by Calculated Risk on 6/12/2015 10:03:00 AM

Friday, June 12, 2015

Preliminary June Consumer Sentiment increases to 94.6

Thursday, June 11, 2015

CoStar: Commercial Real Estate prices declined in April, Up Solidly YoY

by Calculated Risk on 6/11/2015 07:32:00 PM

Friday:

• At 8:30 AM ET, the Producer Price Index for May from the BLS. The consensus is for a 0.4% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 91.2, up from 90.7 in May.

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Price Growth Moderated In April Following First Quarter Surge

COMPOSITE PRICE INDICES LEVEL OFF IN APRIL. Following strong gains of more than 5% in the first quarter of 2015, composite CRE prices saw a slight dip in April as overall sales activity moderated from its recent robust pace. The value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index decreased by 0.7% and 0.8%, respectively, in the month of April. Both indices have risen more than 2% over the last three months and are up more than 12% for the annual period ending in April 2015.

...

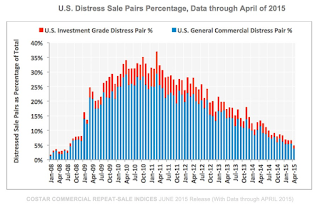

DISTRESS SALES CONTINUE TO DECLINE. The distress percentage of total observed sale pair counts fell to 6.2% in the first four months of 2015, well down from a peak of 32% in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index declined 0.7% in April and is up 12.8% year-over-year.

The equal-weighted index declined 0.8% in April and up 14.5% year-over-year.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down significantly and is close to late 2008 levels.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Lawler on NAR: The “Curious Case” of Existing Home Sales in the South in April

by Calculated Risk on 6/11/2015 03:02:00 PM

From housing economist Tom Lawler:

The National Association of Realtor’s preliminary report on existing home sales in April came in well short of both consensus and those who track local realtor/MLS reports. For analysts in the latter category, the biggest “surprise” in the NAR’s sales estimates was in the South region: the NAR estimated that existing homes sales in the South this April were up just 2.9% on a not seasonally adjusted basis from last April’s pace, well below what one would have expected basis on local realtor/MLS reports. Below is a compilation of various home sales reports based on publicly-available realtor/MLS reports from various parts of the South region. Many of the reports are statewide estimates for MLS sales, though that is not the case for some states (noted below).

Based on these publicly-available1 home sales reports, it seemed reasonable to conclude that the NAR’s estimate of existing home sales in the South region would show a YOY increase of about 10%, and normally the aggregated regional reports and the NAR estimates are “reasonably” consistent. That was clearly not the case last month.

There are several things I should note. First, some (though not all) of the local realtor reports include new home sales. Second, many of the local realtor reports compare preliminary sales data for the latest month with “final” data for the same month of the previous year (.e.g., South Carolina, Virginia, and Oklahoma). NAR reports, in contrast, compare “preliminary” data with “preliminary” data for earlier months. In these cases the “actual” YOY increase in sales is generally slightly higher than shown in the latest report. Third, the NAR’s sample does not incorporate statewide data, but instead is based on a smaller sample (mainly metro areas) that the NAR says reflects about 25% of all sales. And finally, some local realtor reports may not “scrub” the data for errors as rigorously as does the NAR.

Still, based on a very wide range of local realtor/MLS reports from the South, I’m am fairly confident that the NAR’s estimate of the YOY increase in existing home sales in the South in April significantly understated the ‘actual' YOY gain.

| 4/1/2015 | 4/1/2014 | % Chg | |

|---|---|---|---|

| Alabama ( statewide compiled by Alabama Center for Real Estate) | 4,289 | 3,596 | 19.3% |

| Arkansas Association of Realtors | 2,567 | 2,425 | 5.9% |

| Delaware (Local Realtor Reports, all counties) | 884 | 809 | 9.3% |

| D.C. (MRIS) | 711 | 635 | 12.0% |

| Florida (FloridaRealtors) | 36,849 | 32,151 | 14.6% |

| Georgia (thru GAMLS) | 8,104 | 6,975 | 16.2% |

| Kentucky (Louisville, Lexington-Bluegrass areas) | 2,287 | 2,074 | 10.3% |

| Louisiana (Baton Rouge) | 778 | 808 | -3.7% |

| Maryland Association of Realtors | 5,990 | 4,985 | 20.2% |

| Mississippi (Jackson, Gulf Coast) | 755 | 788 | -4.2% |

| North Carolina Association of Realtors* | 10,549 | 9,565 | 10.3% |

| Oklahoma Association of Realtors | 3,664 | 3,753 | -2.4% |

| South Carolina Association of Realtors | 6,112 | 5,498 | 11.2% |

| Tennessee (Knoxville, Memphis, Nashville areas) | 5,137 | 4,718 | 8.9% |

| Texas (statewide compiled by Texas Real Estate Center) | 25,907 | 24,585 | 5.4% |

| Virginia Association of Realtors | 8,886 | 8,467 | 4.9% |

| West Virginia (none) | |||

| Total of Above | 123,469 | 111,832 | 10.4% |

| NAR, South Region | 180,000 | 175,000 | 2.9% |

| *excludes Brunswick and Washington/Beaufort, for which the NCAR shows “N/A” for April 2014 | |||

1 Many of these reports are not easily found, but they are available if one knows were to look.

Fed's Q1 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 6/11/2015 12:11:00 PM

The Federal Reserve released the Q1 2015 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 compared to Q4:

The net worth of households and nonprofits rose to $84.9 trillion during the first quarter of 2015. The value of directly and indirectly held corporate equities increased $487 billion and the value of real estate rose $503 billion.Household net worth was at $84.9 trillion in Q1 2015, up from $83.3 billion in Q4..

The Fed estimated that the value of household real estate increased to $21.1 trillion in Q1 2015. The value of household real estate is still $1.4 trillion below the peak in early 2006 (not adjusted for inflation).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2015, household percent equity (of household real estate) was at 55.6% - up from Q4, and the highest since Q4 2006. This was because of an increase in house prices in Q1 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 55.6% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt decreased by $33 billion in Q1.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1, and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims increased to 279,000

by Calculated Risk on 6/11/2015 09:45:00 AM

Earlier the DOL reported:

In the week ending June 6, the advance figure for seasonally adjusted initial claims was 279,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 276,000 to 277,000. The 4-week moving average was 278,750, an increase of 3,750 from the previous week's revised average. The previous week's average was revised up by 250 from 274,750 to 275,000.The previous week was revised to 277,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 278,750.

This was above the consensus forecast of 276,000, and the low level of the 4-week average suggests few layoffs.