by Calculated Risk on 2/24/2015 10:00:00 AM

Tuesday, February 24, 2015

Yellen: Semiannual Monetary Policy Report to the Congress

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C. (starts at 10 AM ET):

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings. If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance. However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings. Instead the modification should be understood as reflecting the Committee's judgment that conditions have improved to the point where it will soon be the case that a change in the target range could be warranted at any meeting. Provided that labor market conditions continue to improve and further improvement is expected, the Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when, on the basis of incoming data, the Committee is reasonably confident that inflation will move back over the medium term toward our 2 percent objective.Here is the C-Span Link

It continues to be the FOMC's assessment that even after employment and inflation are near levels consistent with our dual mandate, economic conditions may, for some time, warrant keeping the federal funds rate below levels the Committee views as normal in the longer run. It is possible, for example, that it may be necessary for the federal funds rate to run temporarily below its normal longer-run level because the residual effects of the financial crisis may continue to weigh on economic activity. As such factors continue to dissipate, we would expect the federal funds rate to move toward its longer-run normal level. In response to unforeseen developments, the Committee will adjust the target range for the federal funds rate to best promote the achievement of maximum employment and 2 percent inflation.

emphasis added

Here is the Bloomberg TV link.

Case-Shiller: National House Price Index increased 4.6% year-over-year in December

by Calculated Risk on 2/24/2015 09:05:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Grew at Twice the Rate of Inflation in 2014 According to the S&P/Case-Shiller Home Price Indices

Data released today for December 2014 shows a slight uptick in home prices across the country. Nine cities reported monthly increases in prices ... Both the 10-City and 20-City Composites saw year-over-year increases in December compared to November. The 10-City Composite gained 4.3% year-over-year, up from 4.2% in November. The 20-City Composite gained 4.5% year-over-year, compared to a 4.3% increase in November. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.6% annual gain in December 2014 versus 4.7% in November.

...

The National index was slightly negative in December, while both composite Indices were positive. Both the 10- and 20-City Composites reported slight increases of 0.1%, while the National Index posted a -0.1% change for the month. Miami and Denver led all cities in December with increases of 0.7% and 0.5% respectively. Chicago and Cleveland offset those gains by reporting decreases of -0.9% and -0.5% respectively.

...

“The housing recovery is faltering. While prices and sales of existing homes are close to normal, construction and new home sales remain weak. Before the current business cycle, any time housing starts were at their current level of about one million at annual rates, the economy was in a recession” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The softness in housing is despite favorable conditions elsewhere in the economy: strong job growth, a declining unemployment rate, continued low interest rates and positive consumer confidence.

Click on graph for larger image.

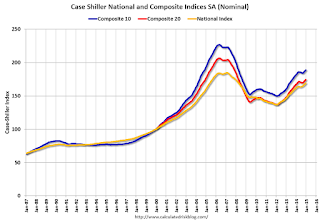

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 16.7% from the peak, and up 0.8% in December (SA).

The Composite 20 index is off 15.6% from the peak, and up 0.9% (SA) in December.

The National index is off 8.4% from the peak, and up 0.7% (SA) in December. The National index is up 23.7% from the post-bubble low set in Dec 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to December 2013.

The Composite 20 SA is up 4.5% year-over-year..

The National index SA is up 4.6% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in December seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 41.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.7% YoY increase for the National index. I'll have more on house prices later.

Monday, February 23, 2015

Tuesday: Yellen Testimony, Case-Shiller House Prices

by Calculated Risk on 2/23/2015 06:32:00 PM

A few excerpts from a preview of Yellen's Testimony by Goldman Sachs economists Kris Dawsey and Chris Mischaikow:

Fed Chair Yellen will be presenting her semi-annual monetary policy testimony—sometimes called the "Humphrey-Hawkins" testimony—on Tuesday and Wednesday of this week (February 24 and 25). We expect Yellen not to stray far from the message of the January FOMC statement and meeting minutes, and we do not think she will preempt the Committee by sending a strong signal on whether "patience" will be removed from the statement at the March meeting.Tuesday:

The testimony will probably not be a major market mover. Indeed, the average absolute yield change around the Fed Chair's semi-annual testimony has declined over time and is considerably lower than the average absolute change around post-FOMC press conferences. Nonetheless, to the extent there are risks to our "don't rock the boat" expectation, we think they are skewed toward a slightly more dovish tilt.

...

The Fed will also release its semi-annual Monetary Policy Report at 10:00AM on Tuesday February 24, which is a roughly fifty-page document that provides additional background, charts, etc. supporting the Chair's testimony. Typically, this document generates very little interest. However, the July statement that "valuation metrics in some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries," received considerable attention.

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices. The consensus is for a 4.7% year-over-year increase in the National Index for December. The Zillow forecast is for the National Index to increase 4.7% year-over-year in December, and for prices to increase 0.5% month-to-month seasonally adjusted.

• At 10:00 AM, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

• Also at 10:00 AM, Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 99.1 from 102.9.

A Few Comments on January Existing Home Sales

by Calculated Risk on 2/23/2015 03:41:00 PM

Inventory is still very low (down 0.5% year-over-year in January). This will be important to watch over the next few months at the start of the Spring buying season.

Note: As usually happens, housing economist Tom Lawler's estimate was closer than the consensus to the NAR reported sales rate.

Also, the NAR reported total sales were up 3.2% from January 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales – foreclosures and short sales – were 11 percent of sales in January, unchanged from last month but down from 15 percent a year ago. Eight percent of January sales were foreclosures and 3 percent were short sales.Last year in December the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in January 2014 were reported at 4.67 million SAAR with 15% distressed. That gives 701 thousand distressed (annual rate), and 3.97 million equity / non-distressed. In January 2015, sales were 4.82 million SAAR, with 11% distressed. That gives 530 thousand distressed - a decline of about 24% from January 2014 - and 4.29 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 8%.

Important: If total existing sales decline a little, or move side-ways - due to fewer distressed sales- that is a positive sign for real estate.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in January (red column) were slightly higher than last year (NSA), and below sales in January 2013.

Earlier:

• Existing Home Sales in January: 4.82 million SAAR, Inventory down slightly Year-over-year

Black Knight: House Price Index down slightly in December, Up 4.5% year-over-year

by Calculated Risk on 2/23/2015 12:45:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Down 0.1 Percent for the Month; Up 4.5 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on December 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI decreased 0.1% percent in December, and is off 10.2% from the peak in June 2006 (not adjusted for inflation).

The year-over-year increases had been getting steadily smaller since peaking in 2013 - as shown in the table below - but the YoY increase has been about the same for the last four months:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

| July-14 | 5.1% |

| Aug-14 | 4.9% |

| Sep-14 | 4.6% |

| Oct-14 | 4.5% |

| Nov-14 | 4.5% |

| Dec-14 | 4.5% |

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 41.0% from the peak in Las Vegas, off 34.3% in Orlando, and 32.0% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston). Prices are also at new highs in Nashville, TN, and San Jose, CA.

Note: Case-Shiller for December will be released tomorrow.