by Calculated Risk on 2/22/2015 11:08:00 AM

Sunday, February 22, 2015

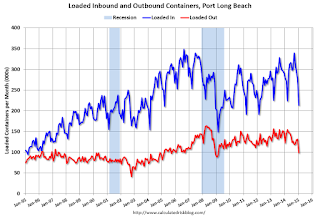

Long Beach Port Traffic Declined Sharply in January

The Port of Long Beach released container traffic statistics for January (the Port of Los Angeles hasn't released January data yet).

The Long Beach data showed a significant decline in port traffic due to the labor issues that were tentatively settled on Friday.

Note: There is usually a seasonal slowdown in February or March (depending on the timing of the Chinese New Year). February traffic will be very slow this year, but March should be strong.

Imports were down 23.5% year-over-year in January, and exports were down 19.6% year-over-year.

This decline in traffic was primarily due to the ongoing labor negotiations.

Saturday, February 21, 2015

Schedule for Week of February 22, 2015

by Calculated Risk on 2/21/2015 01:11:00 PM

The key economic reports this week are January new home sales on Wednesday, existing home sales on Monday, the second estimate of Q4 GDP on Friday, and Case-Shiller house prices on Tuesday.

Fed Chair Janet Yellen will provide testimony to the Senate and House on Tuesday and Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in December were at a 5.04 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:30 AM: Dallas Fed Manufacturing Survey for February.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.7% year-over-year increase in the National Index for December. The Zillow forecast is for the National Index to increase 4.7% year-over-year in December, and for prices to increase 0.5% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 99.1 from 102.9.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for a decrease in sales to 471 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 481 thousand in December.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 283 thousand.

8:30 AM: Consumer Price Index for January. The consensus is for a 0.6% decrease in CPI, and for core CPI to increase 0.1%.

9:00 AM: FHFA House Price Index for December 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM: Gross Domestic Product, 4th quarter 2014 (second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, down from the advance estimate of 2.6%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 58.3, down from 59.4 in January.

9:55 AM: University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 94.0, up from the preliminary reading of 93.6, but down from the December reading of 98.1.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 2.0% increase in the index.

1:30 PM: Speech, Fed Vice Chairman Stanley Fischer, Conducting Monetary Policy with a Large Balance Sheet, At the 2015 U.S. Monetary Policy Forum, New York, New York

Unofficial Problem Bank list declines to 378 Institutions

by Calculated Risk on 2/21/2015 08:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 21, 2015.

Changes and comments from surferdude808:

The OCC released its latest enforcement actions leading to eight removals from the Unofficial Problem Bank List. After the removals, the list stands at 378 institutions with assets of $117.9 billion. We updated asset figures with 2014q4 financials, which accounted for a $812 million of the $3.2 billion decline in assets this week. A year ago, the list held 578 institutions with assets of $193.0 billion.

The OCC terminated actions against Armed Forces Bank, National Association, Fort Leavenworth, KS ($1.7 billion); Academy Bank, National Association, Colorado Springs, CO ($325 million); Mission National Bank, San Francisco, CA ($177 million); Southern Commerce Bank, National Association, Tampa, FL ($70.2 million); The First National Bank of Sullivan, Sullivan, IL ($60 million); Olmsted National Bank, Rochester, MN ($54 million); SunBank, National Association, Phoenix, AZ ($32 million); and Armed Forces Bank of California, National Association, San Diego, CA ($17 million).

Next week, we anticipate the FDIC will provide an update on its enforcement action activity, industry results for the third quarter, and updated aggregate figures for their official problem bank list.

Friday, February 20, 2015

West Coast Port Deal Reached

by Calculated Risk on 2/20/2015 10:15:00 PM

Some good news from the LA Times: Shipping lines and dockworkers reach deal, port shutdown averted

Shipping companies and the dockworkers union have reached a tentative deal on a new labor contract, union officials said Friday night, staving off a shutdown of 29 ports that would have choked off trade through the West Coast.

...

It will take weeks, if not months, just to clear the current backlog, port officials said.

A Comment on Greece

by Calculated Risk on 2/20/2015 05:11:00 PM

There was an agreement today (pending some proposals on Monday) to extend the Greek bailout for four months.

My first reaction is that there seem to be two possible outcomes in four months:

1) The technocrats at the ECB / EU / IMF agree to change the target for the primary budget surplus. The current plan is for Greece to run a primary surplus of 3.0% in 2015 and 4.5% in 2016, however that assumed that the unemployment rate would peak at 14.8% (instead the unemployment rate increased to close to 28%), and that GDP would start increasing in 2012 - instead GDP kept falling - and Greece is now in a Great Depression size contraction.

Contractionary policy has been very contractionary!

It is amazing that Greece is even running a primary budget surplus with a collapsing economy. If the primary target isn't change, the depression will continue. A little growth would help everyone, so easing the primary budget target is critical.

2) The Greeks will take the four months and ready the drachma printing presses.

Point 1 is possible, but the technocrats are the only hope for Greece, not the politicians. See the following quote from German Finance minister Wolfgang Schauble in 2013:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”Not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data for Europe as a whole and Greece in particular). Too many politicians can't (or won't) look at the data and change their minds.