by Calculated Risk on 9/09/2014 02:39:00 PM

Tuesday, September 09, 2014

Las Vegas Real Estate in August: YoY Non-contingent Inventory up 39%, Distressed Sales and Cash Buying down YoY

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices holding steady, fewer cash buyers

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in August was 3,120, down from 3,314 in July and down from 3,539 one year ago.There are several key trends that we've been following:

GLVAR said 32.1 percent of all existing local homes sold in August were purchased with cash. That’s down from 35.6 percent in July, near a five-year low and well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors are buying homes in Southern Nevada.

...

Since 2013, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in August, when GLVAR reported that 11.5 percent of all sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That matched the percentage of short sales in July. Another 8.9 percent of all August sales were bank-owned properties, down from 9.1 percent in July.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in August was 13,752, up 0.3 percent from 13,717 in July, but down 5.0 percent from one year ago. ...

By the end of August, GLVAR reported 7,788 single-family homes listed without any sort of offer. That’s up 7.2 percent from 7,266 such homes listed in July, and a 38.8 percent jump from one year ago.

emphasis added

1) Overall sales were down about 12% year-over-year.

2) Conventional (equity, not distressed) sales were up 5% year-over-year. In August 2013, only 67.0% of all sales were conventional equity. This year, in August 2014, 79.6% were equity sales.

3) The percent of cash sales has declined year-over-year from 52.5% in August 2013 to 32.1% in August 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 38.8% year-over-year.

More inventory (a major theme for 2014) suggests price increases will slow.

Trulia: Asking House Prices up 7.8% year-over-year in August

by Calculated Risk on 9/09/2014 12:09:00 PM

From Trulia chief economist Jed Kolko: Slow and Steady Now Winning the Home-Price Race

Nationally, the month-over-month increase in asking home prices rose to 1.0% in August, up a bit from 0.7% in July. Asking prices rose 7.8% year-over-year, slower than one year ago, in August 2013, when asking prices were up 9.9% year-over-year. At the local level, asking prices rose year-over-year in 96 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

...

Foreclosures have shaped where and when home prices have recovered. Foreclosed homes tend to depress neighboring home values and sell at a discount. But once most of the foreclosures in a market are sold, then overall inventory tightens – especially at the low end – giving home prices a boost. In states with a “non-judicial” foreclosure process (such as California, Michigan, and Texas), foreclosures don’t have to go through the courts. That means homes in non-judicial states are foreclosed and sold more quickly than in states with a “judicial” process (such as Florida, Illinois, and New York). As a result, the foreclosure wave cleared sooner and faster in non-judicial states, and housing markets in those states got an earlier and sharper price boost.

But now, even judicial states are seeing the light at the end of the foreclosure tunnel and are getting their own price boost. In August 2014, asking prices on for-sale homes excluding foreclosures were up 6.9% year-over-year in metros in judicial states, only slightly behind the 7.8% increase in metros in non-judicial states. In contrast, in August 2013, the year-over-year price gain was 14.1% in non-judicial states and just 5.1% in judicial states.

...

Rents Accelerate, Rising 6.3% Year-over-Year

In five of the 25 largest rental markets, rents rose more than 10% year-over-year. Three of these five are in northern California: Sacramento, San Francisco, and Oakland have the highest rent increases in the country, followed by Denver and Miami. Rents rose faster year-over-year in August than three months ago, in May, in 20 of the 25 largest rental markets. In August compared to May, rents accelerated most in Sacramento while cooling in San Diego.

emphasis added

BLS: Jobs Openings at 4.7 million in July, Up 22% Year-over-year

by Calculated Risk on 9/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

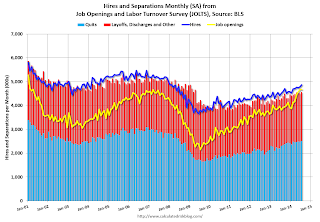

here were 4.7 million job openings on the last business day of July, little changed from June, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was little changed in July at 2.5 million.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

The number of job openings (yellow) are up 22% year-over-year compared to July 2013.

Quits are up 9% year-over-year and are at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the sixth consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in August

by Calculated Risk on 9/09/2014 08:12:00 AM

From the National Federation of Independent Business (NFIB): NFIB SBET Sees Slight Bump in August

August’s Optimism Index rose 0.4 points to 96.1 making it the second highest reading since October, 2007. ...Hiring plans decreased to 10.

NFIB owners increased employment by an average of 0.02 workers per firm in August (seasonally adjusted), the eleventh positive month in a row but basically a “zero” net gain. emphasis added

And in a positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 13, down from 17 last year - and "taxes" and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.1 in August from 95.7 in July.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

Monday, September 08, 2014

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 9/08/2014 06:20:00 PM

From Nick Timiraos at the WSJ: Why More Renters Aren’t Buying (Hint: Weak Incomes, Savings)

A new survey says that younger workers and other renters aren’t turning away from homeownership because they lack the desire to own homes. Instead, they’re staying on the sidelines because they lack the capacity to purchase.My view is people will want to own ... and as their incomes eventually increase, they will become homeowners. No worries.

The analysis from the New York Federal Reserve Bank comes via their survey of consumer expectations in February. It polled 867 homeowners and 344 renters on their attitudes toward homeownership and their plans to move.

One popular trend cited frequently in the press is that millennials and other renters have permanently turned away from owning homes after watching their parents’ generation take it on the chin during the housing bust. ...

But the New York Fed researchers say their survey points to a different conclusion: borrowers want to buy, but they can’t cut it financially. Conservative mortgage lending standards are only likely to exacerbate this problem.

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for August.

• Early, the Trulia Price Rent Monitors for August. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 4.671 million from 4.577 million in May. That was the highest level since February 2001. The number of job openings were up 18% year-over-year compared to June 2013. Quits were up 15% year-over-year in June.