by Calculated Risk on 3/29/2011 11:24:00 AM

Tuesday, March 29, 2011

Real House Prices and Price-to-Rent

The following graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes through January 2011 in real terms (adjusted for inflation using CPI less shelter).

Note: some people use other inflation measures to adjust for real prices.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to May 2000.

A few key points:

• The real price indexes are all at new post-bubble lows.

• I don't expect national real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope for real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• Nominal prices will probably fall some more and my forecast is for a decline of 5% to 10% from the October 2010 levels for the national price indexes.

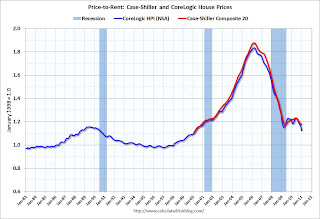

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

This ratio could decline another 10%, and possibly more if prices overshoot to the downside. The decline in the ratio will probably be a combination of falling house prices and increasing rents.

I know some people are forecasting nominal price declines of 20% to 30% from the current level. Those forecasts are based on more distressed supply hitting the market (almost 7 million loans are delinquent and 11.1 million borrowers have negative equity). However I think that forecast for house prices is too pessimistic.

One of the reasons that prices will probably not fall that far is all the cash buyers - especially at the low end. See from Bloomberg: Cash-Paying Vultures Pick Bones of U.S. Housing Market as Mortgages Dry Up (ht Mike In Long Island, db).

Earlier:

• Case Shiller: Home Prices Off to a Dismal Start in 2011

Case Shiller: Home Prices Off to a Dismal Start in 2011

by Calculated Risk on 3/29/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January (actually a 3 month average of November, December and January).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:Home Prices Off to a Dismal Start in 2011

ata through January 2011, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices ... show further deceleration in the annual growth rates in 13 of the 20 MSAs and the 10- and 20-City Composites compared to the December 2010 report. The 10-City Composite was down 2.0% and the 20-City Composite fell 3.1% from their January 2010 levels. San Diego and Washington D.C. were the only two markets to record positive year-over-year changes. However, San Diego was up a scant 0.1%, while Washington DC posted a healthier +3.6% annual growth rate. The same 11 cities that had posted recent index level lows in December 2010, posted new lows in January.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.4% from the peak, and down 0.2% in January (SA). The Composite 10 is still 2.2% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.3% from the peak, and down 0.2% in January (SA). The Composite 20 is only 0.7% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low soon.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.0% compared to January 2010.

The Composite 20 SA is down 3.1% compared to January 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in January seasonally adjusted. From S&P (NSA):

Prices increased (SA) in 8 of the 20 Case-Shiller cities in January seasonally adjusted. From S&P (NSA):In January, the 10-City and 20-City Composites were down 0.9% and 1.0%, respectively, from their December 2010 levels. The monthly statistics show that 19 of the 20 MSAs and both the 10-City and 20-City Composite were down in January 2011 versus December 2010, the only exception being Washington D.C. which posted a month-over-month increase of 0.1%. Seventeen of the 20 MSAs and both Composites have posted more than three consecutive months of negative monthly returns. In January 2011, 12 of the 20 MSAs and the 20-City Composite are down by more than 1% compared to their levels in the previous month.Prices in Las Vegas are off 58% from the peak, and prices in Dallas only off 7.3% from the peak.

From S&P (NSA):

Continuing the trend set late last year, we witnessed 11 MSAs posting new index level lows in January 2011, from their 2006/2007 peaks. These cities are Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa. These same 11 cities had posted lows with December’s report, as well.Both composite indices are still slightly above the post-bubble low (SA), but the indexes will probably be at new lows in early 2011.

Monday, March 28, 2011

Sports Stadium bonds in trouble?

by Calculated Risk on 3/28/2011 10:43:00 PM

Small and large ...

From Michelle McNiel at the Wenatchee World The debt dilemma (ht Ken)

Ask any public official and they’ll say default is simply not an option when it comes to the Town Toyota Center’s $42 million debt.And from Darrell Preston and Aaron Kuriloff at Bloomberg: Texans’ NFL Stadium Bonds Fall Amid Default Talk (ht Brian)

But the “D” word is creeping into conversations around the community, fueled by uncertainty over just how the massive debt is going to be paid on the 4,300-seat events center.

Harris County-Houston Sports Authority bonds that financed venues for the Houston Texans and two other sports teams have fallen as much as 34 percent amid speculation the agency may default on payments.

...

