by Calculated Risk on 8/24/2014 03:52:00 PM

Sunday, August 24, 2014

Vehicle Sales Forecasts: Over 16 Million SAAR again in August

The automakers will report August vehicle sales on Wednesday, Sept 3rd. Sales in July were at 16.40 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in August will be above 16 million SAAR again.

Note: There were 27 selling days in August this year compared to 28 last year.

Here are a couple of forecasts:

From J.D. Power: Summer Sizzle Continues as New-Vehicle Sales in August Forecast to Hit Highest Levels of the Year

Retail light-vehicle sales are projected to hit 1.3 million units and total light-vehicle sales are expected to reach nearly 1.5 million in August 2014, both a 3 percent increase on a selling day adjusted basis, compared with August 2013.From WardsAuto: Forecast: Strong Summer Sales to Continue in August

The seasonally adjusted annualized rate (SAAR) for retail sales in August 2014 is expected to be 13.6 million units, an increase of more than 100,000 units from the selling rate in July 2014. The August SAAR marks the sixth consecutive month where the SAAR has exceeded 13 million. Retail transactions are the most accurate measure of true underlying consumer demand for new vehicles. [Total sales forecast at 16.5 million SAAR]

John Humphrey, senior vice president of the global automotive practice at J.D. Power, notes that continued high levels of consumer expenditures on new vehicles demonstrate the continuation of the overall health of the industry.

“We expect consumer spending on new vehicles in August to approach $39 billion, the highest level on record for the month of August and second-highest month ever behind July 2005 ($39.7 billion),” said Humphrey. “The record consumer spending is fueled by both high sales volumes and high transaction prices.”

A new WardsAuto forecast calls for August U.S. light-vehicle sales to continue to gain ground on year-ago, as the industry seasonally adjusted annual rate stays in line with recent trend. The report calls for just under 1.51 million LV deliveries this month, equating to a daily sales rate of 55,761 units (over 27 days) – a 4.3% improvement over same-month year-ago (28 days). [Total sales forecast of 16.6 million SAAR]Another solid month for auto sales.

The recovery in U.S. Heavy Truck Sales

by Calculated Risk on 8/24/2014 11:33:00 AM

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have more than doubled and hit 413 thousand (SAAR) in July 2014 (about the same is in April of this year) .

The level in April was the highest level since early 2007 (over 7 years ago). Sales are now above the average (and median) of the last 20 years - but still below the peaks - so I expect some more growth in sales.

Saturday, August 23, 2014

Schedule for Week of August 24th

by Calculated Risk on 8/23/2014 01:04:00 PM

The key reports this week are July New Home sales on Monday, the second estimate of Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

For manufacturing, the August Dallas, Richmond and Kansas City Fed surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: New Home Sales for July from the Census Bureau.

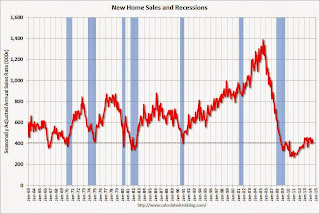

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 406 thousand in June.

10:30 AM: Dallas Fed Manufacturing Survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.1% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June..

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June.. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the May 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 8.4% year-over-year increase in the Composite 20 index (NSA) for June. The Zillow forecast is for the Composite 20 to increase 8.1% year-over-year, and for prices to be unchanged month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for June. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Conference Board's consumer confidence index for August. The consensus is for the index to decrease to 89.7 from 90.9.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, unchanged from 4.0% in the advance estimate.

10:00 AM ET: Pending Home Sales Index for July. The consensus is for a 0.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for August. This is the last of the Fed regional surveys for August.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for an increase to 56.0, up from 52.6 in July.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 80.3, up from the preliminary reading of 79.2, and down from the July reading of 82.5.

Unofficial Problem Bank list declines to 445 Institutions

by Calculated Risk on 8/23/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 22, 2014.

Changes and comments from surferdude808:

Quiet week as expected that is front of the FDIC providing an update on its enforcement action activity. This week there were two removals that lower the Unofficial Problem Bank List count to 445 with assets of $141.0 billion. We updated assets figures for q2 financials, so $833 million of the $1.0 billion decline in assets comes from the latest figures. A year ago, the list held 714 institutions with assets of $253.1 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 445.

Two banks found their way off the list through merger with a healthier institution. First Bank of Miami, Coral Gables, FL ($193 million) merged with the Apollo Bank, Miami, FL. Flint River National Bank, Camilla, GA ($19 million) merged with Five Star Credit Union, Dothan, AL, with this being an infrequent type of merger with a credit union as the survivor.

