by Calculated Risk on 2/27/2011 03:38:00 PM

Sunday, February 27, 2011

Jobs, Jobs, Jobs

As a reminder, the weak payroll report for January was blamed on the snow. Usually I don't buy the weather excuses, but it did appear weather played a role this time. When the report was released, I wrote:

The 36,000 payroll jobs added was far below expectations of 150,000 jobs, however this was probably impacted by bad weather during the survey reference period. If so, there should be a strong bounce back in the February report.That is a key reason the consensus is so high for February. Bloomberg has the consensus at 180,000, MarketWatch has 200,000, Goldman's forecast is 200,000, and I heard ISI is at 230,000).

It will be useful to average the two months to estimate the current pace of payroll growth - especially if weather played a role in January and there is a strong bounce back in February.

And we have to remember the numbers are grim:

• There are 7.7 million fewer payroll jobs now than before the recession started in December 2007.

• Almost 14 million Americans are unemployed.

• Of those unemployed, 6.2 million have been unemployed for six months or more.

• Another 8.4 million are working part time for economic reasons,

• About 4 million more have left the labor force since the start of the recession (we can see this in the dramatic drop in the labor force participation rate),

• of those who have left the labor force, about 1 million are available for work, but are discouraged and have given up.

A simple calculation: If the economy is adding 125,000 jobs per month (average over two months), it would take over 5 years to add back the 7.7 million lost payroll jobs - and that doesn't even include population growth. Grim is an understatement.

Earlier:

• Schedule for Week of February 27th

• Summary for Week ending February 25th

Schedule for Week of February 27th

by Calculated Risk on 2/27/2011 08:29:00 AM

Earlier: Summary for Week ending February 25th

The key report for this week will be the February employment report to be released on Friday, March 4th.

Other key reports include the Personal Income and Outlays report on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Also Fed Chairman Ben Bernanke will deliver the Semiannual Monetary Policy Report to the Congress on Tuesday (Senate) and Wednesday (House).

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

8:30 AM: New York Fed President William Dudley speaks on the economic outlook

8:45 AM: Boston Fed President Eric Rosengren, panel discussion, "Lessons Learned from the Global Meltdown."

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a slight decrease to a still very strong 68.0 (down from 68.8 in January).

10:00 AM: Pending Home Sales for January. The consensus is for a slight decline in pending sales (a leading indicator for existing home sales).

10:30 AM: Dallas Fed Manufacturing Survey for February. The Texas production index was down sharply last month to 0.2 (from 15.3 in December), but is expected to show improvement in February.

10:00 AM: ISM Manufacturing Index for February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.

The consensus is for a decrease to 60.5 from the strong 60.8 in January. All of the regional manufacturing surveys showed strong improvement in February.The PMI was at 60.8% in January, the highest level since May 2004. Some forecasts are as high as 63, and any reading above 61.4 would be the highest since 1983.

10:00 AM: Construction Spending for January. The consensus is for a 0.4% decrease in construction spending.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

All day: Light vehicle sales for February. Light vehicle sales are expected to increase to 12.7 million (Seasonally Adjusted Annual Rate), from 12.6 million in January.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. Edmunds is forecasting: "Edmunds.com analysts predict that February's Seasonally Adjusted Annualized Rate (SAAR) will be 12.64 million, up from 12.54 in January 2011."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for +180,000 payroll jobs in February, down slightly from the 187,000 reported in January.

10:00 AM: Fed Chairman Ben Bernanke testimony, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Fed Beige Book, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on economic outlook

8:00 PM: Fed Chairman Ben Bernanke, "Challenges for State and Local Governments", At the Citizens Budget Commission Annual Dinner in New York

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months. The consensus is for a slight increase to 396,000 from 391,000 last week.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a slight increase to 59.5 from 59.4 in January.

11:00 AM: Minneapolis Fed President Narayana Kocherlakota speaks on labor markets and monetary policy

2:15 PM: Atlanta Fed President Dennis Lockhart speaks on the economy and labor

8:30 AM: Employment Report for February.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January.

The consensus is for an increase of 179,000 non-farm payroll jobs in February, after the disappointing 36,000 jobs added in January. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for February is in blue.