The authority financed the building of Minute Maid Park, home to the Houston Astros Major League Baseball team; Reliant Stadium, for the Texans; and Toyota Center, for the Houston Rockets National Basketball Association team.

...

the authority sold $509.7 million in bonds between 1998 and 2000 [for Reliant Stadium], along with $461.6 million the following year.

Neutron Loans hit California City

by Calculated Risk on 3/28/2011 07:24:00 PM

I'm reminded of this quote:

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses,” said Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo. ... from a 2007 NY Times article (pay)

And from the O.C. Register today: Vacant homes a clue to Santa Ana's census drop

A big jump in the number of vacant homes could be a key to understanding this city's surprising drop in population as recorded by the 2010 census.Some probably double up. Another earlier article suggested some former residents may have moved back to Mexico. But the reason is neutron loans ...

...

Santa Ana's drop, in raw numbers, was the largest of any California city.

...

The census counted 76,896 housing units in Santa Ana and determined that 3,722 of them were vacant. [CR Note: the 2000 Census showed 74,588 housing units in Santa Ana and 1,586 vacant. So the vacancy rate more than doubled]

Among cities in Orange County, Santa Ana had among the highest concentrations of mortgage defaults in 2009, which could explain why the census found so many vacant homes in 2010.

... it's unclear where the people who left behind vacant homes went, since other states didn't show big influxes of people from California, [John Malson, acting chief of the demographic research unit at the Department of Finance] said. ... "We assumed a lot of people were moving back home or doubling up," he said. "It just seems that there might be a missed population from the census."

Personal Saving Rate and Income less Transfer Payments

by Calculated Risk on 3/28/2011 03:43:00 PM

A couple more graphs based on the Personal Income and Outlays report.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This first graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and real personal income less transfer payments declined slightly in February. This remains 3.2% below the previous peak.

The personal saving rate decreased to 5.8% in January.

Personal saving -- DPI less personal outlays -- was $676.7 billion in February, compared with $710.5 billion in January. Personal saving as a percentage of disposable personal income was 5.8 percent in February, compared with 6.1 percent in January.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. However that was just a guess. After increasing sharply during the recession, the saving rate has been mostly moving sideways for the last two years - so spending growth has mostly kept pace with income growth, and that will probably continue all year.

Here come the downgrades for Q1 GDP Growth

by Calculated Risk on 3/28/2011 12:50:00 PM

Before the February Personal Income and Outlays report, most analysts were expecting real GDP growth of over 3% in Q1. As an example, Paul Kasriel at Northern Trust was forecasting 3.1% real GDP growth with 2.2% real Personal Consumption Expenditure (PCE) growth, and Goldman Sachs was forecasting 3.5% real GDP growth with 3.0% real PCE growth.

Both of those forecast now look too high.

Note: The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q1, you would average PCE for January, February, and March, then divide by the average for October, November and December. Of course you need to take this to the fourth power (for the annual rate) and subtract one. Also the March data isn't released until after the advance Q1 GDP report.

There are a few commonly used methods to forecast quarterly PCE growth after the release of the second month of the quarter report (February for Q1). Some analysts use the "two month" method (averaging the growth from October-to-January with the growth from November-to-February). Others use the mid-month method and just use the growth from November-to-February.

Either way, the first two months of Q1 2011 suggest PCE growth of around 1.4% for the quarter as shown in the following table.

| PCE, Billions (2005 dollars), SAAR | 3 Month Change (annualized) | Quarter (Annualized) | |

|---|---|---|---|

| Jan-10 | $9,189.30 | ||

| Feb-10 | $9,228.20 | ||

| Mar-10 | $9,258.60 | ||

| Apr-10 | $9,257.20 | 2.99% | |

| May-10 | $9,280.50 | 2.29% | |

| Jun-10 | $9,289.30 | 1.33% | 2.2% |

| Jul-10 | $9,302.60 | 1.98% | |

| Aug-10 | $9,333.90 | 2.32% | |

| Sep-10 | $9,355.40 | 2.88% | 2.4% |

| Oct-10 | $9,402.80 | 4.38% | |

| Nov-10 | $9,426.60 | 4.03% | |

| Dec-10 | $9,439.30 | 3.64% | 4.0% |

| Jan-11 | $9,435.10 | 1.38% | |

| Feb-11 | $9,459.00 | 1.38% | |

| Mar-11 |

Although there are other components of GDP (investment, trade, government spending and inventory changes), it appears Q1 GDP growth will be lower than expected.

I still expect stronger GDP growth in 2011 than in 2010, but it appears 2011 is off to a sluggish start - and I'm concerned about world events and high oil prices.