott, Mass. "The back-to-school momentum was strong, weather was really favorable and the big plummet in gasoline prices certainly put more disposable money into consumers' wallets."

Of the first 44 retailers to report September results, 32 topped analysts' expectations and 12 fell short, according to Thomson Financial.

"To date there is little evidence that this correction in the housing market has had any significant adverse spillover effects on other parts of the economy."I agree - so far the impact of the housing bust on the general economy has been minimal. I will post my take on Kohn's housing comments later today.

Wednesday, October 04, 2006

Natural Gas Prices go Negative!

by Calculated Risk on 10/04/2006 10:19:00 PM

The BBC reports: A glut of natural gas supplies in Britain has seen prices collapse and left traders having to pay for it to be taken off their hands. (hat tip: Truck and Barter)

Wholesale gas prices for immediate delivery turned negative on Tuesday as supplies surged in from the new Langeled pipeline from Norway.And for an excellent summary of some other good news from Econbrowser: And they all lived happily ever after

Britain's gas storage capacity is 96% full so firms need to offload supplies.

...

After trading at an average of 26p a therm through September, the spot price for gas delivered immediately fell to -5p during the course of the day, meaning traders are paying to get rid of it.

...

"There is simply too much gas flowing into the UK," said Chris Bowden, chief executive of energy services company Utilyx.

For the opposite view, from Professor Roubini: Some more "good" news about the economy today...and the stock market's delusional "suckers' rally"...

California: Real Estate Agent Boom Continues

by Calculated Risk on 10/04/2006 08:12:00 PM

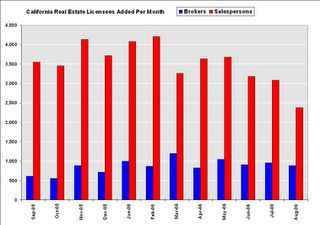

The California Department of Real Estate reports the total number of Real Estate licensees reached 511,459 in the state at the end of August 2006. This is an increase of 53,000 agents / brokers over the last 12 months. The number of Salesperson licensees has reached 372,199, a 13% increase over one year ago. The number of Broker licensees is 139,260; 8% higher than last year. Click on graph for larger image.

Click on graph for larger image.

This graph shows the number of Brokers and Salespersons licensees added per month in California over the last year. It does appear the number of people obtaining real estate salesperson licenses has slowed, but is still increasing at about 8% per year.

Brokers tend to be more committed to real estate, and the number of new broker licensees added per month has remained steady.

Bernanke: housing slowdown to reduce GDP growth

by Calculated Risk on 10/04/2006 02:08:00 PM

From Reuters: Bernanke--housing slowdown to reduce GDP growth

Federal Reserve Chairman Ben Bernanke on Wednesday estimated that the decline in housing construction could reduce gross domestic product growth later this year by a percentage point.The above comments were from the Q&A after Bernanke's speech today. Note that Bernanke believes the payroll tax is a general fund tax and that there is no annual surplus for Social Security:

"I think that I would estimate that slowing housing construction will probably take about a percentage point off of growth in the second half of this year and probably something going into next year as well," the Fed chairman told the Economics Club of Washington at a luncheon here.

At the same time, he said he was unsure how the dynamics of the housing market slowdown would play out, but noted other parts of the economy remain strong, including nonresidential construction.

Although demographic change will affect many aspects of the government’s budget, the most dramatic effects will be seen in the Social Security and Medicare programs, which provide income support and medical care for retirees and which have until now been funded largely on a pay-as-you-go basis.Social Security ran a surplus of $177 Billion in fiscal 2006 alone. I've defended Bernanke before, however this comment is not only inaccurate, but irresponsible.

MBA: Mortgage Applications Rise

by Calculated Risk on 10/04/2006 12:26:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Rise Sharply Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 633.9, an increase of 11.9 percent on a seasonally adjusted basis from 566.5 one week earlier. On an unadjusted basis, the Index increased 11.5 percent compared with the previous week and was down 10.9 percent compared with the same week one year earlier.Mortgage rates were mixed:

"Refinance applications continue to increase as mortgage rates have declined to their lowest levels since the beginning of the year," said Mike Fratantoni, MBA’s senior director, single family research and economics.

The seasonally-adjusted Refinance Index increased by 17.5 percent to 1970.8 from 1677.5 the previous week and the Purchase Index increased by 7.6 percent to 404.6 from 375.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.24 percent from 6.18 percent ...