The consensus is for the unemployment rate to increase to 9.1% from 9.0% in January.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions - aligned at maximum job losses.This shows the severe job losses during the recent recession - there are currently 7.7 million fewer jobs in the U.S. than when the recession started.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for January. The consensus is for a 2.2% increase in orders.

10:00 AM: Fed Vice Chair Janet Yellen, Panel Discussion, Improving the International Monetary and Financial System, At the International Symposium of the Banque de France, Paris, France

Best Wishes to All!

Saturday, February 26, 2011

Libya Updates: Obama calls for Gaddafi to step down, U.N. meets tomorrow

by Calculated Risk on 2/26/2011 08:06:00 PM

Earlier on U.S. economy: Summary for Week ending February 25th

UPDATE: from the WSJ: U.N. Imposes Sanctions on Gadhafi

The United Nations Security Council Saturday night unanimously imposed an arms embargo on Libya, referred its leaders to the International Criminal Court and slapped financial and trade sanctions on Col. Moammar Gadhafi and his inner circle in an effort to stop them from killing more Libyan civilians.• From the WaPo: Obama calls for Gaddafi to step down as leader of Libya

"Widespread and systematic attacks currently taking place in Libya against the civilian population may amount to crimes against humanity" and "those responsible for the attacks" must be held accountable, the resolution said.

In a statement, the White House said Obama told Merkel that "when a leader's only means of staying in power is to use mass violence against his own people, he has lost the legitimacy to rule and needs to do what is right for his country by leaving now." Secretary of State Hillary Rodham Clinton issued a statement Saturday also demanding that Gaddafi step down.• The Telegraph blog that is updated frequently: Libya protests: live

23.53 Our New York correspondent Jon swaine has been at the UN, where Libya's ambassador defected earlier today. Read his full report here.• From al Jazeera: Live Blog - Libya Feb 27

23:42 The full UN Security Council is due to meet tomorrow at 4pm GMT (11am in NYC) to discuss possible sanctions against Gaddafi.

2:38am Al Jazeera understands the UN Security Council resolution will freeze the assets of six members of the Gaddafi family, including the Libyan leader - while 16 members of his administration will be slapped with a travel ban. Waiting on news of the vote...• From the WSJ: Pro-Rebel Officers Vow Defense of Eastern Libya

• From the NY Times: Long Bread Lines and Barricades in Libya’s Capital

Summary for Week ending February 25th

by Calculated Risk on 2/26/2011 02:36:00 PM

With the exception of housing, most of the U.S. economic data last week was fairly positive. We were also reminded of several potential downside risks to the U.S. economy, as falling house prices, higher oil prices, the European financial crisis, and state and local government cutbacks, were all in the news.

The focus last week was once again on the Middle East and North Africa, and especially on the historic and tragic events in Libya. These events have pushed U.S. oil prices to around $100 per barrel and have raised questions about the possible drag of higher oil prices on the U.S. economy.

The European financial crisis has been on the back burner, but yields are still elevated and there are key Euro Zone meetings scheduled in March. I expect this to be front page news again soon.

And a downward revision to state and local government spending contributed to the downward revision in the Q4 real GDP growth estimate, revised down to 2.8% from 3.2%. And several state budgets were in the news, especially the Wisconsin political battles.

The Case-Shiller house price index showed house prices are still falling – for the sixth consecutive month – and more house price declines are expected with the high levels of inventory and a high percentage of distressed sales. Eleven of the twenty Case-Shiller cities are now at new post-bubble lows: Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa, and more will probably follow. Also new home sales remained weak in January.

These are all risks to 2011 economic growth.

But other economic news was more positive. On employment, all of the preliminary indicators suggested an increase in hiring. The four week average of initial weekly unemployment claims fell to the lowest level since 2008. The regional manufacturing surveys all suggest an increase in employment. The Reuters / University of Michigan consumer sentiment index was at the highest level in three years.

And growth in manufacturing continues to be strong. The Richmond Fed reported Manufacturing Activity Advanced at a Healthy Pace in February, and the the Kansas City Fed reported Manufacturing activity matched an all-time survey high in February. This suggests a strong ISM manufacturing report on March 1st.

