by Calculated Risk on 3/30/2011 08:15:00 AM

Wednesday, March 30, 2011

ADP: Private Employment increased by 201,000 in March

ADP reports:

Private-sector employment increased by 201,000 from February to March on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from January 2011 to February 2011 was revised down to 208,000 from the previously reported increase of 217,000.Note: ADP is private nonfarm employment only (no government jobs).

...

The average monthly increase in employment over the last four months – December through March – has been 211,000, consistent with a gradual if uneven decline in the unemployment rate. This is almost three times the average monthly gain of 74,000 over the preceding four months of August through November.

This was about at the consensus forecast of an increase of about 205,000 private sector jobs in March.

The BLS reports on Friday, and the consensus is for an increase of 195,000 payroll jobs in March, on a seasonally adjusted (SA) basis, and for the unemployment rate to hold steady at 8.9%.

MBA: Mortgage Purchase Application activity decreases slightly

by Calculated Risk on 3/30/2011 07:19:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 10.1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.7 percent from one week earlier.

...

"Treasury and mortgage rates increased towards the end of last week, as global markets calmed following the recent crises in Japan and the Middle East. Refinance volume predictably fell in response to these rate increases. As rates climb back to 5 percent, fewer homeowners have both the incentive and the ability to refinance," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase volume remained roughly flat as we enter what is typically the peak homebuying season."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.92 percent from 4.80 percent, with points decreasing to 0.83 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

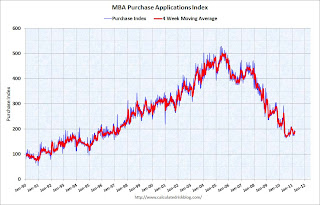

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still moving sideways suggesting fairly weak home sales "as we enter what is typically the peak homebuying season". Note: There is a large percentage of cash buyers too.

Here come the downgrades for Q1 GDP Growth: Part II

by Calculated Risk on 3/30/2011 12:06:00 AM

Based on the February Personal Income and Outlays report, it is pretty clear that GDP growth in Q1 is going to be sluggish. We are going to see a number of downgrades, this once via David Leonhardt at the NY Times: As Economy Sputters, a Timid Fed (pay)

"a prominent research firm ... Macroeconomic Advisers, has downgraded its estimate of economic growth in the current quarter to a paltry 2.3 percent, from 4 percent."Leonhardt mostly discusses the Fed, QE2 and whether the Fed is properly balancing unemployment and inflation.

Earlier posts on Case-Shiller house prices:

• Case Shiller: Home Prices Off to a Dismal Start in 2011

• Real House Prices and Price-to-Rent

• House Price Graph Gallery

Tuesday, March 29, 2011

State and Local tax revenue increases in 2010

by Calculated Risk on 3/29/2011 08:34:00 PM

The Census Bureau released the State and Local tax revenue data for Q4 2010 today. Here is the page.

From Conor Dougherty at the WSJ: Tax Revenue Snaps Back

State and local tax revenue has nearly snapped back to the peak hit several years ago—a gain attributed to a reviving economy and tax increases implemented during the recession.Local governments are mostly funded by property taxes, and it usually takes some time for falling prices to show up in property taxes. Local property tax revenue is just starting to decline in the Census data.

But the improvement masks deeper problems for state and local governments that are likely to linger for years. To weather the recession, state governments relied on now-depleted federal stimulus funds ...

Total tax receipts for state and local governments hit $1.29 trillion in 2010, just 2.3% shy of the $1.32 trillion taken in during 2008, not adjusted for inflation, according to Census Bureau data.

State revenue is mostly from individual income taxes and sales taxes (see tables at the Census Bureau) and this revenue is still well below the pre-recession levels.

Even with improving revenue, there will be more state and local fiscal tightening this year - and that will remain a drag on economic growth.

Proposed New Mortgage Lending Rules

by Calculated Risk on 3/29/2011 03:56:00 PM

Earlier, several regulators released proposed new mortgage lending rules. Here is the press release from the Federal Reserve.

And here is the 233 page document.

Alan Ziebel at the WSJ has an overview: Regulators Unveil Mortgage-Lending Rules

The proposal ... is designed to encourage safer lending practices by mandating that issuers of mortgage-backed securities either follow conservative principles, such as requiring 20% down payments for mortgages, or hold a portion of the loans on their books. Companies that package loans into securities would have to hold at least 5% of the credit risk, unless the loans meet an exemption for high-quality loans.I've noted before that a 10% down payment with mortgage insurance seems reasonable. These front end and back end debt-to-income (DTI) guidelines used to be pretty standard.

... The proposal requests public comment on an alternative approach that would allow for a 10% down payment and mortgage insurance.

It also recommends that homeowners spend only 28% of their pretax income on their primary mortgage and 36% on total debt ...

It is important to note that more risky loans can still be made - but the lender has to hold some of the credit risk (a "skin in the game" incentive to adequately underwrite the loans).

Lenders are arguing for a little more flexibility to meet the qualified residential mortgage (QRM) exemption, from the MBA:

"While factors like downpayment, debt to income (DTI) ratio and past payment history can be accurate predictors of loan performance, we do not believe that each ought to be considered independently.My reaction is the rule is fine (I'd go with the 10% down payment and mortgage insurance). For the riskier loans, the lender can hold on to some credit risk (a great incentive to properly underwrite the loan).

"Rather, the rule should allow for consideration of a borrowers entire credit profile before determining whether risk retention is necessary on a given loan. For example, we believe that a lower downpayment loan could be less risky if a borrower has a strong history of making payments on time and if the borrower's debt to income ratio is on the lower end of the scale. The rule should provide more flexibility in this regard."

Philly Fed February State Coincident Indexes

by Calculated Risk on 3/29/2011 02:48:00 PM

Earlier posts on Case-Shiller house prices:

• Case Shiller: Home Prices Off to a Dismal Start in 2011

• Real House Prices and Price-to-Rent

• House Price Graph Gallery

Click on map for larger image.

Click on map for larger image.

The recovery may be sluggish, but it is fairly widespread geographically.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty six states are showing increasing three month activity. Four states are showing declining three month activity: Kansas, Delaware, New Jersey, and New Mexico.

Here is the Philadelphia Fed state coincident index release (pdf) for February 2011.

In the past month, the indexes increased in 44 states, decreased in three (Kansas, New Jersey, and Wyoming), and remained unchanged in three (Delaware, New Mexico, and South Dakota) for a one-month diffusion index of 82.

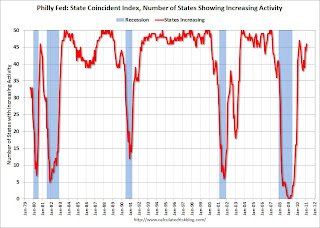

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 44 states, decreased in 3, and remained unchanged in 4. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Several states fell back into declining activity in the 2nd of half of last year, but the situation has improved a little in early 2011.

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.