by Calculated Risk on 4/07/2015 10:07:00 AM

Tuesday, April 07, 2015

BLS: Jobs Openings at 5.1 million in February, Up 23% Year-over-year

From the BLS: Job Openings and Labor Turnover Summary

There were 5.1 million job openings on the last business day of February, little changed from 5.0 million in January, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in February, about the same as in January.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 5.133 million from 4.965 million in January. This is the highest level for job openings since January 2001.

The number of job openings (yellow) are up 23% year-over-year compared to February 2014.

Quits are up 10% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another very positive report. It is a good sign that job openings are over 5 million, and that quits are increasing solidly year-over-year.

CoreLogic: House Prices up 5.6% Year-over-year in February

by Calculated Risk on 4/07/2015 09:11:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 5.6 Percent Year Over Year in February 2015

CoreLogic® ... today released its February 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 5.6 percent in February 2015 compared to February 2014. This change represents three years of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.1 percent in February 2015 compared to January 2015.

Including distressed sales, 26 states and the District of Columbia were at or within 10 percent of their peak prices. Six states, including Colorado (+9.8 percent), New York (+8.2 percent), North Dakota (+7.7 percent), Texas (+8.5 percent), Wyoming (+8.4 percent) and Oklahoma (+5.2 percent), reached new home price highs since January 1976 when the CoreLogic HPI started.

Excluding distressed sales, home prices increased by 5.8 percent in February 2015 compared to February 2014 and increased by 1.5 percent month over month compared to January 2015. ...

“Since the second half of 2014, the dwindling supply of affordable inventory has led to stabilization in home price growth with a particular uptick in low-end home price growth over the last few months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “From February 2014 to February 2015, low-end home prices increased by 9.3 percent compared to 4.8 percent for high-end home prices, a gap that is three times the average historical difference.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in February, and is up 5.6% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty six consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase has mostly moved sideways over the last seven months.

Monday, April 06, 2015

Tuesday: Job Openings

by Calculated Risk on 4/06/2015 08:31:00 PM

A depressing quote from Paul Krugman: Economics and Elections

[A] large body of political science research [on elections shows] ... What mainly matters is income growth immediately before the election. And I mean immediately: We’re talking about something less than a year, maybe less than half a year.This is why we see political stunts in odd years (threats to not pay the bills, government shutdowns). People forget quickly.

This is, if you think about it, a distressing result, because it says that there is little or no political reward for good policy. A nation’s leaders may do an excellent job of economic stewardship for four or five years yet get booted out because of weakness in the last two quarters before the election.

Monday:

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. Job openings increased in January to 4.998 million from 4.877 million in December. The number of job openings were up 28% year-over-year, and Quits were up 17% year-over-year.

• At 3:00 PM, Consumer Credit for March from the Federal Reserve. The consensus is for a $14 billion increase in credit.

Update: U.S. Heavy Truck Sales

by Calculated Risk on 4/06/2015 04:08:00 PM

Click on graph for larger image.

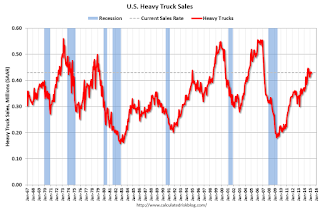

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the March 2015 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate basis (SAAR). Since then sales have more than doubled and hit 446 thousand SAAR in August 2014. Sales have declined a little since August (possibly due to the oil sector), and were at 430 thousand SAAR in March.

The level in August 2014 was the highest level since February 2007 (over 7 years ago). Sales have been above 400 thousand SAAR for nine consecutive months, are now above the average (and median) of the last 20 years.

Zillow: February Case-Shiller House Price Index year-over-year change expected to be about the same as in January

by Calculated Risk on 4/06/2015 12:40:00 PM

The Case-Shiller house price indexes for January were released last week. Zillow forecasts Case-Shiller a month early - now including the National Index - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect More of the Same From Case-Shiller in Feb.

The January S&P/Case-Shiller (SPCS) data published yesterday showed healthy home price appreciation largely in line with prior months, with 4.5 percent annual growth in the U.S. National Index in January, down slightly from 4.6 percent annual growth in December.So the year-over-year change in for February Case-Shiller index will probably be about the same as in the January report.

Annual appreciation in home values as measured by SPCS has been less than 5 percent for the past five months. We anticipate this trend to continue, with next month’s (February) national index expected to rise 4.4 percent, in line with historically normal levels between 3 percent and 5 percent.

The 10- and 20-City Composite Indices both experienced modest bumps in annual growth rates in January; the 10-City index rose 4.4 percent and the 20-City Index rose to 4.6 percent–up from rates of 4.3 percent and 4.5 percent, respectively, in December. The non-seasonally adjusted (NSA) 10- and 20-City indices were flat from December to January, and we expect both to remain flat in February (NSA).

All forecasts are shown in the table below. These forecasts are based on the January SPCS data release and the February 2014 Zillow Home Value Index (ZHVI), released March 27. Officially, the SPCS Composite Home Price Indices for January will not be released until Tuesday, April 28.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| January Actual YoY | 4.4% | 4.4% | 4.6% | 4.6% | 4.5% | 4.5% |

| February Forecast YoY | 4.4% | 4.4% | 4.6% | 4.6% | 4.4% | 4.4% |

| February Forecast MoM | 0.0% | 0.6% | 0.0% | 0.6% | 0.3% | 0.5% |

From Zillow:

The Zillow Home Value Index rose 4.9 percent year-over-year in February, the first month of sub-5 percent annual appreciation since May 2013. Zillow data shows the annual home value appreciation rate has fallen every month since April, and we expect this slowdown to continue throughout 2015. The January Zillow Home Value Forecast calls for a 2.6 percent rise in home values through February 2016. Further details on our forecast of home values can be found here, and more on Zillow’s full January 2014 report can be found here.