Next week, we expect the FDIC to provide an update on its enforcement action activity on Friday and release q2 industry results including the official problem bank list numbers maybe earlier in the week.

Friday, August 22, 2014

ECB's Draghi: Unemployment in the euro area

by Calculated Risk on 8/22/2014 03:06:00 PM

From ECB President Mario Draghi at Jackson Hole: Unemployment in the euro area

No one in society remains untouched by a situation of high unemployment. For the unemployed themselves, it is often a tragedy which has lasting effects on their lifetime income. For those in work, it raises job insecurity and undermines social cohesion. For governments, it weighs on public finances and harms election prospects. And unemployment is at the heart of the macro dynamics that shape short- and medium-term inflation, meaning it also affects central banks. Indeed, even when there are no risks to price stability, but unemployment is high and social cohesion at threat, pressure on the central bank to respond invariably increases.On Fiscal Policy:

1. The causes of unemployment in the euro area

The key issue, however, is how much we can really sustainably affect unemployment, which in turn is a question – as has been much discussed at this conference – of whether the drivers are predominantly cyclical or structural. As we are an 18 country monetary union this is necessarily a complex question in the euro area, but let me nonetheless give a brief overview of how the ECB currently assesses the situation.

Figure 1: Change in the unemployment rate since 2008 – the euro area and the US

The long recession in the euro area

The first point to make is that the euro area has suffered a large and particularly sustained negative shock to GDP, with serious consequences for employment. This is visible in Figure 1, which shows the evolution of unemployment in the euro area and the US since 2008. Whereas the US experienced a sharp and immediate rise in unemployment in the aftermath of the Great Recession, the euro area has endured two rises in unemployment associated with two sequential recessions.

From the start of 2008 to early 2011 the picture in both regions is similar: unemployment rates increase steeply, level off and then begin to gradually fall. This reflects the common sources of the shock: the synchronisation of the financial cycle across advanced economies, the contraction in global trade following the Lehman failure, coupled with a strong correction of asset prices – notably houses – in certain jurisdictions.

From 2011 onwards, however, developments in the two regions diverge. Unemployment in the US continues to fall at more or less the same rate. In the euro area, on the other hand, it begins a second rise that does not peak until April 2013. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy. Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions.

Turning to fiscal policy, since 2010 the euro area has suffered from fiscal policy being less available and effective, especially compared with other large advanced economies. This is not so much a consequence of high initial debt ratios – public debt is in aggregate not higher in the euro area than in the US or Japan. It reflects the fact that the central bank in those countries could act and has acted as a backstop for government funding. This is an important reason why markets spared their fiscal authorities the loss of confidence that constrained many euro area governments’ market access. This has in turn allowed fiscal consolidation in the US and Japan to be more backloaded.Conclusion:

Thus, it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy, and I believe there is scope for this, while taking into account our specific initial conditions and legal constraints. These initial conditions include levels of government expenditure and taxation in the euro area that are, in relation to GDP, already among the highest in the world. And we are operating within a set of fiscal rules – the Stability and Growth Pact – which acts as an anchor for confidence and that would be self-defeating to break.

Unemployment in the euro area is a complex phenomenon, but the solution is not overly complicated to understand. A coherent strategy to reduce unemployment has to involve both demand and supply side policies, at both the euro area and the national levels. And only if the strategy is truly coherent can it be successful.Draghi is pleading for help from fiscal policymakers (Bernanke also pleaded with Congress in US for fiscal help - to no avail - but as the graph shows, the situation is even worse in Europe).

Without higher aggregate demand, we risk higher structural unemployment, and governments that introduce structural reforms could end up running just to stand still. But without determined structural reforms, aggregate demand measures will quickly run out of steam and may ultimately become less effective. The way back to higher employment, in other words, is a policy mix that combines monetary, fiscal and structural measures at the union level and at the national level. This will allow each member of our union to achieve a sustainably high level of employment.

We should not forget that the stakes for our monetary union are high. It is not unusual to have regional disparities in unemployment within countries, but the euro area is not a formal political union and hence does not have permanent mechanisms to share risk, namely through fiscal transfers. [19] Cross-country migration flows are relatively small and are unlikely to ever become a key driver of labour market adjustment after large shocks.

Thus, the long-term cohesion of the euro area depends on each country in the union achieving a sustainably high level of employment. And given the very high costs if the cohesion of the union is threatened, all countries should have an interest in achieving this.