by Calculated Risk on 1/10/2011 08:54:00 AM

Monday, January 10, 2011

Europe Update

• From Bloomberg: Germany May Soften Objections to Fund Increase as Bonds Drop

Germany may soften its opposition to expanding the region’s 750 billion-euro ($966 billion) rescue facility as Belgium’s political deadlock sent borrowing costs surging and the European Central Bank bought Portuguese bonds.• From AP: Greece borrowing rates hit new record

• From Reuters: ECB Throws Portugal a Temporary Lifeline

The European Central Bank threw Portugal a temporary lifeline on Monday by buying up its bonds, traders said, as market and peer pressure mounted for Lisbon to seek an international bailout soon.This will be a key week for Portugal.

If Portugal turns to the EFSF, so much for a firewall between the markets and Spain ... the yield on the Spain 10-year bonds hit 5.53% today.

Weekend:

• Summary for Week ending January 8th

• Schedule for Week of January 9th

Sunday, January 09, 2011

China Reports Smaller Trade Surplus for December

by Calculated Risk on 1/09/2011 11:27:00 PM

From Bloomberg: China Reports Smaller Trade Surplus Before Obama Meeting

China reported a less-than-forecast $13.1 billion trade surplus for December, bolstering the nation’s bargaining position ahead of a Jan. 19 meeting where U.S. President Barack Obama may press for more gains in the yuan.Nice timing - but I'm skeptical of China's data. The U.S. trade numbers for November will be released this Thursday. The country-by-country trade numbers are not seasonally adjusted, and there is always a huge surge in imports from China right before the holidays - and then a sharp decline, so this might just be seasonal. We will need to look at the year-over-year numbers for China on Thursday.

The gap compared with ... November’s $22.9 billion.

Europe Update: Portugal

by Calculated Risk on 1/09/2011 06:07:00 PM

This might be an interesting week ...

From Marcus Walker at the WSJ: Portugal's Test of Debt Market Looms This Week

Portugal hopes to raise new funds in a bond auction on Wednesday ... European Union governments including Germany and France have for weeks been urging Portugal to apply for rescue loans from the joint EU-International Monetary Fund bailout facility ...The yield on the Portugal 10-year bond is at 7.1%.

the EU's deliberations over Portugal haven't reached the intensity seen ahead of the Greek and Irish rescues ... That could change quickly, however, should Portugal's borrowing costs continue to rise. Euro-zone finance ministers are set to meet Jan. 17, by which time the market's appetite for Portuguese debt should be clear.

If the bond auction goes OK, maybe yields will fall. If not, we might see the 'intensity of deliberations' increase next weekend.

Earlier:

• Summary for Week ending January 8th

• Schedule for Week of January 9th

California Governor calls for tax extensions, spending cuts

by Calculated Risk on 1/09/2011 02:15:00 PM

From the LA Times: Gov. Jerry Brown wants to tame budget with tax extensions, deep cuts

To tame the state's chronic budget shortfalls, the Democratic governor will request cuts in a broad array of state programs and services, particularly those that lend a hand to the needy, according to those familiar with his plan.The Sacramento Bee has many of the details. And the LA Times has an interactive tool California budget balancer

He will call on lawmakers to sharply curb welfare spending by reducing eligibility and payouts and cutting the duration of benefits from five years to four. Under Brown's plan, Medi-Cal would let patients see the doctor less often and would require them to pay more when they do. Children in the state's Healthy Families insurance program would no longer receive vision coverage, and their families would pay more for medical care.

The governor will also ask voters to approve an extension of 2009 tax hikes on their incomes, purchases and vehicles in a spring special election, insiders say, and he will tie the tax extension to protecting school funding.

State and local government budgets (and debt) will be significant issue all across the country in 2011. I'm especially pessimistic about California - it would take a miracle to make any progress.

Summary for Week ending January 8th

by Calculated Risk on 1/09/2011 09:08:00 AM

Note: here is the economic Schedule for Week of January 9th.