Below is a summary of economic data last week mostly in graphs:

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

S&P/Case-Shiller reported that home prices are close to a post-bubble low.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.2% from the peak and still 2.4% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.2% from the and only 0.8% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low in January.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

From S&P:

From S&P:

Eleven MSAs posted new index level lows in December 2010, since their 2006/2007 peaks. These cities are Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa.Prices are now falling just about everywhere, and more cities are hitting new post-bubble lows. Both composite indices are still slightly above the post-bubble low, but the indexes will probably be at new lows in early 2011.

• New Home Sales decreased in January

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December.This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. New home sales have averaged 293 thousand per month (annual rate) over the last nine months - all below the previous record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of January.

The previous record low for January was 24 thousand in 2009 and 2010.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed.The inventory of completed homes for sale fell to 78,000 units in January. And the combined total of completed and under construction is at the lowest level since this series started.

• January Existing Home Sales: 5.36 million SAAR, 7.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2010 (5.36 million SAAR) were 2.7% higher than last month, and were 5.3% higher than January 2010.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change. According to the NAR, inventory decreased to 3.38 million in January from 3.56 million in December.

Although inventory decreased from December to January, inventory increased 3.1% YoY in January. This is the sixth consecutive month of year-over-year increases in inventory, although the increase in January was lower than the previous months. But any increase is bad news with the high level of inventory.

Although inventory decreased from December to January, inventory increased 3.1% YoY in January. This is the sixth consecutive month of year-over-year increases in inventory, although the increase in January was lower than the previous months. But any increase is bad news with the high level of inventory.Inventory should increase in February and March, and this is something to watch closely over the next few months.

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).The red column in January is for 2011. Sales NSA were about the same level as the last three years. January is usually the weakest month of the year for existing home sales (followed by February). The real key is what happens in the spring and summer.

The bottom line: Sales increased slightly in January (using the old method to estimate sales), apparently due to an increase in investor purchases of distressed properties at the low end. Inventory remains very high, and the year-over-year increase in inventory is very concerning.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% to 15% or more in 2009 and 2010). The numbers released this week will probably be revised down significantly this summer.

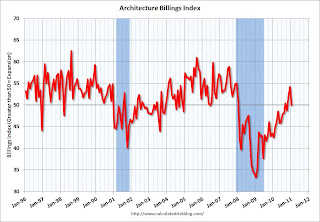

• AIA: Architecture Billings Index shows no change in January

From the American Institute of Architects: Billings at Architecture Firms Hold Steady in January

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so.

• Consumer Sentiment increases in February

The final February Reuters / University of Michigan consumer sentiment index increased to 77.5, the highest level in three years.

The final February Reuters / University of Michigan consumer sentiment index increased to 77.5, the highest level in three years.This was above the consensus forecast of 75.4.

In general consumer sentiment is a coincident indicator. This is still fairly low, but improving.

• Total REO decreased slightly in Q4

This graph from economist Tom Lawler shows an estimate of all the REO inventory. Lawler writes:

This graph from economist Tom Lawler shows an estimate of all the REO inventory. Lawler writes: Based on the FDIC’s QBP report, as well as preliminary data on REO for private-label securities (using Barclay’s Capital data, as I don’t have data from my other source yet), REO inventory at “the F’s,” FDIC-insured institutions, and PLS would look as follows [see graph]From CR: REO inventory is still below the levels in 2008 - but not much - and that was when prices were falling quickly. I think the various lenders are a little more careful disposing of REOs now, but the level of REOs suggest downward house price pressure.

• Other Economic Stories ...

• Q4 real GDP growth revised down to 2.8% annualized rate

• From Nick Timiraos: Home Sales Data Doubted

• From David Streitfeld at the NY Times: Shiller says house prices could fall 15% to 25%

• From MarketWatch: Consumer confidence jumps in February

• From the American Trucking Association: ATA Truck Tonnage Index Surged 3.8 Percent in January

• Unofficial Problem Bank list increases to 960 Institutions

Best wishes to all!