The average contract interest rate for one-year ARMs decreased to 5.86 percent from 5.90 percent ...

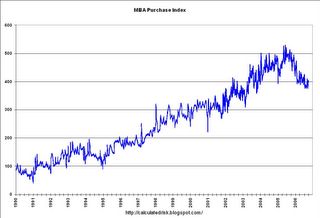

The second graph shows the MBA Purchase Index since inception in 1990. The index was started as housing slumped in the early '90s.

The second graph shows the MBA Purchase Index since inception in 1990. The index was started as housing slumped in the early '90s.Note: Actual data after 2001. Before 2001, graph was copied from another source.

This third graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

This was the last week of loan activity before the New Nontraditional Mortgage Guidance was released. Refinance and ARM activity was very strong. It will be interesting to see if the guidance has any impact on applications over the next few weeks.

Tuesday, October 03, 2006

Housing and Jobs

by Calculated Risk on 10/03/2006 01:58:00 PM

So far the housing bust has had little impact on employment. The following two graphs are the areas I've been watching closely: residential construction and retail employment. Click on graph for larger image.Note the scale doesn't start from zero: this is to better show the change in employment.

Click on graph for larger image.Note the scale doesn't start from zero: this is to better show the change in employment.

Residential construction employment is down about 1% from the peak in February. There is probably a significant cash economy (including illegal immigrants) working in residential construction, and these workers might be the first to be let go. But I expect BLS reported employment in residential construction will start declining soon.

Professor Roubini expects housing to impact the employment numbers this week:

I expect that September payroll figures could be as low as 70,000 (against a consensus of 128,000) as the housing and housing related sectors will start to take a toll on employment.

Retail employment has been trending down, and the YoY change in retail employment is now -0.7%. The YoY decrease in retail employment is concerning: see Retail Employment

On retail, the Chicago Tribune reports (hat tip Kett82): Housing skid's latest victim: Holiday hiring

If you need a little extra cash for the holidays, finding a temp sales job at the local mall could be tougher this year, says Challenger, Gray & Christmas Inc.If there is a downward cycle associated with the housing bust, it will come from lower housing related employment and less borrowing from the home ATM. There has been some evidence that mortgage equity extraction decreased slightly in Q2, but so far housing related employment has been steady.

The Chicago-based outplacement firm predicts that seasonal hiring won't keep pace with the 5 percent to 5.5 percent sales increase economists are forecasting for the October through December holiday season.

The reasons: Stores are taking a cautious approach to the holiday in light of the slowdown in housing demand. Rising interest rates means fewer consumers are pulling cash out of their homes. And the spread of self-serve checkout lanes and electronic inventory control means retailers need fewer sales clerks and stockroom workers to sell merchandise.

More on Budget Deficit

by Calculated Risk on 10/03/2006 02:28:00 AM

My post on Angry Bear: Bogus Budget Projections

Just something to think about when we start hearing about "progress on the deficit."

NY Times: Housing Costs Rise as Burden

by Calculated Risk on 10/03/2006 12:11:00 AM

The NY Times summarizes a new Census Bureau report: Across Nation, Housing Costs Rise as Burden Click on map for National data.

The burden of housing costs in nearly every part of the country grew sharply from 2000 to 2005, according to new Census Bureau data being made public today. The numbers illustrate vividly the impact, often distributed unevenly, of the crushing combination of escalating real estate prices and largely stagnant incomes.

While many of the highest home values were on the coasts, in places like Southern California and Manhattan, many of the biggest jumps in the percentage of people paying a burdensome amount of their income for housing occurred in the Midwest and in suburbs nationwide, making it clear that the housing squeeze has reached deep into the middle class.

...

"Housing prices have gone up much more than incomes have," said Christopher Jones, vice president for research at the Regional Plan Association in New York City. "Clearly, you can’t sustain that sort of imbalance over the long run. There’s only so long that housing prices can go up without sustained increases in income to support them."

Monday, October 02, 2006

Fiscal 2006: National Debt Increases $574.3 Billion

by Calculated Risk on 10/02/2006 12:40:00 PM

The Treasury Department reported today that the National Debt increased $574.3 Billion in Fiscal 2006, compared to $553.7 Billion in Fiscal 2005. The record annual increase was $595.8 Billion in Fiscal 2004. Click on graph for larger image.

Click on graph for larger image.

The Bush Administration pulled out all the tricks in Fiscal 2006 to make the deficit look better.

