by Calculated Risk on 3/13/2015 10:02:00 AM

Friday, March 13, 2015

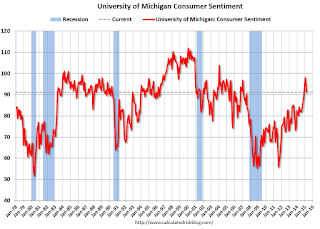

Preliminary March Consumer Sentiment decreases to 91.2

Thursday, March 12, 2015

Friday: PPI, Consumer Sentiment

by Calculated Risk on 3/12/2015 07:51:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Steady Near March Lows

Mortgage rates were mixed today depending on the lender, but moved just slightly lower on average. This wasn't the case this morning as essentially all lenders came out with noticeably lower rates following the weaker-than-expected Retail Sales report. As the day progressed, early gains in bond markets faded, especially after the afternoon's 30yr Bond auction. While that refers to 30yr Treasuries, the goings-on in the Treasury market always have some effect on the mortgage-backed-securities that dictate mortgage rates. Today was no exception, and as prices fell into the afternoon, most lenders 'repriced' to higher rates. ...CR Note: The Ten Year yield decreased slightly to 2.10% today from 2.11% on Wednesday.

That puts us very close to the lowest levels in March, seen on the first two days of the month. Most lenders are quoting conventional 30yr fixed rates of 3.875% to top tier borrowers. A few of the stronger lenders are at 3.75% and fewer still remain at 4.0%.

Friday:

• 8:30 AM ET, the Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 95.5, up from 95.4 in February.

Hotels: Solid Start for 2015

by Calculated Risk on 3/12/2015 04:35:00 PM

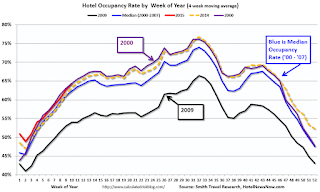

From HotelNewsNow.com: STR: US hotel results for week ending 7 March

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 1-7 March 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 0.5 percent to 64.5 percent. Average daily rate increased 2.0 percent to finish the week at US$116.74. Revenue per available room for the week was up 2.5 percent to finish at US$75.27.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will increase over the next couple of months.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Q4 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 3/12/2015 12:00:00 PM

The Federal Reserve released the Q4 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $82.9 trillion during the fourth quarter of 2014. The value of directly and indirectly held corporate equities increased $742 billion and the value of real estate rose $356 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $82.9 trillion in Q4 2014 (up $28.0 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.6 trillion in Q4 2014. The value of household real estate is still $1.9 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is close to the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but has moved sideways over the last year.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2014, household percent equity (of household real estate) was at 54.5% - up from Q3, and the highest since Q1 2007. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 54.5% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $5 billion in Q4.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q4, and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims decreased to 289,000

by Calculated Risk on 3/12/2015 09:25:00 AM

Catching up: The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 36,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 320,000 to 325,000. The 4-week moving average was 302,250, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 1,250 from 304,750 to 306,000.The previous week was revised up to 325,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,250.

This was below the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.