by Calculated Risk on 5/30/2013 09:16:00 PM

Thursday, May 30, 2013

Friday: April Personal Income and Outlays, 2013 Social Security Trustees Report

The 2013 Social Security Trustees Report is expected tomorrow. If it is released, expect some terrible media coverage. Last year, the Columbia Journalism Review issued a Report Card on Social Security Trust Fund Coverage. They gave the media an "F" on headlines, and a "C-" on coverage.

With a few exceptions like USNews.com, the ABCNews blog, and Mark Miller, who noted on his Reuters blog “[Security Commissioner Michael] Astrue went out of his way to emphasize that the program is far from broke,” Astrue’s warning went unheeded.. Most press coverage ignored Astrue’s cautions and left the impression with the public that Social Security will not be there for them. “There won’t be much money left for you” after 2033, declared a reporter on WBEZ in Chicago.Obviously any site that says "broke" or "bankrupt", is well, wrong. Unfortunately the coverage is typically more political than data driven. Be prepared to ridicule the coverage (The Columbia article has some great examples from last year).

Friday economic releases:

• At 8:30 AM ET, the BEA will release the Personal Income and Outlays for April. The consensus is for a 0.1% increase in personal income in April, and for no change in personal spending. Also for the Core PCE price index to increase 0.1%. Based on the second estimate of GDP, there will be an upward revision to outlays for Q1.

• At 9:45 AM, the Chicago Purchasing Managers Index for May will be released. The consensus is for an increase to 50.0, up from 49.0 in April.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 83.7.

• Expected: The 2013 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds

Fake Prosperity in Ireland for the G8 Summit

by Calculated Risk on 5/30/2013 05:50:00 PM

Oh my ... from the Irish Times: Recession out of the picture as Fermanagh puts on a brave face for G8 leaders

Just a few weeks ago, Flanagan’s – a former butcher’s and vegetable shop in the neat village – was cleaned and repainted with bespoke images of a thriving business placed in the windows. Any G8 delegate passing on the way to discuss global capitalism would easily be fooled into thinking that all is well with the free-market system in Fermanagh. But, the facts are different. ...The picture in the Irish Times is amazing. Ahhh, a Potemkin village that might fool some "leaders" into thinking Ireland is actually recovering.

The butcher’s business has been replaced by a picture of a butcher’s business. Across the road is a similar tale. A small business premises has been made to look like an office supplies store. It used to be a pharmacy, now relocated on the village main street.

Elsewhere in Fermanagh, billboard-sized pictures of the gorgeous scenery have been located to mask the occasional stark and abandoned building site or other eyesore.

A few comments on 2nd Estimate of GDP

by Calculated Risk on 5/30/2013 03:29:00 PM

Earlier the BEA reported the second estimate of Q1 GDP. The revisions were fairly small, as the BEA reported that real GDP increased at a 2.4% annual rate in Q1, revised down from the advanced estimate of 2.5%. The underlying details were slightly positive.

Personal consumption expenditure (PCE) grew at a 3.4% annualized real rate in Q1, revised up from 3.2%.

The change in private inventories was revised down to a 0.63 percentage point contribution from a 1.03 percentage point contribution in the advance report (a 0.40 percentage point decline between estimates). This smaller buildup in inventories for Q1 is probably a positive for Q2.

A key negative was the contribution from state and local government from -0.14 percentage points to -0.29 percentage points - the largest drag since Q2 2011.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years - and is now adding to the economy.

However the drag from state and local governments has continued. Just ending this drag will be a positive for the economy. Note: In real terms, state and local government spending is at the lowest level since Q1 2001.

With consumer spending holding up, residential investment increasing - and state and local governments near the bottom - this suggests decent growth going forward. Of course there will be a substantial drag from Federal fiscal policy over the next couple of quarters ...

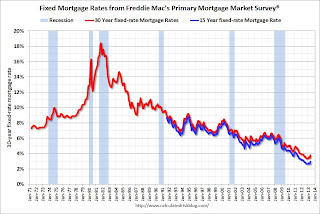

Freddie Mac: "Fixed Mortgage Rates Highest in a Year"

by Calculated Risk on 5/30/2013 12:31:00 PM

From Freddie Mac today: Fixed Mortgage Rates Highest in a Year

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates following long-term government bond yields higher. The average 30-year fixed moved up nearly half a percentage point since the beginning of May when it averaged 3.35 percent. ...

30-year fixed-rate mortgage (FRM) averaged 3.81 percent with an average 0.8 point for the week ending May 30, 2013, up from last week when it averaged 3.59 percent. Last year at this time, the 30-year FRM averaged 3.75 percent.

15-year FRM this week averaged 2.98 percent with an average 0.7 point, up from last week when it averaged 2.77 percent. A year ago at this time, the 15-year FRM averaged 2.97 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®. Not much of an increase recently, but this is the highest level in a year.

This is a weekly average for the week ending May 30th. Rates moved higher over the last couple of days, and 30 year rates will probably be close to 4% in the next survey if Treasury yields remain at the current level.

Note: The Freddie Mac survey started in 1971 and rates were below 5% in earlier periods.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 30% over the last 3 weeks) and will probably decline significantly if rates stay at this level.

NAR: Pending Home Sales index increases slightly in April

by Calculated Risk on 5/30/2013 10:03:00 AM

From the NAR: Pending Home Sales Edge Up in April

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 0.3 percent to 106.0 in April from 105.7 in March, and is 10.3 percent above April 2012 when it was 96.1; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

Home contract activity is at the highest level since the index hit 110.9 in April 2010, immediately before the deadline for the home buyer tax credit. Pending sales have been above year-ago levels for the past 24 months.

...

The PHSI in the Northeast jumped 11.5 percent to 92.3 in April and is 17.7 percent above a year ago. In the Midwest the index rose 3.2 percent to 107.1 in April and is 15.1 percent higher than April 2012. Pending home sales in the South slipped 1.1 percent to an index of 119.2 in April but are 12.3 percent above a year ago. With pronounced inventory constraints, the index in the West fell 7.6 percent in April to 94.6 and is 2.6 percent below April 2012.

With limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key is that the number of conventional sales is increasing while foreclosures and short sales decline - and that is a sign of an improving market (although with significant investor buying), even if total sales decline.