by Calculated Risk on 4/20/2011 10:00:00 AM

Wednesday, April 20, 2011

March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

The NAR reports: Existing-Home Sales Rise in March

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010.

...

All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010. Investors accounted for 22 percent of sales activity in March, up from 19 percent in February; they were 19 percent in March 2010.

...

Total housing inventory at the end of March rose 1.5 percent to 3.55 million existing homes available for sale, which represents an 8.4-month supply4 at the current sales pace, compared with a 8.5-month supply in February.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2011 (5.10 million SAAR) were 3.7% higher than last month, and were 6.3% lower than March 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.549 million in March from 3.498 million in February.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.4 months in March, down from 8.5 months in February. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were above the consensus of 5.0 million SAAR, and are about what I expected (Lawler's forecast was 5.08 million). I'll have more soon.

MBA: Mortgage Purchase Application activity increases

by Calculated Risk on 4/20/2011 07:37:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 2.7 percent from the previous week. The seasonally adjusted Purchase Index increased 10.0 percent to its highest level since December 3, 2010, driven largely by a 17.6 percent increase in Government purchase applications.

...

“Purchase application volume jumped last week largely due to another sharp increase in applications for government loans. Borrowers were likely motivated to apply for loans before the scheduled increase in FHA insurance premiums,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Refinance activity increased somewhat, as rates dropped to their lowest level in a month towards the end of the week.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.98 percent, with points increasing to 1.07 from 0.93 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although this is the highest level of purchase activity this year, the level is still low compared to recent years.

AIA: Architecture Billings Index little changed in March

by Calculated Risk on 4/20/2011 12:01:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: US architecture billings index flat in March -AIA

The Architecture Billings Index slipped 0.1 point to 50.5 in March, according to the American institute of Architects.

...

"Demand is not falling back into the negative territory, but also not exhibiting the same pace of increases seen at the end of 2010," said AIA Chief Economist Kermit Baker.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index showed billings increased slightly in March (index at 50.5, anything above indicates an increase in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so - but there won't be a strong increase in investment.

Tuesday, April 19, 2011

Thoughts on Residential Investment Recovery

by Calculated Risk on 4/19/2011 06:30:00 PM

A few thoughts looking out a few years ...

• Residential investment (RI) is the best leading indicator for the economy. This isn't perfect - nothing is - but RI is usually a strong leading indicator for the business cycle. The slump in RI helped me call the 2007 recession correctly, and the lack of a recovery in residential investment is a key reason the recovery has been sluggish and choppy so far. Note: Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

• In 2011, residential investment will make a positive contribution to the economy for the first time since 2005. The five years of drag on GDP from RI (2006 through 2010) is the longest period on record, breaking the previous record of four years from 1930 to 1933 (yeah, the Great Depression). The positive contribution this year will mostly be due to a pickup in multifamily construction (apartments) and in home improvement. However single family housing starts will continue to struggle.

• This positive contribution from residential investment suggests the economy will continue to grow all year and also in 2012 (point 1: RI is best leading indicator). There are plenty of downside risks, but I expect the expansion to continue.

• A record low number of housing units will be added to the housing stock this year. With more jobs, and more household formation in 2011, the number of excess housing units will be reduced substantially this year – perhaps by 600,000 to 700,000 units (or more).

Recently economist Tom Lawler took a long look at the 2010 Census data, and estimated there were about 2 to 3 million excess vacant housing units as of April 1, 2010. With the record low number of housing units delivered last year, Lawler estimated that as of April 1, 2011 the excess “would be somewhere in the range of 1.45 to 2.45 million units – with the latter almost certainly too high”. With another record low number of units added to the housing stock this year, the excess will be in the 750 thousand to 1.7 million range next April (with the latter “certainly too high"). This suggests the excess supply will be gone sometime between early 2014 and 2016.

As the excess supply is absorbed, new residential investment will increase in some areas – and will probably return to normal sometime in 2014 - or as late as 2017 - depending on the actual number of excess vacant housing units. I'm leaning more towards 2015 or 2016.

• “Normal” for housing starts will be the rate of household formation (probably averaging around 1.1 million per year in 2015), plus the net number of 2nd homes purchased, plus the number of demolitions. I think the 2nd home markets will be slow to recover, so "normal" will probably be around 1.3 million housing starts in 2015 or 2016 or 2017 (after the excess supply is absorbed) – up sharply from the current rate of around 550 thousand. For new home sales, normal will probably be in the 800 thousand to 850 thousand range – far above the recent 250 thousand to 300 thousand range, but also far below the 1.2 to 1.3 million range in 2004 and 2005.

• Unfortunately it is hard to pin down the timing better right now because the number of excess vacant housing units is uncertain. My guess is housing starts will return to "normal" in 2015 or 2016.

Housing: On pace for Record Low Completions in 2011

by Calculated Risk on 4/19/2011 02:05:00 PM

With just three months of data for 2011, it is already pretty clear that there will be a record low number of housing completions this year. Here is a look at the data so far ...

In general multi-family housing starts are trending up. Apartment owners are seeing falling vacancy rates, and some have started to plan for 2012 and will be breaking ground this year. However it takes about 13 months on average to complete a multi-family building, and the low level of starts in 2010 means a low level of completions this year.

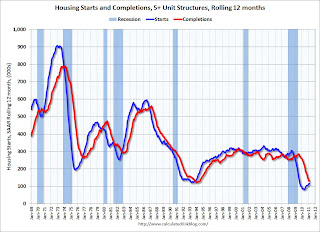

The following graph shows this lag between multi-family starts and completions through March:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Notice that the blue line (Starts) is now trending up, and the red line (completions) is still falling. Based on starts in 2010, I expect mutlifamily completions to be around 100 thousand in 2011 - well below the 146.5 thousand in 2010, and below the previous record low of 127.1 thousand in 1993.

