by Calculated Risk on 1/19/2013 08:02:00 AM

Saturday, January 19, 2013

Schedule for Week of Jan 20th

Note: I'll post a summary for last week soon.

There are two key December housing reports that will be released this week, Existing home sales on Tuesday, and New Home sales on Friday.

For manufacturing, the January Richmond Fed and Kansas City Fed surveys will be released this week.

All US markets will be closed in observance of the Martin Luther King, Jr. Day holiday.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 5.10 million on seasonally adjusted annual rate (SAAR) basis. Sales in November 2012 were 5.04 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 4.97 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January. The consensus is for a a reading of 5 for this survey, unchanged from December (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: FHFA House Price Index for November 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 360 thousand from 335 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This release might provide hints about the ISM PMI for January. This consensus is for a decrease to 54.0 from 54.2 in December.

10:00 AM: Conference Board Leading Indicators for December. The consensus is for a 0.4% increase in this index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. The consensus is for a reading of 2, up from -2 in December (below zero is contraction).

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for an increase in sales to 388 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 377 thousand in November.

Friday, January 18, 2013

Bank Failure #2 in 2013: 1st Regents Bank, Andover, Minnesota

by Calculated Risk on 1/18/2013 09:20:00 PM

Nor all of First Regent’s men

Can save it again

by Soylent Green is People

From the FDIC: First Minnesota Bank, Minnetonka, Minnesota, Assumes All of the Deposits of 1st Regents Bank, Andover, Minnesota

As of September 30, 2012, 1st Regents Bank had approximately $50.2 million in total assets and $49.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.5 million. ... 1st Regents Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Minnesota.A Friday tradition continues ...

Lawler: Early Look At Existing Home Sales in December

by Calculated Risk on 1/18/2013 06:49:00 PM

From economist Tom Lawler:

Based on reports from various realtor associations/MLS across the country, I expect that existing home sales in December as measured by the National Association of Realtors will come in at a seasonally adjusted annual rate of 4.97 million in December, down 1.4% from November’s pace (which I think should be revised upward a bit), but up 13.5% from last December’s seasonally adjusted pace. Folks who track unadjusted data from local realtor reports but don’t take into account “calendar” effects would probably expect a lower number; after all, most (though not all) local realtor reports showed substantially lower YOY growth in December compared to November, and the number of local areas showing YOY sales declines was up in December compared to November. Indeed, national existing homes sales on an unadjusted basis, which showed YOY growth of 15.5% in November, are likely to show a YOY growth rate of less than half that amount in December. However, not only was there one fewer “business” day this December compared to last December, but both Christmas and New Years (this year) came on a Tuesday --- reducing the “effective” number of business days even further. As a result, this December’s seasonal factor will “gross up” the unadjusted sales figures by more than last Decembers.

On the inventory front, both local realtor reports and entities that track local real estate listings showed that in most (though not all) areas of the country the number of homes listed for sale at the end of December was down sharply from the end of the November – which is typical for most (though not quite all) parts of the country. Based on looking at various sources of data, my “best guess” is that the NAR’s estimate of the inventory of existing homes for sale at the end of December will be 1.87 million, down 7.9% from November and down 19.4% from last December.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price in December will show another double-digit YOY increase, probably of around 11.0%. This gain does not, of course, reflect the increase in “typical” home prices, but does reflect in part the sharply lower foreclosure sales share of home resales this December compared to last December.

CR Note: The NAR will report December existing home sales on Tuesday, Jan 22nd. The consensus is the NAR will report sales of 5.10 million.

Based on Lawler's estimates, the NAR will report inventory around 1.87 million units for December, and months-of-supply around 4.5 months (down from 4.8 months in November). This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since early 2005.

The Future's so Bright ...

by Calculated Risk on 1/18/2013 03:19:00 PM

It looks like economic growth will pickup over the next few years. I've written about this before - a combination of growth in the key housing sector, a significant amount of household deleveraging behind us, the end of the drag from state and local government layoffs (four years of austerity nearing the end), some loosening of household credit, and the Fed staying accommodative (with a 7.8% unemployment rate and inflation below the Fed's target, the Fed will remain accommodative).

The key short term risk is too much additional deficit reduction too quickly. There is a strong argument that the "fiscal agreement" might be a little too much with the current unemployment rate - my initial estimate was that Federal government austerity would subtract about 1.5 percentage points from growth in 2013 (Merrill Lynch estimate up to 2.0 percentage points including an estimate for the coming sequester agreement). This means another year of sluggish growth, even with an improved private sector (retail will be impacted by the payroll tax increase). But ex-austerity, we'd probably be looking at a decent year.

