by Calculated Risk on 8/25/2014 08:38:00 AM

Monday, August 25, 2014

Chicago Fed: "Index shows economic growth picked up in July"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in July

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.39 in July from +0.21 in June. Three of the four broad categories of indicators that make up the index made positive contributions to the index in July, and two of the four categories increased from June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.25 in July from +0.16 in June, marking its fifth consecutive reading above zero. July’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in July (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, August 24, 2014

Sunday: No Futures for You!

by Calculated Risk on 8/24/2014 08:31:00 PM

From CME Group: (ht Nemo)

UPDATE: Due to technical issues, CME Globex Markets remain halted. Updates will be provided as they become availableMonday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July. This is a composite index of other data.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 406 thousand in June.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for August.

Weekend:

• Schedule for Week of Aug 24th

Oil prices were down over the last week with WTI futures at $93.41 per barrel and Brent at $101.86 per barrel. A year ago, WTI was at $105, and Brent was at $111 - so prices are down about 10% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.43 per gallon (down about a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Vehicle Sales Forecasts: Over 16 Million SAAR again in August

by Calculated Risk on 8/24/2014 03:52:00 PM

The automakers will report August vehicle sales on Wednesday, Sept 3rd. Sales in July were at 16.40 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in August will be above 16 million SAAR again.

Note: There were 27 selling days in August this year compared to 28 last year.

Here are a couple of forecasts:

From J.D. Power: Summer Sizzle Continues as New-Vehicle Sales in August Forecast to Hit Highest Levels of the Year

Retail light-vehicle sales are projected to hit 1.3 million units and total light-vehicle sales are expected to reach nearly 1.5 million in August 2014, both a 3 percent increase on a selling day adjusted basis, compared with August 2013.From WardsAuto: Forecast: Strong Summer Sales to Continue in August

The seasonally adjusted annualized rate (SAAR) for retail sales in August 2014 is expected to be 13.6 million units, an increase of more than 100,000 units from the selling rate in July 2014. The August SAAR marks the sixth consecutive month where the SAAR has exceeded 13 million. Retail transactions are the most accurate measure of true underlying consumer demand for new vehicles. [Total sales forecast at 16.5 million SAAR]

John Humphrey, senior vice president of the global automotive practice at J.D. Power, notes that continued high levels of consumer expenditures on new vehicles demonstrate the continuation of the overall health of the industry.

“We expect consumer spending on new vehicles in August to approach $39 billion, the highest level on record for the month of August and second-highest month ever behind July 2005 ($39.7 billion),” said Humphrey. “The record consumer spending is fueled by both high sales volumes and high transaction prices.”

A new WardsAuto forecast calls for August U.S. light-vehicle sales to continue to gain ground on year-ago, as the industry seasonally adjusted annual rate stays in line with recent trend. The report calls for just under 1.51 million LV deliveries this month, equating to a daily sales rate of 55,761 units (over 27 days) – a 4.3% improvement over same-month year-ago (28 days). [Total sales forecast of 16.6 million SAAR]Another solid month for auto sales.

The recovery in U.S. Heavy Truck Sales

by Calculated Risk on 8/24/2014 11:33:00 AM

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have more than doubled and hit 413 thousand (SAAR) in July 2014 (about the same is in April of this year) .

The level in April was the highest level since early 2007 (over 7 years ago). Sales are now above the average (and median) of the last 20 years - but still below the peaks - so I expect some more growth in sales.

Saturday, August 23, 2014

Schedule for Week of August 24th

by Calculated Risk on 8/23/2014 01:04:00 PM

The key reports this week are July New Home sales on Monday, the second estimate of Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

For manufacturing, the August Dallas, Richmond and Kansas City Fed surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: New Home Sales for July from the Census Bureau.

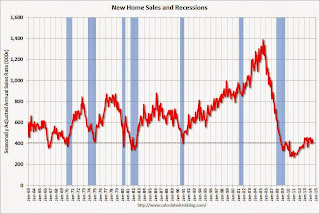

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 406 thousand in June.

10:30 AM: Dallas Fed Manufacturing Survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.1% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June..

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June.. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the May 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 8.4% year-over-year increase in the Composite 20 index (NSA) for June. The Zillow forecast is for the Composite 20 to increase 8.1% year-over-year, and for prices to be unchanged month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for June. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Conference Board's consumer confidence index for August. The consensus is for the index to decrease to 89.7 from 90.9.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, unchanged from 4.0% in the advance estimate.

10:00 AM ET: Pending Home Sales Index for July. The consensus is for a 0.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for August. This is the last of the Fed regional surveys for August.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for an increase to 56.0, up from 52.6 in July.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 80.3, up from the preliminary reading of 79.2, and down from the July reading of 82.5.