by Calculated Risk on 7/28/2015 01:11:00 PM

Tuesday, July 28, 2015

Real Prices and Price-to-Rent Ratio in May

A great discussion from Nick Timiraos at the WSJ: Are Home Prices Again Breaking Records? Not Really

The National Association of Realtors‘ monthly home sales report made a big splash last week with news that median home prices in June had broken the record set in 2006 at the peak of the housing bubble, reaching a nominal high of $236,400.The price-to-rent does seem a little high (last graph below), but the speculation associated with a bubble isn't present. No worries.

Does this mean we have another problem on our hands? Not really.

...[see data and graphs]

...

There may be other reasons to worry about housing affordability by comparing prices with incomes or prices with rents for a given market. But crude comparisons of nominal home prices with their 2006 and 2007 levels shouldn’t be used to make cavalier claims about a new bubble.

The year-over-year increase in prices is mostly moving sideways now at a little over 4%. In October 2013, the National index was up 10.9% year-over-year (YoY). In May 2015, the index was up 4.4% YoY.

Here is the YoY change since last May for the National Index:

| Month | YoY Change |

|---|---|

| May-14 | 7.1% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.7% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.4% |

| Feb-15 | 4.3% |

| Mar-15 | 4.2% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

Most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

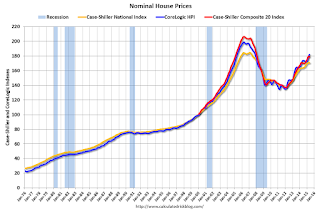

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to April 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to October 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.6% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to March 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

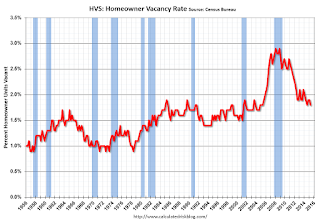

HVS: Q2 2015 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2015 10:16:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.4% in Q2, from 63.7% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate is the lowest in decades.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Case-Shiller: National House Price Index increased 4.4% year-over-year in May

by Calculated Risk on 7/28/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Lead Housing According to the S&P/Case-Shiller Home Price Indices

The 10-City Composite and National indices showed slightly higher year-over-year gains while the 20-City Composite had marginally lower year-over-year gains when compared to last month. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 4.9% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.4% annual increase in May 2015 versus a 4.3% increase in April 2015.

...

Before seasonal adjustment, in May the National index, 10-City Composite and 20-City Composite all posted a gain of 1.1% month-over-month. After seasonal adjustment, the National index was unchanged; the 10-City and 20-City Composites were both down 0.2% month-over-month. All 20 cities reported increases in May before seasonal adjustment; after seasonal adjustment, 10 were down, eight were up, and two were unchanged.

...

“As home prices continue rising, they are sending more upbeat signals than other housing market indicators,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, single family home price increases have settled into a steady 4%-5% annual pace following the double-digit bubbly pattern of 2013. Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.4% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 13.3% from the peak, and down 0.2% (SA) in May.

The National index is off 7.5% from the peak, and unchanged (SA) in May. The National index is up 24.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to May 2014.

The Composite 20 SA is up 4.9% year-over-year..

The National index SA is up 4.4% year-over-year.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in May seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 39.5% from the peak, and prices in Denver are at a new high (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 51% above January 2000 (51% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 11% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

Monday, July 27, 2015

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 7/27/2015 08:14:00 PM

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in May.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

• Also at 10:00 AM, Q2 Housing Vacancies and Homeownership survey.

To put the recent 5 day sell-off in perspective, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...

Vehicle Sales Forecasts for July: Over 17 Million Annual Rate Again, Best July in a Decade

by Calculated Risk on 7/27/2015 04:51:00 PM

The automakers will report July vehicle sales on Monday, August 3rd. Sales in June were at 17.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in July will be over 17 million SAAR again.

Note: There were 26 selling days in July, the same as in July 2014. Here are a few forecasts:

From J.D. Power: New-Vehicle Retail Sales SAAR in July to Hit 14 Million, Highest Level for the Month in a Decade

The forecast for new-vehicle retail sales in July 2015 is 1,260,200 units, a 2.5 percent increase compared with July 2014 and the highest retail sales volume for the month since July 2006, when sales hit 1,294,085. Retail transactions are the most accurate measure of consumer demand for new vehicles. [Total forecast 17.2 million SAAR]From Kelley Blue Book: New-Car Sales To Increase Nearly 3 Percent In July 2015, According To Kelley Blue Book

emphasis added

New-vehicle sales are expected to increase 2.6 percent year-over-year to a total of 1.47 million units in July 2015, resulting in an estimated 17.1 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book www.kbb.com ...From WardsAuto: 17 Million SAAR Streak Should Continue in July

...

"As the industry settles into the summer selling season, new-car sales are expected to remain consistent with last month's numbers, representing modest and slowing growth versus last year," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Sales in the first half of the year totaled 8.5 million units, a year-over-year improvement of 4.4 percent and the highest first-half volume since 2005. Total sales in 2015 are projected to hit 17.1 million units overall, a 3.6 percent year-over-year increase and the highest industry total since 2001."

If the projected 17.3 million-unit seasonally adjusted annual rate is reached, it will mark the first time since 2000 that the monthly LV SAAR has exceeded 17 million units in three consecutive months, and would represent the highest July SAAR since 2005.Another strong month for auto sales.

...

At forecast levels, year-to-date sales through July would rise to 9.97 million units, up 4.4% over the first seven months of 2014.