by Calculated Risk on 1/21/2015 07:10:00 PM

Wednesday, January 21, 2015

Thursday: Unemployment Claims

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 316 thousand.

• At 9:00 AM, FHFA House Price Index for November 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 11:00 AM, the Kansas City Fed manufacturing survey for January.

And here is a repeat of a post I wrote last year: Housing: Demographics for Renting and Buying

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. (note: the beginning of this post is from an earlier post on apartment supply and demand).

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

The demographics are still favorable for apartments, since a large cohort is still moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

LA area Port Traffic in December

by Calculated Risk on 1/21/2015 04:06:00 PM

Note: LA area ports were impacted by a trucker strike in November, and there are ongoing labor negotiations (and some slowdown).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for December since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in November. Outbound traffic was down 1.0% compared to 12 months ending in November.

Inbound traffic has been increasing, and outbound traffic has been mostly moving sideways (down a little recently).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were unchanged year-over-year in December, exports were down 11% year-over-year.

Exports suggest a slowdown in Asia, but import traffic was decent considering the ongoing labor negotiations. Hopefully the negotiations will be settled soon.

Comments on December Housing Starts

by Calculated Risk on 1/21/2015 12:44:00 PM

Just over a year ago, in November 2013, housing starts were at a 1.091 million pace on a seasonally adjusted annual rate (SAAR) basis. (Since revised to 1.105 million).

That end of the year surge in 2013 led many analysts to push up their forecast for 2014 (see blue column for November 2013 in the first graph below).

It ends up not one month in 2014 was above November 2013 (as revised). This is a reminder not to be influenced too much by one month of data.

That brings us to this morning: the Census Bureau reported that single family starts were at 728 thousand in December, the highest level since early 2008. If single family starts just hold that level in 2015, annual single family starts would be up about 12% over 2014. With more growth, 20% would seem possible. However I think 20% is too optimistic (based on lots and pricing), and just like in 2013, we shouldn't let one month of data influence us too much.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

There were 1.006 million total housing starts during 2014, up 8.7% from the 925 thousand in 2013. Single family starts were up 4.9%, and multifamily starts up 17.1%.

The following table shows the annual housing starts since 2005, and the percent change from the previous year. The housing recovery slowed in 2014, especially for single family starts. However I expect further growth in starts over the next several years.

| Housing Starts (000s) and Annual Change | ||||

|---|---|---|---|---|

| Total | Total % Change | Single | Single % Change | |

| 2005 | 2,068.3 | 5.8% | 1,715.8 | 6.5% |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.3 | 24.3% |

| 2013 | 924.9 | 18.5% | 617.6 | 15.4% |

| 2014 | 1,005.8 | 8.7% | 648.0 | 4.9% |

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

AIA: Architecture Billings Index increased in December

by Calculated Risk on 1/21/2015 10:32:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From Reuters: U.S. architecture billings index rises in December

The index rose to 52.2 in December from 50.9 in November, making it ten months that the index had risen in 2014.

A reading above 50 indicates an increase in billings.

"Particularly encouraging is the continued solid upturn in design activity at institutional firms, since public sector facilities were the last nonresidential building project type to recover from the downturn," AIA Chief Economist Kermit Baker said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.2 in December, up from 50.9 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has indicated expansion for eight consecutive months, and those positive readings suggest an increase in CRE investment in 2015.

Housing Starts increased to 1.089 Million Annual Rate in December

by Calculated Risk on 1/21/2015 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,089,000. This is 4.4 percent above the revised November estimate of 1,043,000 and is 5.3 percent above the December 2013 rate of 1,034,000.

Single-family housing starts in December were at a rate of 728,000; this is 7.2 percent above the revised November figure of 679,000. The December rate for units in buildings with five units or more was 339,000.

An estimated 1,005,800 housing units were started in 2014. This is 8.8 percent above the 2013 figure of 924,900.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,032,000. This is 1.9 percent below the revised November rate of 1,052,000, but is 1.0 percent above the December 2013 estimate of [1,022,000].

Single-family authorizations in December were at a rate of 667,000; this is 4.5 percent above the revised November figure of 638,000. Authorizations of units in buildings with five units or more were at a rate of 338,000 in December.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased slightly in December. Multi-family starts are up 5% year-over-year.

Single-family starts (blue) increased in December and are at the highest level since March 2008.

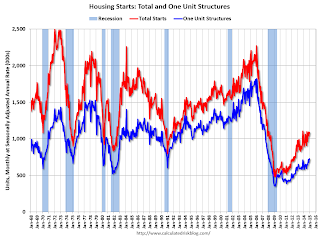

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),This was above expectations of 1.040 million starts in December, and starts in October and November were revised up, so this was a solid report. I'll have more later ...