by Calculated Risk on 1/05/2015 07:32:00 PM

Monday, January 05, 2015

Tuesday: ISM Non-Manufacturing Index

For fun, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...

Tuesday:

• Early: Reis Q4 2014 Apartment Survey of rents and vacancy rates.

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.2 decrease in November orders.

• Also at 10:00 AM ET, ISM non-Manufacturing Index for December. The consensus is for a reading of 58.2, down from 59.3 in November. Note: Above 50 indicates expansion.

U.S. Light Vehicle Sales decrease to 16.8 million annual rate in December

by Calculated Risk on 1/05/2015 02:05:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.75 million SAAR in December. That is up 8.8% from December 2013, and down 1.7% from the 17.09 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 16.75 million SAAR from WardsAuto).

This was below the consensus forecast of 16.9 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the eighth consecutive month with a sales rate over 16 million - and the best year since 2006.

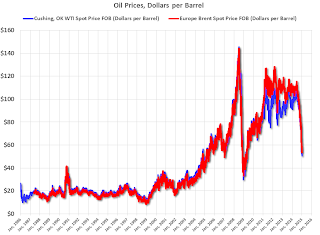

WTI Crude Oil Falls Close to $50 per Barrel

by Calculated Risk on 1/05/2015 11:41:00 AM

From Business Insider: Oil Keeps Falling

US crude and Brent futures dropped to fresh 5-1/2-year lows Monday as worries about a surplus of global supplies amid weak demand continued to drag on oil markets.Note: For why prices are falling, see A Comment on Oil Prices and Question #7 for 2015: What about oil prices in 2015?

At 4.20pm GMT (11.20 am ET), West Texas Intermediate crude was trading at $50.30 a barrel, a decline of more than 4.5% from Friday's close to the lowest level since April 2009.

Brent crude, the international benchmark, was also down more than 5% to below $54 a barrel, the lowest price since May 2009.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen 4.5% today to $50.31 per barrel, and Brent to $53.33.

Oil prices are off about 53% from the peak last year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Nationally gasoline prices are around $2,18 per gallon, and gasoline futures are down about 6 cents per gallon today.

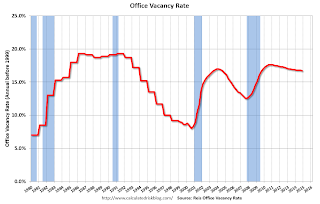

Reis: Office Vacancy Rate declined in Q4 to 16.7%

by Calculated Risk on 1/05/2015 08:59:00 AM

Reis released their Q4 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined in Q4 to 16.7% from 16.8% in Q3 2014. This is down from 16.9% in Q4 2013, and down from the cycle peak of 17.6%.

From Bloomberg: U.S. Office-Occupancy Gains Jump to a Seven-Year High

Occupied office space increased by a net 10.97 million square feet (1 million square meters) during the last three months of the year, the most since the third quarter of 2007, according to property-research firm Reis Inc. The measure, known as net absorption, jumped 28 percent in 2014 to 32.5 million square feet, also a seven-year high.

...

The nationwide vacancy rate at the end of the year was 16.7 percent, the lowest since the third quarter of 2009 and down from 16.9 percent in 2013.

...

“As long as we don’t get a random shock to the economy, and labor growth continues, vacancies should fall and rents should rise faster in 2015,” [Ryan Severino, Reis senior economist] said.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.7% in Q4, down from 16.9% in Q4 2014. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Net absorption is picking up, but there will not be a significant pickup in new construction until the vacancy rate falls much further.

Office vacancy data courtesy of Reis.

Sunday, January 04, 2015

Monday: Vehicle Sales

by Calculated Risk on 1/04/2015 07:47:00 PM

Starting in 2009, there were always a large number of analysts predicting the Fed would raise rates very soon (not me) - until Bernanke and the FOMC stopped that speculation when they included the following phrase in the August 2011 statement: "The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013."

That was eventually changed to "late 2014", and then to "mid-2015" ... now it seems likely the FOMC will raise rates this year. It has been a long long time!

From the WSJ: As Fed Prepares to Raise Rates, Economists Caution of Potential Bumps

“If we do it right, we don’t put the economy off-kilter,” said Federal Reserve Bank of Boston President Eric Rosengren . But “there are unusual conditions that I think complicate the normalization of rates this time.”Monday:

For instance, the current low level of long-term interest rates “indicates that there may be a bumpier ride, just because there needs to be an adjustment at some point along the cycle,” he said.

Still, Mr. Rosengren and others who spoke over the weekend at the American Economic Association’s annual meeting in Boston expressed relief that the U.S. economy has healed to the point where officials can seriously consider their first rate increase since 2006.

It is remarkable, said New York University economist Mark Gertler, that “after six or seven years, we’re finally talking about policy normalization, and it’s not a hypothetical conversation.”

• Early: Reis Q4 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in December from 17.1 million in November (Seasonally Adjusted Annual Rate).

Weekend:

• Schedule for Week of January 4, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 14 and DOW futures are down 100 (fair value).

Oil prices were down over the last week with WTI futures at $52.69 per barrel and Brent at $56.42 per barrel. A year ago, WTI was at $94, and Brent was at $107 - so prices are down 44% and 47% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.20 per gallon (down about $1.10 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |