by Calculated Risk on 1/25/2011 10:53:00 AM

Tuesday, January 25, 2011

Misc: State Unemployment Rates, Richmond Fed Manufacturing Survey, Consumer Confidence

Several items ...

• From the Telegraph: UK economy shrinks 0.5pc

Gross domestic product fell 0.5pc in the fourth quarter, the most in more than a year, the Office for National Statistics reported on Tuesday.Double dip?

• From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in December. ... Nevada continued to register the highest unemployment rate among the states, 14.5 percent in December. The states with the next highest rates were California, 12.5 percent, and Florida, 12.0 percent. The Nevada rate was the highest in its series.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Ten states now have double digit unemployment rates.

• From the Richmond Fed: Manufacturing Activity Continues to Expand in January; Expectations Remain Upbeat

In January, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — fell seven points to 18 from December's reading of 25. Among the index's components, shipments dropped seven points to 23, new orders lost twelve points to finish at 17, and the jobs index was unchanged at 14.This was below expectations of a decline to 22.

• The Conference Board reported their consumer confidence index was at 60.6 (1985=100), up from 52.5 in December. This was above expectations of an increase to 54.2. Confidence is a coincident indicator and this suggests improvement in January.

Earlier:

• Case-Shiller: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows in November

Case-Shiller: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows in November

by Calculated Risk on 1/25/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November (actually a 3 month average of September, October and November).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows

Data through November 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show a deceleration in the annual growth rates in 17 of the 20 MSAs and the 10- and 20-City Composites compared to what was reported for October 2010. The 10-City Composite was down 0.4% and the 20-City Composite fell 1.6% from their November 2009 levels. Home prices fell in 19 of 20 MSAs and both Composites in November from their October levels. In November, only four MSAs – Los Angeles, San Diego, San Francisco and Washington DC – showed year-over-year gains. The Composite indices remain above their spring 2009 lows; however, eight markets – Atlanta, Charlotte, Detroit, Las Vegas, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices peaked in 2006 and 2007, meaning that average home prices in those markets have fallen even further than the lows set in the spring of 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.0% from the peak, and down 0.4% in November(SA).

The Composite 20 index is off 30.9% from the peak, and down 0.5% in November (SA).

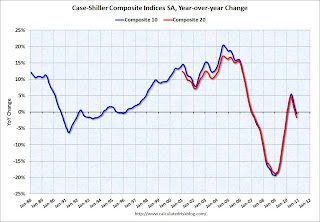

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 0.4% compared to November 2009. This is the first year-over-year decline since 2009.

The Composite 20 SA is down 1.6% compared to November 2009.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 3 of the 20 Case-Shiller cities in November seasonally adjusted.

Prices increased (SA) in only 3 of the 20 Case-Shiller cities in November seasonally adjusted. Prices in Las Vegas are off 57.8% from the peak, and prices in Dallas only off 8.9% from the peak.

Prices are now falling - and falling just about everywhere. As S&P noted "eight markets – Atlanta, Charlotte, Detroit, Las Vegas, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices peaked in 2006 and 2007". Both composite indices are still slightly above the post-bubble low.

Monday, January 24, 2011

Report: Financial Crisis Inquiry Commission has referred multiple cases for possible prosecution

by Calculated Risk on 1/24/2011 08:42:00 PM

Note: The Financial Crisis Inquiry Commission will release its report on the causes of the financial and economic crisis on Thursday, January 27, 2011, in Washington, D.C. at 10 AM ET.

From Shahien Nasiripour at the HuffPo: Financial Crisis Commission Finds Cause For Prosecution Of Wall Street

The bipartisan panel appointed by Congress to investigate the financial crisis has concluded that several financial industry figures appear to have broken the law and has referred multiple cases to state or federal authorities for potential prosecution ...I haven't had high expectations for this commission - we already know the dissenting reports are a joke - but I'll still read the report on Thursday.

Though civil charges appear a more likely outcome should prosecution result, one source familiar with the panel's deliberations said criminal charges should not be ruled out.

The commission's decision to refer conduct for prosecution underscores the severity of the activities it has uncovered and plans to detail in its widely anticipated final report, the sources said.

Political Grandstanding

by Calculated Risk on 1/24/2011 05:54:00 PM

There have been a few recent "policy" discussions that I haven't mentioned - because they are all about political posturing with no real substance.

A couple of examples:

• The Debt Ceiling. The deficit and the debt are real issues, but the "debt ceiling" debate is political posturing. Professor Hamilton recently wrote: Debt ceiling politics

If you have a concrete proposal to raise tax revenue or cut spending, then put it on the table. But if you simply want to grandstand on the debt ceiling as if it were a stand-alone issue, it is clear that you have nothing but contempt for the voters.• A recent article in the NY Times about "discussions" on state bankruptcies. Not Gonna Happen. Economix has California’s state treasurer, Bill Lockyer response: State Bankruptcies? ‘Ludicrous,’ He Says

“It’s a cynical proposal, intended to incite a panic in response to a phony crisis,” Mr. Lockyer said in a conference call with journalists. “Killer bees, space aliens, and now it’s the invasion of the bankrupt states.”The state budget issues are serious. And the U.S. debt and deficit issues are serious too. But I've ignored the "debt ceiling" and "state bankruptcy" discussions for a reason - they are nonsense.

Regarding the FOMC: How long is an "Extended Period"?

by Calculated Risk on 1/24/2011 03:33:00 PM

This is an update to a post I wrote in April 2010. Once again people are asking if the Fed will raise rates this year? It is unlikely.

That reminds me of a question Catherine Rampell at the NY Times Economix asked: How Long Is an ‘Extended Period’?

My short answer: Longer than many analysts expect.

We can compare to the "considerable period" language in 2003:

• June 25, 2003: Lowered Rate to 1%, Unemployment Rate peaked at 6.3%So "extended period" is probably 6+ months after the language changes. The FOMC will meet this week, and there has been no hint that the "extended period" language will change. The next meeting will be on March 15th and the next two day meeting is near the end of April.

• August 12, 2003: “the Committee believes that policy accommodation can be maintained for a considerable period.” Unemployment rate at 6.1%

• December 9, 2003: Last statement using the phrase "considerable period". Unemployment rate at 5.7%

• January 28, 2004: the Committee believes that it can be patient in removing its policy accommodation. Unemployment Rate 5.7%

• May 4, 2004: “the Committee believes that policy accommodation can be removed at a pace that is likely to be measured.” Unemployment Rate 5.6%

• June 30, 2004: FOMC raised the Fed Funds rate 25 bps. Unemployment Rate 5.6%

Based on past experience - as I noted last year - it is unlikely the Fed will raise rates until the unemployment rate is below 8%, and therefore I think it is very unlikely the Fed will raise rates this year.

Moody's: Commercial Real Estate Prices increased 0.6% in November

by Calculated Risk on 1/24/2011 11:37:00 AM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 0.6% in November. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales and there are a large percentage of distressed sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 2.8% from a year ago and down about 42% from the peak in 2007.

CoStar reported that CRE prices declined in November, and that the commercial market is bifurcated (even trifurcated) with trophy properties doing well, but prices for other properties still declining.