Also they suspended Medicare payments for the last nine days of the fiscal year:

The Centers for Medicare & Medicaid Services (CMS) has been instructed by the United States Congress in the Deficit Reduction Act (DRA) of 2005, to place a brief hold on Medicare payments for ALL claims (e.g., initial claims, adjustment claims, and Medicare Secondary Payer (MSP) claims) for the last 9 days of the Federal fiscal year, i.e., September 22, 2006 through September 30, 2006.Not paying your bills and relying on accounting tricks doesn't make the fiscal situation better; it just makes it look better in the short term.

Sunday, October 01, 2006

Concerns Rising about Corporate Profits

by Calculated Risk on 10/01/2006 12:40:00 AM

From the NY Times: Is the Corporate Profit Machine About to Sputter? Here are some negative comments:

Thomas M. Doerflinger, equity strategist at UBS [is concerned about the] weakness in housing and a slowdown in consumer spending will eat into profit growth next year, he said. “We are looking for a significant slowdown” in profit growth, to about 4 percent in 2007, he said.And the housing bust is the main concern:

William W. Priest, chief executive of Epoch Investment Partners ... says he believes that some factors that have swelled corporate earnings in the last few years are beginning to turn. Access to cheap labor overseas, along with productivity gains in the United States that have exceeded wage gains, created the best of all worlds for big companies, Mr. Priest said.

...

Mr. Priest also expects to see increasing evidence of retrenchment by consumers. “In the last few years, there’s been an acceleration of consumption relative to income,” he said. “It’s essentially come from the home A.T.M. machine.” But the combination of higher interest rates and declining property values in many areas will make it harder for consumers to draw on the value of their homes.

Over all, Mr. Priest expects profit growth to slow to 3 to 5 percent next year.

Even more pessimistic is Douglas Cliggott, chief investment officer at the hedge fund Race Point Asset Management. Mr. Cliggott expects profits to shrink next year by 10 to 15 percent.

“We’re downshifting from a very favorable environment,” said Mr. Cliggott ...

Predictions of a worsening housing slump that eventually crimps consumer spending are at the heart of bearish profit forecasts. Already, inventories of unsold homes have been rising, along with mortgage foreclosures, and there is growing evidence of falling prices. Several homebuilders have warned of profits that will not meet forecasts.And now for some positive views:

But some of the more bullish market watchers do not believe that housing woes will set off a full-blown, profit-smashing recession. “Housing activity is declining faster than we expected, but we don’t expect the spillover effects to produce a general decline in G.D.P.,” said Brian Gendreau, investment strategist at ING Investment Management, a unit of the ING Group. “People still have a large reservoir of housing net worth they can draw on.”.

Steven Wieting, lead economist for domestic equities at Citigroup, is also sanguine about the possible effects of a decline in the housing market. “Industries boom and bust simultaneously,” he said. “Housing could bust and other industries continue to flourish.”

The consumer wealth effect from the long, sustained climb in housing prices should survive any downturn, he said. “If we’re approaching a housing decline, it follows years of wealth accumulation, and that’s not going to be easily reversed.” Still, Mr. Wieting expects a gradual deceleration in profit growth next year, to roughly 7.5 percent.

Do homeowners still have "a large reservoir of housing net worth they can draw on"? Yes and no.

Do homeowners still have "a large reservoir of housing net worth they can draw on"? Yes and no.Household equity is at an all time high - because of the rapid increases in prices - but the percentage of equity in household real estate is at a record low of 54.1%. (graph from a previous post)

That may sound like a high percentage of equity, but according to Robert Broeksmit, Chairman of the Residential Board of Governors, Mortgage Bankers Association (from the Senate hearing on Nontraditional Mortgages):

"More than a third of homeowners, approximately 34 percent, own their homes free and clear."This group is probably risk adverse and it's unlikely they will borrow significantly on their homes to fuel consumption. So the entire debt burden falls on the other 66%. With a record low percentage of household equity, and record homeowner financial obligations ratios, it's hard to see how the housing ATM will continue to support the economy. Especially if home prices start to fall.

And finally some comments from Dirk Van Dijk at Zacks:

AT Zacks, which compiles the analysts’ forecasts that now call for double-digit earnings gains through next year, the research director, Dirk Van Dijk, wonders whether the rosy numbers will come to bloom. “There is some doubt in my mind as to the ’07 numbers,” he allowed. “There are a lot of yellow flags out there in the macro picture.”I think there are some red flags too.