We can do a similar analysis for single family housing completions. Through March, about 90 thousand units have been completed (1 to 4 unit structures), and based on housing starts, another 200 thousand or so will be completed over the next 6 months (it takes about 6 months on average to complete single family structures). Even if starts increase over the next few months, it seems likely that 1 to 4 unit completions will be in the 400 thousand to 450 thousand range for the year - well below the previous record low of 505 thousand set in 2010.

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes (and an estimate for 2011)

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes (and an estimate for 2011)

In 2010, 1 to 4 unit completions were at a record low 505 thousand. This was just below the 535 thousand units completed in 2009 and was far below the previous record low of 712 thousand units in 1982. 1 to 4 units completions are currently on pace for another record low in 2011.

For 5+ units, completions were at 147 thousand units in 2010. This was just above the record low of 127 thousand in 1993 - and that record will be broken in 2011.

This doesn't include demolitions that were probably in the 200 thousand unit range (some estimate are as high as 300 thousand). This suggest the excess supply was reduced in 2010, and will probably be significantly reduced in 2011. Of course this also depends on household formation - and that means jobs.

Here is a table of housing units added to stock by year:

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 20111 | |

|---|---|---|---|---|---|---|---|

| 1 to 4 Units | 1,673.4 | 1,695.3 | 1,249.8 | 842.5 | 534.6 | 505.2 | 450.0 |

| 5+ Units | 258.0 | 284.2 | 253.0 | 277.2 | 259.8 | 146.5 | 100.0 |

| Manufactured Homes | 146.8 | 117.3 | 95.7 | 81.9 | 49.8 | 50 | 50 |

| Sub-Total | 2,078.2 | 2,096.8 | 1,598.5 | 1,201.6 | 844.2 | 701.7 | 600.0 |

| Demolitions | 200 | 200 | 200 | 200 | 150 | 150 | 150 |

| Total added to Stock | 1,878.2 | 1,896.8 | 1,398.5 | 1,001.6 | 694.2 | 551.7 | 450.0 |

1 Estimates for 2011.

2 Demolitions estimated (extra conservative for last few years).

This means a record low number of housing units will be added to the housing stock in 2011.

Special thanks to housing economist Tom Lawler who shared with me some of his thoughts on completions.

Housing: Feeling the Hate

by Calculated Risk on 4/19/2011 12:17:00 PM

I've seen previous housing busts in California, and although they were less severe than the current bust, there always seemed to be a stage when people hated housing. So I've been looking for the "hate", and maybe we found some ...

First, from Equity LifeStyle Properties, Inc. (ELS) conference call (an accidental landlord, ht Brian):

Analyst: Along the lines of the rental home program a couple more questions. How big do you expect that program to ultimately get?And from Bloomberg: Americans Shun Cheapest Homes in 40 Years as Ownership Fades

ELS: I think the answer to that question is really another question, how long do we think the current environment and distinct single-family home situation is going to last and what are the issues that are going to cause that thing to kind of loosen up and return to some maybe a different normal but at least some sense of normalcy. I have not been a fan of the rental program because it changes the dynamic of the business that we know and love where we owned the land and somebody owns a structure on it. I think our desire to get some other capital involved in a rental situation is indicative of that desire to focus on really being a landowner as opposed to being a homeowner, but that said, I would also have to say that it has been much better than what I would have anticipated in terms of the operational drag, the ability to rent the homes, the wear and tear on the homes, the value of the homes over time much better than what I would have anticipated . And I think in some respects there could be a place for a component of rental over the long term. It gets to a customer that is very focused on maintaining or preserving capital but may not have access to capital but otherwise it is a good customer in our communities.

Analyst: Back to the home rental program has the basic customer changed in the business, that is, I guess the conventional or the traditional buyer was someone who was selling their home in order to buy a retirement home and didn't need financing and so what is the dynamic? Is it someone that is just hanging onto their pre-retirement home and [wants] financing? I guess it is not clear to me why third-party financing is very critical to the business.

ELS: It is a use of capital issue. But with respect to the first part of your question , we run an application process that screens potential customers, and I would say the one thing that you will notice but I wouldn't call it a significant change but noticeable is that there are more customers with some type of history in their credit profile, meaning a foreclosure or short sale or something with respect to their previous housing arrangement. But as it relates to FICO and non-single-family home related credit issues, we are not seeing any change with respect to that. We are seeing a psychological change just in terms of people wanting to preserve their capital and not want to put much of it into a single-family home situation. They would rather have it in the bank or the stock market. I'm not sure where else but certainly not excited about putting large amounts of capital into a housing situation. That is what we are seeing at the level of the property

“I know people who have watched their home values get cut in half, and I know people who are losing their homes,” said [Victoria Pauli], 31, who works as a property manager for a real estate company. “It’s part of the American dream to want to own your own home, and I used to feel that way, but now I tell myself: Be careful what you wish for.”I disagree that housing is "cheap", but I'm starting to feel the hate.

...

At the end of 2010, the fourth year of the housing collapse, the share of people who said a home was a safe investment dropped to 64 percent from 70 percent in the first quarter. The December figure was the lowest in a survey that goes back to 2003, when it was 83 percent.

“The magnitude of the housing crash caused permanent changes in the way some people view home ownership,” said Michael Lea, a finance professor at San Diego State University. “Even as the economy improves, there are some who will never buy a home because their confidence in real estate is gone.”