by Calculated Risk on 8/27/2014 04:27:00 PM

Wednesday, August 27, 2014

Average 30 Year Fixed Mortgage Rates decline to 4.11%, No "Refi Boom" in Sight

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 4 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates declined today to 4.11% from 4.13% yesterday.

One year ago rates were at 4.61%, so rates are down 50 bps year-over-year.

I've mentioned before that mortgage refinancing tends to pickup when mortgage rates drop by about 50 bps from the recent levels. However rates were only at or above 4.60% for a short period - and many homeowners refi'd when rates were below 4% in 2012 and 2013. So I don't expect a "refi boom" right now.

Here is a table from Mortgage News Daily:

Freddie Mac: Mortgage Serious Delinquency rate declined in July, Lowest since January 2009

by Calculated Risk on 8/27/2014 12:36:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 2.02% from 2.07% in June. Freddie's rate is down from 2.70% in July 2013, and this is the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for July in a few days.

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.68 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until early 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

CBO Projection: Budget Deficits in Future Years to be Smaller than Previous Forecast

by Calculated Risk on 8/27/2014 10:25:00 AM

The Congressional Budget Office (CBO) released new budget projections today An Update to the Budget and Economic Outlook: 2014 to 2024. The projected budget deficits have been reduced for most of the next ten years, although the projected deficit for 2014 has been revised up slightly (by $14 billion).

NOTE: In the previous update, the CBO revised down their projection of the deficit for fiscal 2014 from 3.7% to just under 2.9% of GDP.

From the CBO:

The federal budget deficit for fiscal year 2014 will amount to $506 billion, CBO estimates, roughly $170 billion lower than the shortfall recorded in 2013. At 2.9 percent of gross domestic product (GDP), this year's deficit will be much smaller than those of recent years (which reached almost 10 percent of GDP in 2009) and slightly below the average of federal deficits over the past 40 years.The CBO projects the deficit will decline further in 2015, and will be at or below 3% of GDP through fiscal 2019. Then the deficit will slowly increase.

...

CBO's current economic projections differ in some respects from the ones issued in February 2014. The agency has significantly lowered its projection of growth in real GDP for 2014, reflecting surprising economic weakness in the first half of the year. However, the level of real GDP over most of the coming decade is projected to be only modestly lower than estimated in February. In addition, CBO now anticipates lower interest rates throughout the projection period and a lower unemployment rate for the next six years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO revised down their deficit projections for fiscal years 2017 through 2024.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 8/27/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 22, 2014. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.28 percent from 4.29 percent, with points decreasing to 0.25 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

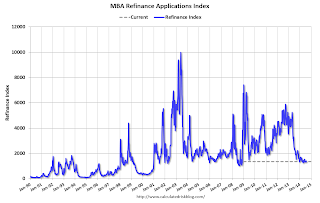

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

As expected, refinance activity is very low this year.

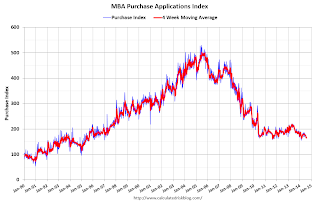

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, August 26, 2014

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in July

by Calculated Risk on 8/26/2014 08:31:00 PM

The Case-Shiller house price indexes for June were released this morning. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Slowdown Forecasted to Continue

The Case-Shiller data for June 2014 came out this morning, and based on this information and the July 2014 Zillow Home Value Index (ZHVI, released August 21), we predict that next month’s Case-Shiller data (July 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index increased by 7.0 percent and the NSA 10-City Composite Home Price Index increased by 6.9 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 0.1 percent for the 20-City Composite Index and flat for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for July will not be released until Tuesday, September 30.So the Case-Shiller index will probably show a lower year-over-year gain in July than in June (8.1% year-over-year).

| Zillow July 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2013 | 176.39 | 172.88 | 162.38 | 158.96 |

| Case-Shiller (last month) | June 2014 | 187.19 | 185.57 | 172.33 | 170.69 |

| Zillow Forecast | YoY | 6.9% | 6.9% | 7.0% | 7.0% |

| MoM | 0.7% | 0.0% | 0.8% | 0.1% | |

| Zillow Forecasts1 | 188.5 | 185.2 | 173.7 | 170.5 | |

| Current Post Bubble Low | 146.45 | 149.91 | 134.07 | 137.13 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.7% | 23.5% | 29.6% | 24.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||