by Calculated Risk on 5/06/2014 03:37:00 PM

Tuesday, May 06, 2014

What's Right with Housing?

There have been quite a few hand-wringing articles lately discussing the problems with housing. Most articles point to some of these suspects:

1) Existing home sales were down 7.5% year-over-year in March.

2) New home sales were down 13% year-over-year in March and down slightly Q1 over Q1.

3) Housing starts were down 5.9% year-over-year in March, and down 2% Q1 compared to Q1 2013.

4) The 4-week average of the Mortgage Bankers Association (MBA) mortgage purchase index is down 19% compared to the same week last year.

5) Mortgage credit is still tight.

6) Mortgage rates are up significantly from last year.

7) The homeownership rate is still falling.

8) Younger people prefer renting and more ...

Oh my, the sky is falling!

Well, maybe not.

The first mistake these writers make is they are asking the wrong question. Of course housing is lagging the recovery because of the residual effects of the housing bust and financial crisis (this lag was predicted on this blog and elsewhere for years - it should not be a surprise).

The correct question is: What's right with housing? And there is plenty.

1) Existing home sales were down 7.5% year-over-year in March. Wait, isn't that bad news? Nope - not if the decline is related to fewer distressed sales - and it is. (fewer foreclosures and short sales).

2) Mortgage delinquencies are down sharply. See: Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in March and Mortgage Monitor: Mortgage delinquency rate in March lowest since October 2007, "Only One in 10 American Borrowers Underwater"

3) Mortgage credit is tight. Hey, isn't that bad news? Nope. There is only one way to go ...

Click on graph for larger image.

Click on graph for larger image.

4) New home sales are up significantly from the bottom, but are still historically very low.

There really is no where to go but up. A growing population will require more new homes. (I'll post again on household formation in the future). The graph for housing starts looks similar.

5) The percent of borrowers with negative equity is declining sharply. See: CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013 and Zillow: Negative Equity declines further in Q4 2013

6) The impact from rising mortgage rates is mostly behind us. Economists at Goldman Sachs have found "the effect of monetary policy shocks on [building] permits persists for 3-4 quarters". Rates increased from around 3.5% in May 2013 to 4.4% in July 2013. Since then rates have moved sideways or down a little - and the "3-4 quarters" is almost over.

7) Existing home inventory is increasing, and house price increases are slowing. Sometimes rising inventory is a sign of trouble (I was pointing to this in 2005), but now inventory is so low that it is a positive that inventory is increasing. This will also slow house price increases (I think that will be a positive for housing too - a more normal market).

8) The MBA purchase index is skewed by large lenders. Over the last few years, small lenders (many not included in the MBA survey) have focused on purchase applications (they market through real estate channels and charge lower fees than the large lenders). Other data suggests mortgage applications are mostly flat year-over-year. UPDATE: The MBA told me they have expanded coverage of the index to include many smaller purchase focused lenders. The MBA doesn't believe their data is "skewed" by the large lenders.

9) Investor buying is declining.

Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years.

Zillow: Case-Shiller House Price Index expected to slow to 11.9% year-over-year increase in March

by Calculated Risk on 5/06/2014 11:23:00 AM

The Case-Shiller house price indexes for February were released last week (CoreLogic this morning). Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller will continue to slow. From Zillow: Finally…We’re Seeing More of the Slowdown

The Case-Shiller data for February 2014 came out [last week], and based on this information and the March 2014 Zillow Home Value Index (ZHVI, released April 21), we predict that next month’s Case-Shiller data (March 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 11.9 and 12.1 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from February to March will be 0.8 percent for the 20-City Composite Index and 0.7 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for March will not be released until Tuesday, May 27.The Case-Shiller Comp 20 was up 13.7% year-over-year (YoY) in November, up 13.4% YoY in December, 13.2% in January, and up 12.9% YoY in February - and will probably be around 11.9% YoY in March - so the index appears to be slowing down.

