by Calculated Risk on 7/11/2013 05:46:00 PM

Thursday, July 11, 2013

Sacramento: Conventional Sales in June highest in Years, Inventory increases 18% year-over-year

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). Note: I used Sacramento because the data was available!

For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June 2013, 26.5% of all resales (single family homes) were distressed sales. This was down from 29.1% last month, and down from 54.2% in June 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 7.4%, and the percentage of short sales decreased to 19.0%. (the lowest percentage for short sales since August 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 18.3% year-over-year in June. This is the second consecutive month with a year-over-year increase in inventory - the first two months in two years - and suggests inventory probably bottomed in Sacramento.

Cash buyers accounted for 29.9% of all sales, down from 33.6% last month (frequently investors).

Total sales were down 12% from June 2012, but conventional sales were up 30% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

Possibly the most important number in the release this month was the year-over-year increase in active inventory. This suggests price increases will slow in Sacramento, and I expect to see a similar pattern in other areas.

RealtyTrac: Foreclosure Activity Drops to Lowest Level since 2006

by Calculated Risk on 7/11/2013 01:51:00 PM

This was released this morning from RealtyTrac: U.S. Foreclosure Activity Decreases 14 Percent in June to Lowest Level Since December 2006 Despite 34 Percent Jump in Judicial Scheduled Foreclosure Auctions

RealtyTrac® ... today released its Midyear 2013 U.S. Foreclosure Market Report™, which shows a total of 801,359 U.S. properties with foreclosure filings — default notices, scheduled auctions and bank repossessions — in the first half of 2013, a 19 percent decrease from the previous six months and down 23 percent from the first half of 2012.

...

A total of 127,790 U.S. properties had foreclosure filings in June, down 14 percent from the previous month and down 35 percent from a year ago to the lowest monthly level since December 2006 — a six and a half year low.

U.S. foreclosure starts in June dropped 21 percent from the previous month and were down 45 percent from a year ago to the lowest monthly level since December 2005 — a seven and a half year low. Year to date through June, 409,491 foreclosure starts have been filed nationwide, on pace to reach more than 800,000 for the year, which would be down from 1.1 million foreclosure starts in 2012.

...

Judicial foreclosure auctions (NFS) were scheduled for 28,296 U.S. properties in June, up less than 1 percent from May but up 34 percent from June 2012. States with substantial annual increases in scheduled judicial foreclosure auctions included New Jersey (up 103 percent), Florida (up 100 percent), Maryland (up 94 percent), New York (up 66 percent), and Illinois (up 65 percent to a 35-month high).

...

“Halfway through 2013 it is becoming increasingly evident that while foreclosures are no longer a problem nationally they continue to be a thorn in the side of several state and local markets, particularly where a backlog of delayed distress has built up thanks to a lengthy foreclosure process,” said Daren Blomquist, vice president at RealtyTrac. “The increases in judicial foreclosure auctions demonstrate that these delayed foreclosure cases are now being moved more quickly through to foreclosure completion.

Click on graph for larger image.

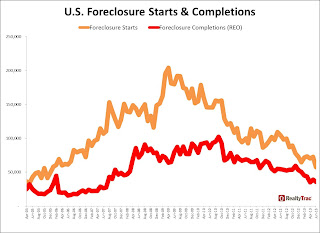

Click on graph for larger image.This graph from RealtyTrac shows foreclosure starts and completions since 2005.

Some of the decline in foreclosure activity is related to the increased emphasis on short sales and modifications.

The difference in various states is another reminder that a national foreclosure law, with strong borrower protections, should be part of the housing finance reform legislation.

Will the Fed "Taper" in September if the August unemployment rate is 7.6%?

by Calculated Risk on 7/11/2013 10:47:00 AM

Short answer: No.

The BLS will release two more employment reports before the September 17-18 FOMC meeting (employment reports for July and August). The current unemployment rate is 7.6% (as of June), and the Fed's forecast is for the unemployment rate to decline to an average of 7.2% to 7.3% in Q4 of this year.