Below is a summary of the previous week, mostly in graphs.

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

The BLS reported that payroll employment increased by 103,000 in December, and the unemployment rate declined to 9.4 percent.

Click on graph for larger image.

Click on graph for larger image.

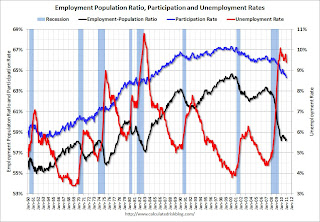

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 9.4% (red line).

The Labor Force Participation Rate declined to 64.3% in December (blue line). The Employment-Population ratio increased to 58.3% in December (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The best news was the decline in the unemployment rate to 9.4% from 9.8% in November. However this was partially because the participation rate declined to 64.3% - a new cycle low, and the lowest level since the early '80s. Note: This is the percentage of the working age population in the labor force.

The 103,000 payroll jobs added was below expectations of 140,000 jobs, however payroll for October payroll was revised up 38,000 and November was revised up 32,000 for a total of 70,000.

The increase in the long term unemployed, and the high level of part time workers for economic reasons are ongoing concerns. The average workweek was steady at 34.3 hours, and average hourly earnings ticked up 3 cents.

• U.S. Light Vehicle Sales at 12.55 million SAAR in December

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.55 million SAAR in December. That is up 13.1% from December 2009, and up 2.7% from the November 2010 sales rate.

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.55 million SAAR in December. That is up 13.1% from December 2009, and up 2.7% from the November 2010 sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.3 million SAAR.

• ISM Manufacturing Index increases in December

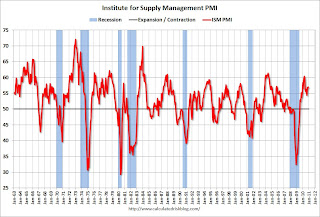

The Institute for Supply Management reported the PMI was at 57.0% in December, up slightly from 56.6% in November.

The Institute for Supply Management reported the PMI was at 57.0% in December, up slightly from 56.6% in November.

Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations and in line with the regional Fed manufacturing surveys.

• ISM Non-Manufacturing Index showed expansion in December

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

• Private Construction Spending increased in November

The Census Bureau reported overall construction spending increased in November compared to October. "[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion."

The Census Bureau reported overall construction spending increased in November compared to October. "[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion."

Private construction spending also increased in November: "Spending on private construction was at a seasonally adjusted annual rate of $491.8 billion, 0.3 percent (±1.1%)* above the revised October estimate of $490.5 billion."

This graph shows private residential and nonresidential construction spending since 1993. Private residential spending increased in November; private non-residential construction spending is still declining.

Sometime this year (in 2011), residential construction spending will probably pass non-residential spending. Although I expect the recovery in residential spending to be sluggish, Residential investment will probably make a positive contribution to GDP growth in 2011 for the first time since 2005.

• Other Economic Stories ...

• From Bloomberg: Banks Lose Pivotal Massachusetts Foreclosure Case

• From Alejandro Lazo at the LA Times: Housing bust creates new kind of declining city

• Reis: Apartment Vacancy Rates decline in Q4

• Reis: Strip Mall Vacancy rates steady in Q4

• Reis: Office Vacancy Rate steady in Q4

• From the American Bankruptcy Institute: Consumer Bankruptcy Filings increase 9 percent in 2010

• ADP: Private Employment increased by 297,000 in December

• Restaurant Performance Index slips in November

• Unofficial Problem Bank list increases at 932 Institutions

Best wishes to all!

Saturday, January 08, 2011

Two stories: Europe and Foreclosures

by Calculated Risk on 1/08/2011 10:46:00 PM

The next blowup in Europe seems to be getting closer ...

• From Reuters: Germany and France want Portugal to accept aid: report

And more on the banks ...

• From David Streitfeld at the NY Times: Facing Scrutiny, Banks Slow Pace of Foreclosures

Employment posts yesterday:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

• Employment Graph Gallery