by Calculated Risk on 5/05/2014 08:26:00 PM

Monday, May 05, 2014

Q1 2014 GDP Details on Residential and Commercial Real Estate

Tuesday:

• At 8:30 AM ET, Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.2 billion in March from $42.3 billion in February.

The BEA released the underlying details for the Q1 advance GDP report.

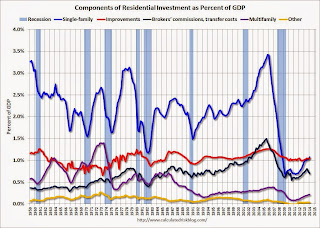

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Investment in single family structures is now back to being the top category for the first time in 22 quarters. Home improvement was the top category for twenty one consecutive quarters following the housing bust ... but now investment in single family structures is the top category once again.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $179 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just over 1.0% of GDP). Investment in single family structures was $184 billion (SAAR) (almost 1.1% of GDP).

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 49% from the recent peak (as a percent of GDP) and increasing slowly. The office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 57% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 57% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 60%. With the hotel occupancy rate close to normal, it is likely that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging - but that investment is starting to increase. And residential investment is generally increasing, but from a very low level.