by Calculated Risk on 1/05/2011 10:27:00 PM

Wednesday, January 05, 2011

Some background on Gene Sperling

Gene Sperling is expected to be named chairman of the Council of Economic Advisers on Friday - succeeding Larry Summers.

From the NY Times: Obama Turning to Experienced Hands as He Remakes Staff

Gene Sperling, a counselor to Treasury Secretary Timothy F. Geithner, was expected to be named on Friday as the director of the National Economic Council, the top economic policy job inside the White House. Mr. Sperling also held the position in the Clinton administration.And some background from David Leonhardt at Economix: Gene Sperling 101

The Brighter Outlook

by Calculated Risk on 1/05/2011 05:46:00 PM

Back in early 2009, one of the key reasons I thought there wouldn't be a "depression" (defined as a 10% decline in real GDP) was because the drag from several key sectors was slowing (see Feb, 2009: Looking for the Sun)

The logic was similar last year when I argued for sluggish growth but no double dip recession - I just didn't see a huge decline in residential investment. I noted that "usually a recession (or double-dip) is preceded by a sharp decline in Residential Investment (housing is the best leading indicator for the business cycle), and it [is] hard for RI to fall much further".

Now we can even go further. As I argued in Question #2 for 2011: Residential Investment, residential investment, and residential construction employment, will probably make positive contributions in 2011 to real GDP growth and payroll employment.

From the ADP employment report this morning:

Construction employment was unchanged in December, ending continuous monthly declines since June 2007. The decline in Construction employment, since its peak in January 2007, is 2,306,000.The tide is changing.

And there has even been some positive news for commercial real estate: Reis reported the vacancy rates for offices and malls didn't increase in Q4. Even if this is the peak, I still expect non-residential investment in structures to be a drag through the middle of this year - but that drag will slow too.

The real key will be employment growth. More jobs means more households, and if we see my forecast for job growth in 2011, we will probably see around 1 million more households in 2011. With the net increase to the housing stock at or near record lows in 2011, this would significantly help reduce the excess supply of vacant housing units.

There are still downside risks - notably from housing, state and local governments and possibly from Europe - and there are still drags from the financial crisis with excessive household debt and excess capacity in many sectors. But overall it appears the outlook for 2011 is brighter.

Here is the series I wrote over the last couple of weeks, Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

European Bond Yields

by Calculated Risk on 1/05/2011 03:07:00 PM

Just an update ...

• From the NY Times: Portugal's Borrowing Costs Rise as E.U. Sells Bonds for Irish Rescue

The European Union began issuing bonds on Wednesday to finance its rescue fund for Ireland, even as Portugal was required to pay more to sell short-term debt.• In addition to Portugal, yields are rising again in Ireland and Greece. The Ireland 10-year bond yield is over 9%, and the Greece 10-year bond yield is at a record 12.62%. Both Greece and Ireland are using the "bailout" funds, and the high yields suggest investors expect an eventual default.

... the Portuguese Treasury and Government Debt Agency sold €500 million of six-month bills ... The bills carried an average yield of 3.69 percent, far above the 2.05 percent Portugal paid for a similar issue in September.

• Update: From Bloomberg: Spanish Bank Stocks Drop on Funding Cost, Led by BBVA

It seems another blowup is inevitable.

Reis: Strip Mall Vacancy rates steady in Q4

by Calculated Risk on 1/05/2011 12:05:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

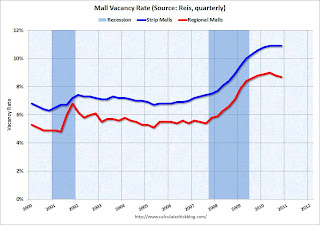

From Reuters: Rents at big U.S. malls up, but smaller centers lag

In the fourth quarter, vacancies at U.S. strip malls were flat at 10.9 percent ... Asking rent at strip malls fell 0.1 percent ... at large regional malls ... the vacancy rate fell ... to 8.7 percent ... Asking rents rose for the first time since the third quarter of 2008 ...At regional malls the record vacancy rate was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

"We appear to be in a meandering sort of direction," said Reis economist Ryan Severino.

It appears both the mall and office vacancy rates have peaked (or are near a peak), but the rates are still very high - and it will take some time for the vacancy rates to come down enough to start building again.

ISM Non-Manufacturing Index showed expansion in December

by Calculated Risk on 1/05/2011 10:00:00 AM

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: October 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 12th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.This was a solid report, however the decline in the employment index is disappointing.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI (Non-Manufacturing Index) registered 57.1 percent in December, 2.1 percentage points higher than the 55 percent registered in November, and indicating continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 6.5 percentage points to 63.5 percent, reflecting growth for the 13th consecutive month at a faster rate than in November. The New Orders Index increased 5.3 percentage points to 63 percent, and the Employment Index decreased 2.2 percentage points to 50.5 percent, indicating growth in employment for the fourth consecutive month, but at a slower rate. The Prices Index increased 6.8 percentage points to 70 percent, indicating that prices increased significantly in December. According to the NMI, 14 non-manufacturing industries reported growth in December. Respondents' comments vary by company and industry, but overall are mostly positive about business conditions."

emphasis added

ADP: Private Employment increased by 297,000 in December

by Calculated Risk on 1/05/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 297,000 from November to December on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from October to November was revised down but only slightly, from the previously reported increase of 93,000 to an increase of 92,000.Note: ADP is private nonfarm employment only (no government jobs).

This month’s ADP National Employment Report suggests nonfarm private employment grew very strongly in December, at a pace well above what is usually associated with a declining unemployment rate. After a mid-year pause, employment seems to have accelerated as indicated by September’s employment gain of 29,000, October’s gain of 79,000, November’s gain of 92,000 and December’s gain of 297,000. Strength was also evident within all major industries and every size business tracked in the ADP Report.

The consensus was for ADP to show an increase of about 100,000 private sector jobs in December, so this was well above consensus.

The BLS reports on Friday, and the consensus is for an increase of 140,000 payroll jobs in December, on a seasonally adjusted (SA) basis, and for the unemployment rate to decline slightly to 9.7%.