A significant portion of the decline in the unemployment rate from 10.0% in October 2009 to 7.6% in June 2013 was related to a decline in the participation rate from 65.0% in Oct 2009 to 63.5% in June 2013. If the participation rate had held steady, the unemployment rate would be 9.7% (assuming an increase in the participation rate with the same employment level).

Of course a large portion of the decline in the participation rate was expected and was due to demographics (both the aging of the population, and more young Americans staying in school). There has been an ongoing debate about how much of the decline in the participation rate has been due to demographics and how much due to economic weakness (I think more demographics, other have attributed more of the decline to economic weakness).

However just about every analyst expects 1) a continued long term decline in the participation rate, 2) some short term bounce back in the participation rate as the economy recovers. The bounce back could be just a flattening of the participation rate (the short term bounce back just offsetting the long term decline) or the participation rate could increase 0.5% or so in the next year or two. (I think somewhat flat is likely)

The participation rate could be very important regarding the timing of when the Fed starts tapering QE3 asset purchases. We can use the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level based on the participation rate.

As an example, if the participation rate holds steady over the next two months, it would take 114 thousand jobs added per month to keep the unemployment rate at 7.6%. The economy has added 202 per month so far in 2013, and at that pace - with the participation rate steady at 63.5% - the unemployment rate would decline to 7.4% to 7.5% in August.

However, if the participation rate increases slightly to 63.6% (more people returning to the labor force), then the economy would need to add 220 thousand jobs per month to just keep the unemployment rate steady at 7.6%.

The participation rate was probably one of the factors Fed Chairman Ben Bernanke was referring to yesterday when he said the June unemployment rate of 7.6% "probably understates the weakness of the labor market." I've seen a number of analysts point to recent job gains as the key to the Fed tightening in September; I think the unemployment rate and participation rate are more important indicators for the Fed.

Note: You can put in your own assumptions to the calculator. Another frequent question is when will the unemployment rate fall to 6.5% (the Fed's threshold, but not trigger, for raising the Fed's funds rate). If the participation rate stays steady, the unemployment rate will fall to 6.5% in December 2014 if the economy adds around 200,000 jobs per month. This is consistent with the Fed not raising rates until 2015 or later.

Weekly Initial Unemployment Claims increase to 360,000

by Calculated Risk on 7/11/2013 08:35:00 AM

The DOL reports:

In the week ending July 6, the advance figure for seasonally adjusted initial claims was 360,000, an increase of 16,000 from the previous week's revised figure of 344,000. The 4-week moving average was 351,750, an increase of 6,000 from the previous week's revised average of 345,750.The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 351,750.

The 4-week average has mostly moved sideways over the last few months. Claims were above the 337,000 consensus forecast, but I wouldn't read too much into this one report since this was a holiday week and data in July can be impacted by the timing of auto plant shutdowns.

Wednesday, July 10, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 7/10/2013 08:28:00 PM

From the WSJ: Fed Affirms Easy-Money Tilt

"You can only conclude that highly accommodative monetary policy for the foreseeable future is what's needed in the U.S. economy," he said Wednesday at a conference held by the National Bureau of Economic Research, citing the high unemployment rate, low inflation and "quite restrictive" fiscal policy. He said he expects the Fed won't raise short-term rates for some time after the unemployment rate hits 6.5%, which would be more than a full percentage point lower than its current level.I just don't see tapering in September unless the economy clearly picks up in July and August. However many analysts think tapering is a "done deal".

...

Mr. Bernanke, speaking at Wednesday's conference, said he was "somewhat optimistic" about the economy. However, he noted the June unemployment rate of 7.6% "probably understates the weakness of the labor market," inflation is running below the Fed's 2% objective and fiscal policy is quite restrictive.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 337 thousand from 343 thousand last week.