Here are a few graphs:

Click on graph for larger image.

Click on graph for larger image.

This graph shows total and single family housing starts. Even after the 28.1% in 2012, the 780 thousand housing starts in 2012 were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959. Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

Residential investment and housing starts are usually the best leading indicator for economy, so this suggests the economy will continue to grow over the next couple of years.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over. Some states like California are close to running a surplus, and, as the BLS reported this morning, even Nevada is seeing a sharp improvement in the unemployment rate.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

And another key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to around 3% in fiscal 2015.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next three years based on current policy (Jan Hatzius at Goldman Sachs estimates the deficit will 3% of GDP in 2015). Note: With 7.8% unemployment, there is a strong argument for less deficit reduction in the short term, but that doesn't seem to be getting any traction.

This graph from the the NY Fed shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

Household debt peaked in Q2 2008 and has been declining for over four years. There is probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

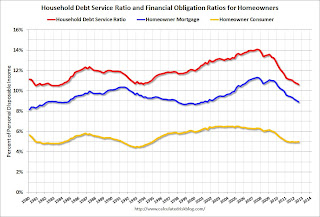

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio has declined back to early 1980s levels, and is near the record low - thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is at 1994 levels.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. Now, with falling interest rates, and less mortgage debt (mostly due to foreclosures), the ratio is back to 2001 levels. This will probably decline further, but for many homeowners, the obligation ratio is low.

There are several tailwinds for the economy, and the headwinds (like household deleveraging) are mostly subsiding. Deficit reduction is on a reasonable path - we don't want to reduce the deficit much faster than this projection for the next few years, because that will be too much of a drag on the economy.

Overall it appears the economy is poised for more growth over the next few years.

What about the longer term?

There are a number of longer term challenges from rising health care expenditures, climate change, income and wealth inequality and more, but I remain very optimistic about the longer term too. There is a constant focus on the aging population, but by 2020, eight of the top ten largest cohorts (five year age groups) will be under 40, and by 2030 the top 11 cohorts are the youngest 11 cohorts. The renewing of America! And these young people are smart (less exposure to lead is a significant story), and well educated too. I'll write more on the long term soon.

Last year, I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.

2007 Fed Transcripts

by Calculated Risk on 1/18/2013 01:48:00 PM

Here are the Fed transcripts for 2007.

From the WSJ: Fed's 2007 Transcripts Show Shift to Alarm

The Fed entered 2007 with interest-rate policies on hold and many officials comfortable about the economic outlook. By year-end, the U.S. was in recession ...One of my ongoing criticisms of Bernanke was that he was "behind the curve".

Fed Chairman Ben Bernanke ... was often behind the curve in his economic outlook. In January, for example, he projected that the "worst outcomes" for housing had become less likely. In May, he said he saw "good fundamental reasons to think that growth will be moderate."

He began to see after midyear that strains in financial markets threatened to move beyond housing to the broader economy and financial system. Mr. Bernanke himself slowly took on a more interventionist stance, but appears to have embraced that position reluctantly.

...

Meanwhile, Janet Yellen, then president of the Federal Reserve Bank of San Francisco and now the central bank's vice chairman, became increasingly alarmed about the growing risks to the economy as the year progressed.

"I still feel the presence of a 600-pound gorilla in the room, and that is the housing sector," she said in June 2007. "The risk for further significant deterioration in the housing market, with house prices falling and mortgage delinquencies rising further, causes me appreciable angst."

By December, she was pushing the Fed for aggressive responses to the crisis. "At the time of our last meeting, I held out hope that the financial turmoil would gradually ebb and the economy might escape without serious damage. Subsequent developments have severely shaken that belief," she said in December.

And some excerpts from FT Alphaville: From subprime to crisis: the Fed’s 2007 transcripts and 2007 FOMC transcripts: a few more excerpts. Janet Yellen in September 2007:

"We see a large drop in house prices as quite likely to adversely affect consumption spending over time through a number of different channels, including wealth effects, collateral effects, and negative effects on spending through the interest rate resets. A big worry is that a significant drop in house prices might occur in the context of job losses, and this could lead to a vicious spiral of foreclosures, further weakness in housing markets, and further reductions in consumer spending. ... at this point I am concerned that the potential effects of the developing credit crunch could be substantial. I recognize that there’s a tremendous amount of uncertainty around any estimate. But I see the skew in the distribution to be primarily to the downside, reflecting possible adverse spillovers from housing to consumption and business investment."And from the WaPo Wonkblog: The Fed’s 2007 crisis response: Twinkies, pessimism pills, and missed warnings.