by Calculated Risk on 6/11/2015 07:32:00 PM

Thursday, June 11, 2015

CoStar: Commercial Real Estate prices declined in April, Up Solidly YoY

Friday:

• At 8:30 AM ET, the Producer Price Index for May from the BLS. The consensus is for a 0.4% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 91.2, up from 90.7 in May.

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Price Growth Moderated In April Following First Quarter Surge

COMPOSITE PRICE INDICES LEVEL OFF IN APRIL. Following strong gains of more than 5% in the first quarter of 2015, composite CRE prices saw a slight dip in April as overall sales activity moderated from its recent robust pace. The value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index decreased by 0.7% and 0.8%, respectively, in the month of April. Both indices have risen more than 2% over the last three months and are up more than 12% for the annual period ending in April 2015.

...

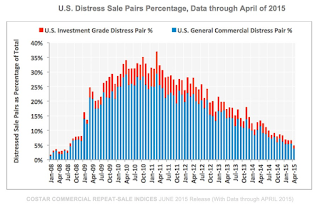

DISTRESS SALES CONTINUE TO DECLINE. The distress percentage of total observed sale pair counts fell to 6.2% in the first four months of 2015, well down from a peak of 32% in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index declined 0.7% in April and is up 12.8% year-over-year.

The equal-weighted index declined 0.8% in April and up 14.5% year-over-year.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down significantly and is close to late 2008 levels.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.