Buffett on Housing

by Calculated Risk on 2/26/2011 12:24:00 PM

A few excerpts from Warren Buffett's annual letter to shareholders.

On Housing:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.He wrote the same thing last year:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Last year I disagreed, but now I think a recovery will probably "begin" within "a year or so".

On Clayton (manufactured homes):

At Clayton, we produced 23,343 homes, 47% of the industry’s total of 50,046. Contrast this to the peak year of 1998, when 372,843 homes were manufactured. (We then had an industry share of 8%.)CR Note: This is close to the record low for manufacturing homes set in 2009 of 49.8 thousand units.

Clayton owns 200,804 mortgages that it originated. (It also has some mortgage portfolios that it purchased.) At the origination of these contracts, the average FICO score of our borrowers was 648, and 47% were 640 or below. Your banker will tell you that people with such scores are generally regarded as questionable credits.Note: The worst performing mortgages originated during the housing bubble were NOT protected by a government guarantee, instead they were the product of the Wall Street driven originate-to-distribute model. But I agree with Buffett's comments on how prudent lending "concentrates the mind", and about putting people into homes they can afford.

Nevertheless, our portfolio has performed well during conditions of stress. ...

Our borrowers get in trouble when they lose their jobs, have health problems, get divorced, etc. The recession has hit them hard. But they want to stay in their homes, and generally they borrowed sensible amounts in relation to their income. In addition, we were keeping the originated mortgages for our own account, which means we were not securitizing or otherwise reselling them. If we were stupid in our lending, we were going to pay the price. That concentrates the mind.

If home buyers throughout the country had behaved like our buyers, America would not have had the crisis that it did. Our approach was simply to get a meaningful down-payment and gear fixed monthly payments to a sensible percentage of income. This policy kept Clayton solvent and also kept buyers in their homes.

... a house can be a nightmare if the buyer’s eyes are bigger than his wallet and if a lender – often protected by a government guarantee – facilitates his fantasy. Our country’s social goal should not be to put families into the house of their dreams, but rather to put them into a house they can afford.

Unofficial Problem Bank list increases to 960 Institutions

by Calculated Risk on 2/26/2011 08:51:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 25, 2011.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2011, which contributed to many changes for the Unofficial Problem Bank List. This week, there are three removals and 12 additions leaving the Unofficial Problem Bank List at 960 institutions. The net changes added $8.9 billion in assets, which is the largest weekly asset increase since June 18, 2010 when $19 billion was added. The average net weekly change has been about seven additions and $1.7 billion in assets. However, the aggregate assets on the list declined this week by $4.7 billion to $413.8 billion from $418.9 billion as 2010q3 financials were replaced by year-end figures. Positively, the change in financials caused a $13.6 billion decline in assets.CR Note: The FDIC released the Q4 Quarterly Banking Profile this week. The FDIC reported 884 official "problem" institutions at the end of 2010 (the highest since 1992) with $390 billion in assets. There are a total 6,529 commercial banks and 1,128 savings institutions, so about 11.5% are on the "problem" list. Assets of all institutions are $13.1 trillion, so problem institutions have just under 3% of total assets.

The three removals include the failed Valley Community Bank, St. Charles, IL ($124 million) and action terminations against Lafayette Community Bank, Lafayette, IN ($131 million) and American Continental Bank, City Of Industry, CA ($129 million).

Most notable among the 12 additions this week are BankAtlantic, Fort Lauderdale, FL ($4.5 billion Ticker: BBX); Bridgeview Bank Group, Bridgeview, IL ($1.5 billion); EVB, Tappahannock, VA ($1.1 billion Ticker: EVBS); PrimeSouth Bank, Blackshear, GA ($422 million); and West Pointe Bank, Oshkosh, WI ($409 million).

Other changes include the FDIC issuing a Prompt Corrective Action order against Seattle Bank, Seattle, WA ($468 million) and terminating one against Idaho First Bank, McCall, ID ($77 million).

After the monthly release of actions by the FDIC, it would not be unusual for the Unofficial Problem Bank List to trend down until the middle of next month as closings tend to outpace new order issuance during this part of the month. Until next week, try to have a safe & sound banking week.