by Calculated Risk on 7/15/2015 07:00:00 AM

Wednesday, July 15, 2015

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 17% YoY

Note: Results for holiday weeks - and the following week - can be very volatile.

From the MBA: Refi Applications Up, Purchase Applications Down in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 10, 2015. The prior week’s results included an adjustment for the July 4th holiday. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 17 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged from 4.23 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 17% higher than a year ago.

Tuesday, July 14, 2015

Wednesday: Yellen, Industrial Production, NY Fed Mfg Survey, Beige Book and more

by Calculated Risk on 7/14/2015 06:34:00 PM

From the WSJ: White House Cuts Growth Forecast for 2015, 2016

The White House said it sees U.S. growth rising by just 2% this year before rebounding to 2.9% in 2016—down from its earlier forecast of 3% growth for both 2015 and 2016 released in February—after the economy stalled during the first quarter.Due to demographics, 2% really is the new 4%. But there is good news on the deficit and unemployment!

...

The White House estimates that the annual budget deficit will fall to $455 billion this year, down 22% from its estimate of $583 billion in February.

...

It sees the unemployment rate falling to 5.3% this year and 4.9% next year, down from forecasts of 5.4% and 5.1%, respectively, published in February.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for July. The consensus is for a reading of 3.5, up from -2.0 last month (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.1%.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Update: The California Budget Surplus

by Calculated Risk on 7/14/2015 03:23:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller Betty Yee: CA Controller’s June Cash Report Shows Another Surge to End 2014-15 Fiscal Year

California ended the fiscal year with another unexpected revenue surge in June, with total General Fund receipts surpassing the Governor’s May estimates by $859.4 million, according to State Controller Betty T. Yee’s monthly report of California’s cash balance, receipts, and disbursements published today.Some states are still struggling, but California is doing much better.

For the second year in a row, the General Fund ended with a positive cash balance.

June capped a 12-month boom in state revenues, driven largely by personal income tax. For the fiscal year ending June 30, total revenues for the General Fund (the source of most state spending) were $6.8 billion more than anticipated a year ago, when the 2014-15 budget was enacted. This was 6.4 percent higher than projected. Compared to the previous fiscal year, California revenues were $12.7 billion higher, a bump of 12.5 percent.

June’s revenues easily outstripped projections included in the Governor’s revised budget released only a month earlier. Personal income tax led the way, coming in $762.5 million higher than anticipated in the May Revision

emphasis added

CoreLogic: "Foreclosure Rate of 1.3 Percent is Back to December 2007 Levels"

by Calculated Risk on 7/14/2015 12:40:00 PM

From CoreLogic: National Overview through May 2015

A CoreLogic analysis shows 41,000 foreclosures were completed in May 2015, a 19.2 percent year-over-year decline from 51,000 in May 2014. By comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

...

Approximately 491,000 homes in the United States were in some stage of foreclosure as of May 2015, compared to 676,000 in May 2014, a decrease of 27.4 percent. This was the 43rd consecutive month with a year-over-year decline. As of May 2015, the foreclosure inventory represented 1.3 percent of all homes with a mortgage, compared to 1.7 percent in May 2014.

Click on graph for larger image.

Click on graph for larger image.Here is a map from the May report that shows foreclosure inventory by state.

Some key "bubble" states - like Arizona and California - have mostly recovered.

Several judicial foreclosure states - like New Jersey and Florida - are still struggling.

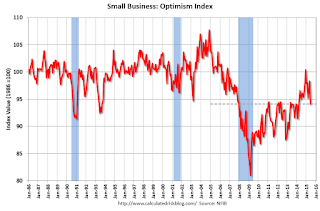

NFIB: Small Business Optimism Index decreased in June

by Calculated Risk on 7/14/2015 10:45:00 AM

From the National Federation of Independent Business (NFIB): Small Business Takes Significant Hit in June

The Small Business Optimism Index fell 4.2 points to 94.1 ... The 42 year Index average is 98.0, while the pre-recession average is 99.5 (1974-2007). This leaves the current reading 4 points below the overall average ...

It looks like small businesses “hired in May and then went away”. So, small businesses took a breather from job creation in June after a string of five solid months of job creation. On balance, owners added a net -0.01 workers per firm in recent months, essentially zero.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 94.1 in June from 98.3 in May. This is the lowest level since May 2014.