by Calculated Risk on 1/19/2011 12:11:00 PM

Wednesday, January 19, 2011

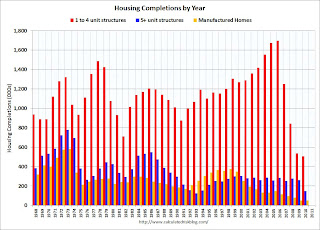

Record Low Housing Completions in 2010

This is a key story: there were a record low number of housing completions in 2010, breaking the record set in 2009.

The total for single family, multi-family and manufactured homes (estimated) was 703 thousand units in 2010. That is about 17% below the 844 units completed in 2009 (including manufactured homes). The previous record low was 1.244 million in 1982.

As Tom Lawler noted, there will be record low number of multi-family units completed in 2011 - since it takes over a year on average to complete - and probably a record low number of total units.

Note: Multi-family completions will be at a record low this year, but starts will increase.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes.

In 2010, 1 to 4 unit completions were at a record low 506 thousand. This was just below the 534 thousand units completed in 2009. This is far below the previous record low of 712 thousand units in 1982.

For 5+ units, completions were at 147 thousand units. This was just above the record low of 127 thousand in 1993 - and that record will be broken in 2011.

This doesn't include demolitions that were probably in the 200 to 300 thousand unit range. This suggest the excess supply was reduced in 2010, and will probably be significantly reduced in 2011. Of course this also depends on household formation - and that means jobs.

Housing Starts Decline in December

by Calculated Risk on 1/19/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 529 thousand (SAAR) in December, down 4.3% from the revised November rate of 553 thousand, and up 11% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 9.0% to 417 thousand in December - the lowest level since early 2009.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight ups and downs due to the home buyer tax credit.

There was an increase in permits, especially for multi-family units.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was below expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed. But I do expect starts to increase in 2011 from this low level.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 529,000. This is 4.3 percent (±14.1%)* below the revised November estimate of 553,000 and is 8.2 percent (±14.4%)* below the December 2009 rate of 576,000.

Single-family housing starts in December were at a rate of 417,000; this is 9.0 percent (±11.7%)* below the revised November figure of 458,000.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 635,000. This is 16.7 percent (±2.1%) above the revised November rate of 544,000, but is 6.8 percent(±2.8%) below the December 2009 estimate of 681,000.

Single-family authorizations in December were at a rate of 440,000; this is 5.5 percent (±2.3%) above the revised November figure of 417,000.

MBA: Mortgage Purchase Application decline in latest survey

by Calculated Risk on 1/19/2011 07:27:00 AM

The MBA reports: Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 7.7 percent from the previous week. This is the third consecutive weekly increase in refinance applications and is the highest Refinance Index observed since the beginning of December. The seasonally adjusted Purchase Index decreased 1.9 percent from one week earlier.

...

"Mortgage rates have moved somewhat lower since the beginning of the year, as mixed data on the job market continue to cloud the outlook for the economy," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Refinance applications have picked up, as borrowers take advantage of lower rates, but purchase applications remain quite low, indicating that home sales are unlikely to pick up any time soon."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.77 percent from 4.78 percent, with points increasing to 1.20 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index suggests weak existing home sales through the first couple months of 2011. As the MBA's Fratantoni noted: "[P]urchase applications remain quite low, indicating that home sales are unlikely to pick up any time soon."

AIA: Architecture Billings Index highest since December 2007

by Calculated Risk on 1/19/2011 12:01:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From the American Institute of Architects: Architecture Billings Index (ABI) for December

“On the heels of its highest mark since 2007, the Architecture Billings Index (ABI) jumped more than two points in December. ... The American Institute of Architects (AIA) reported the December ABI score was 54.2, up from a reading of 52.0 the previous month. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, up slightly from a mark of 61.4 in November.”

“This is more promising news that the design and construction industry is continuing to move toward a recovery,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. "However, historically December is the most unpredictable month from a business standpoint, and therefore the most difficult month from which to interpret a trend. The coming quarter will give us a much better sense of the strength of the apparent upturn in design activity.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index showed expansion in December (above 50) and this is the highest level since December 2007.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year or so.

Tuesday, January 18, 2011

LA Port Traffic in December

by Calculated Risk on 1/18/2011 09:05:00 PM

The following graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for December. LA area ports handle about 40% of the nation's container port traffic.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Since there is a strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic is up 17% and outbound up 13%.

The 2nd graph is the monthly data (with strong seasonal pattern).

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of December, loaded inbound traffic was up 7.8% compared to December 2009, and loaded outbound traffic was up 9.3% compared to December 2009. This suggests that the trade deficit with China (and other Asian countries) might have declined somewhat in December (seasonally adjusted).

For outbound traffic, 2010 was the 2nd highest year ever behind 2008. For inbound traffic, 2010 was the 5th highest behind 2005 through 2008.

NAHB Builder Confidence Graph

by Calculated Risk on 1/18/2011 06:52:00 PM

Earlier the National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in January. Here is the graph ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction although there is plenty of noise month-to-month. The HMI has mostly moved sideways - with some minor ups and downs - for over 2 years now at a very depressed level.