by Calculated Risk on 5/30/2014 12:22:00 PM

Friday, May 30, 2014

Headline for Next Friday: "U.S. Employment at All Time High"

Just a quick note, total nonfarm U.S. employment is currently 113 thousand below the pre-recession peak. With the release of the May employment report next Friday, total employment will probably be at an all time high.

Note: The consensus is for an increase of 217 thousand non-farm payroll jobs added in May.

I guess I'm going to have to retire the following graph until the next recession ... (once call the "THE SCARIEST JOBS CHART EVER").

Click on graph for larger image.

The graph shows the percentage of payroll jobs lost during post WWII recessions through April.

Of course this doesn't include growth of the labor force, but this will be a significant milestone as the economy recovers from the housing bust and severe financial crisis.

Final May Consumer Sentiment at 81.9, Chicago PMI increases to 65.5

by Calculated Risk on 5/30/2014 09:55:00 AM

Click on graph for larger image.

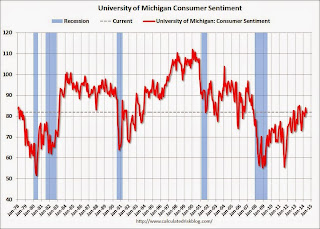

The final Reuters / University of Michigan consumer sentiment index for May decreased to 81.9 from the April reading of 84.1, and was up slightly from the preliminary May reading of 81.8.

This was below the consensus forecast of 82.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

Still waiting for sentiment to back at post-recession highs!

Chicago PMI May 2014: Chicago Business Barometer Up 2.5 to 65.5 in May

The Chicago Business Barometer increased to 65.5 in May from 63.0 in April, the highest since October, as demand strengthened and the economy continued to recover from a weather related slowdown in Q1. ...This was above the consensus estimate of 61.0.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “It looks pretty clear now that the slowdown in Q1 was due to the poor weather, with activity now back to or exceeding the level seen in Q4. The rise in the Barometer to a seven month high in May suggests we’ll see a significant bounceback in GDP growth this quarter following the contraction in Q1.”

emphasis added

Personal Income increased 0.3% in April, Spending decreased 0.1%

by Calculated Risk on 5/30/2014 08:30:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $43.7 billion, or 0.3 percent ... in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $8.1 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.3 percent in April, in contrast to an increase of 0.8 percent in March. ... The price index for PCE increased 0.2 percent in April, the same increase as in March. The PCE price index, excluding food and energy, increased 0.2 percent in April, the same increase as in March. ... The April price index for PCE increased 1.6 percent from April a year ago. The April PCE price index, excluding food and energy, increased 1.4 percent from April a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is just one month for Q2 - and the month-to-month decline in PCE was due to the surge in spending in March (following the severe winter).

Thursday, May 29, 2014

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 5/29/2014 08:59:00 PM

From the WSJ: Borrowers Tap Their Homes at a Hot Clip

A rebound in house prices and near-record-low interest rates are prompting homeowners to borrow against their properties, marking the return of a practice that was all the rage before the financial crisis.This is still a low level (not really a "hot clip"), but this is an increase from last year. I've been expecting Mortgage Equity Withdrawal (MEW) to turn positive soon, and maybe the Q1 Flow of Funds report will suggest positive MEW (to be released by the Fed on June 5th).

Home-equity lines of credit, or Helocs, and home-equity loans jumped 8% in the first quarter from a year earlier, industry newsletter Inside Mortgage Finance said Thursday. The $13 billion extended was the most for the start of a year since 2009. Inside Mortgage Finance noted the bulk of the home-equity originations were Helocs.

While that is still far below the peak of $113 billion during the third quarter of 2006, this year's gains are the latest evidence that the tight credit conditions that have defined mortgage lending in recent years are starting to loosen.

Friday:

• At 8:30 AM, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a decrease to 61.0, down from 63.0 in April.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 82.5, up from the preliminary reading of 81.8, but down from the April reading of 84.1.

A comment on GDP Revisions: No Worries

by Calculated Risk on 5/29/2014 02:22:00 PM

The BEA reported this morning that GDP declined at a 1.0% annual rate in Q1. This is disappointing, but not concerning looking forward.

The key driver of the downward revision was a much larger negative change in private inventories (see table below that shows the contribution to GDP from each major category). In the advance release, change in private inventories subtracted 0.57 percentage points from GDP. With the 2nd release - based on more data - change in private inventories subtracted 1.61 percentage point. This was payback from the positive contribution in Q3 last year (change in private inventories tends to bounce around quarter-to-quarter).

There were also downward revisions to investment in nonresidential structure, trade, and state and local government.

PCE was revised up from 3.0% to 3.1% in Q1 (annualized growth rate), and the contribution from PCE to GDP increased slightly.

This weakness will not continue - growth has already picked up in Q2. And I expect both residential investment and state and local governments to add to growth soon. And even investment in nonresidential structures should turn positive.

The growth story is intact. No worries.

| Revision: Contributions to Percent Change in Real Gross Domestic Product | |||

|---|---|---|---|

| Advance | 2nd Release | Revision | |

| GDP, Percent change at annual rate: | 0.1 | -1.0 | -1.1 |

| PCE, Percentage points at annual rates: | |||

| Personal consumption expenditures | 2.04 | 2.09 | 0.05 |

| Investment, Percentage points at annual rates: | |||

| Nonresidential Structures | 0.00 | -0.21 | -0.21 |

| Equipment | -0.32 | -0.18 | 0.14 |

| Intellectual property products | 0.06 | 0.19 | 0.13 |

| Residential | -0.18 | -0.16 | 0.02 |

| Change in private inventories | -0.57 | -1.62 | -1.05 |

| Trade, Percentage points at annual rates: | |||

| Net exports of goods and services | -0.83 | -0.95 | -0.12 |

| Government, Percentage points at annual rates: | |||

| Federal Government | 0.05 | 0.05 | 0.00 |

| State and Local | -0.14 | -0.20 | -0.06 |