| Zillow March 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Mar 2013 | 161.13 | 165.55 | 148.44 | 152.58 |

| Case-Shiller (last month) | Feb 2014 | 179.96 | 184.04 | 165.35 | 169.21 |

| Zillow Forecast | YoY | 12.1% | 12.1% | 11.9% | 11.9% |

| MoM | 0.4% | 0.7% | 0.5% | 0.8% | |

| Zillow Forecasts1 | 180.7 | 185.5 | 166.1 | 170.7 | |

| Current Post Bubble Low | 146.45 | 149.81 | 134.07 | 137.10 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 23.4% | 23.8% | 23.9% | 24.5% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

CoreLogic: House Prices up 11.1% Year-over-year in March

by Calculated Risk on 5/06/2014 09:32:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 11.1 Percent Year Over Year in March

Home prices nationwide, including distressed sales, increased 11.1 percent in March 2014 compared to March 2013. This change represents 25 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 1.4 percent in March 2014 compared to February 2014.

Excluding distressed sales, home prices nationally increased 9.5 percent in March 2014 compared to March 2013 and 0.9 percent month over month compared to February 2014. Distressed sales include short sales and real estate owned (REO) transactions.

“March data on new and existing home sales was weaker than expected and is a cause for concern as we enter the spring buying season,” said Dr. Mark Fleming, chief economist for CoreLogic. “Interest rate-disenfranchised potential sellers are adding to the existing shadow inventory, while buyers who can't find what they want to buy are on the sidelines creating a new kind of 'shadow demand.' This supply and demand imbalance continues to drive home prices higher, even though transaction volumes are lower than expected.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.4% in March, and is up 11.1% over the last year. This index is not seasonally adjusted, so this was a strong month-to-month gain during the "weak" season.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty five consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty five consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to continue to slow.

Trade Deficit decreased in March to $40.4 Billion

by Calculated Risk on 5/06/2014 08:44:00 AM

The Department of Commerce reported this morning:

[T]otal March exports of $193.9 billion and imports of $234.3 billion resulted in a goods and services deficit of $40.4 billion, down from $41.9 billion in February, revised. March exports were $3.9 billion more than February exports of $190.0 billion. March imports were $2.5 billion more than February imports of $231.8 billion.The trade deficit was close to the consensus forecast of $40.2 billion.

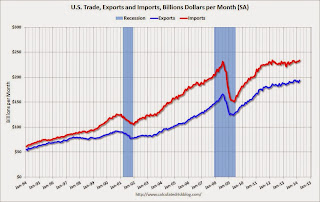

The first graph shows the monthly U.S. exports and imports in dollars through March 2014.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports increased in March.

Exports are 17% above the pre-recession peak and up 5% compared to March 2013; imports are about 1% above the pre-recession peak, and up about 5% compared to March 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $93.91 in March, up from $90.21 in February, and down from $96.95 in March 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $20.4 billion in March, from $17.9 billion in March 2013. About half of the trade deficit is related to China.

Overall it appears trade is picking up slightly.

Monday, May 05, 2014

Q1 2014 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 5/05/2014 08:26:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.2 billion in March from $42.3 billion in February.

The BEA released the underlying details for the Q1 advance GDP report.

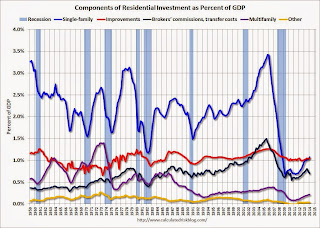

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Investment in single family structures is now back to being the top category for the first time in 22 quarters. Home improvement was the top category for twenty one consecutive quarters following the housing bust ... but now investment in single family structures is the top category once again.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $179 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just over 1.0% of GDP). Investment in single family structures was $184 billion (SAAR) (almost 1.1% of GDP).

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 49% from the recent peak (as a percent of GDP) and increasing slowly. The office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 57% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 57% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 60%. With the hotel occupancy rate close to normal, it is likely that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging - but that investment is starting to increase. And residential investment is generally increasing, but from a very low level.