by Calculated Risk on 2/04/2015 08:20:00 AM

Wednesday, February 04, 2015

ADP: Private Employment increased 213,000 in January

Private sector employment increased by 213,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 220,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 31,000 jobs in January, down from 47,000 jobs gained in December. The construction industry added 18,000 jobs, down from last month’s gain of 26,000. Meanwhile, manufacturing added 14,000 jobs in January, below December’s 23,000.

Service-providing employment rose by 183,000 jobs in January, down from 207,000 in December. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Employment posted another solid gain in January, although the pace of growth is slower than in recent months. Businesses in the energy and supplying industries are already scaling back payrolls in reaction to the collapse in oil prices, while industries benefiting from the lower prices have been slower to increase their hiring. All indications are that the job market will continue to improve in 2015.”

The BLS report for January will be released on Friday and the consensus is for 230,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications increase, FHA Refinance Applications up 76%

by Calculated Risk on 2/04/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 30, 2015. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

“Following several weeks of already elevated refinance activity due to falling interest rates, FHA refinance applications increased 76.5 percent in response to a reduction in annual mortgage insurance premiums which took effect January 26,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Conventional refinance volume was up only 0.5 percent for the week while VA refinance volume was down 24.3 percent. FHA purchase applications were also up 12.4 percent over the week prior, despite a decrease in purchase applications in the rest of the market.” ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.79 percent, the lowest level since May 2013, from 3.83 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

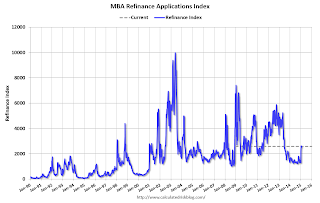

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

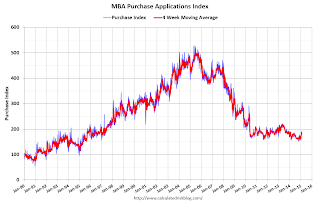

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 3% from a year ago.

Tuesday, February 03, 2015

Wednesday: ADP Employment, ISM non-Manufacturing

by Calculated Risk on 2/03/2015 09:00:00 PM

From the WSJ: Oil Prices Surge 7% to One-Month High

U.S. oil futures notched a fourth consecutive gain, their longest winning streak since August. Prices have risen 19% in that time. The benchmark crude-oil contract on the New York Mercantile Exchange settled up $3.48, or 7%, at $53.05 a barrel, the highest settlement price since Dec. 31, 2014.Still down almost 50% from a year ago. A wild ride!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

• At 10:00 AM, the ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.

Lawler: Historical New Housing Put in Place (Completions/Placements)

by Calculated Risk on 2/03/2015 05:51:00 PM

Here is some interesting data (just for background) from housing economist Tom Lawler:

Note: Manufactured housing placements prior to 1974 and for 2014 based on shipments. Census stopped releasing estimates for MH placements this summer.

Note that while the total number of new housing units completed/put in place from 2003 to 2007 was almost identical to that for 1983 to 1987, single-family production was 41% higher.

Since the end of 2007, the number of single-family (attached and detached) homes occupied by renters has probably increased by over 4 million.

| Housing Put in Place by Type (Annual Average, Thousands of Units) | ||||

|---|---|---|---|---|

| Single Family | Multi- family | Manufactured Housing | Total | |

| 1968-72 | 928 | 641 | 435 | 2,004 |

| 1973-77 | 1,061 | 575 | 324 | 1,960 |

| 1978-82 | 1,016 | 487 | 251 | 1,754 |

| 1983-87 | 1,053 | 581 | 269 | 1,903 |

| 1988-92 | 976 | 326 | 202 | 1,504 |

| 1993-07 | 1,102 | 231 | 305 | 1,638 |

| 1998-02 | 1,251 | 324 | 273 | 1,848 |

| 2003-07 | 1,485 | 301 | 119 | 1,905 |

| 2008-12 | 553 | 207 | 57 | 817 |

| 2013 | 569 | 195 | 56 | 820 |

| 2014 | 630 | 264 | 60 | 953 |

U.S. Light Vehicle Sales decrease to 16.6 million annual rate in January

by Calculated Risk on 2/03/2015 02:27:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.55 million SAAR in January. That is up 8.9% from January 2013, and down 1.5% from the 16.80 million annual sales rate last month. The comparison to January 2014 was easy (sales were impacted by the severe weather last year).

From John Sousanis at Wards Auto: January 2015 U.S. LV Sales Thread: Trucks Spur Strong January Sales

Led by strong gains in truck sales, U.S. automakers sold 1.149 million light vehicles in January, a 9.3% increase in daily sales (over 26 days) compared with year-ago (25 days). The resultant seasonally adjusted annual rate - roughly 16.55 million - was the industry's highest January SAAR since 2006.

General Motors led all automakers, accounting for 17.7% of the month's LV sales, followed by Ford (15.2%) and Toyota (14.8%).

Subaru recorded the largest year-over-year growth with a 28.3% increase in daily sales, while Volvo and Volkswagen registered industry-worst 3.8% DSR declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 16.55 million SAAR from WardsAuto).

This was at the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.This was another strong month for vehicle sales - the ninth consecutive month with a sales rate over 16 million.