by Calculated Risk on 12/26/2012 09:00:00 AM

Wednesday, December 26, 2012

Case-Shiller: House Prices increased 4.3% year-over-year in October

S&P/Case-Shiller released the monthly Home Price Indices for October (a 3 month average of August, September and October).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Sustained Recovery in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through October 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, ... showed home prices rose 4.3% in the 12 months ending in October in the 20-City Composite, out-distancing analysts’ forecasts. Anticipated seasonal weakness appeared as twelve of the 20 cities and both Composites posted monthly declines in home prices in October.

The 10- and 20-City Composites recorded respective annual returns of +3.4% and +4.3% in October 2012 – larger than the +2.1% and +3.0% annual rates posted for September 2012. In nineteen of the 20 cities, annual returns in October were higher than September. Chicago and New York were the only two cities with negative annual returns in October. Phoenix home prices rose for the 13th month in a row. San Diego was second best with nine consecutive monthly gains.

...

“Annual rates of change in home prices are a better indicator of the performance of the housing market than the month-over-month changes because home prices tend to be lower in fall and winter than in spring and summer. Both the 10- and 20-City Composites and 19 of 20 cities recorded higher annual returns in October 2012 than in September. The impact of the seasons can also be seen in the seasonally adjusted data where only three cities declined month-to-month. The 10-City Composite annual rate of +3.4% in October was lower than the 20-City Composite annual figure of +4.3% because the two weaker cities – Chicago and New York – have higher weights in the 10-City Composite." [says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices.]

“Looking over this report, and considering other data on housing starts and sales, it is clear that the housing recovery is gathering strength. Higher year-over-year price gains plus strong performances in the southwest and California, regions that suffered during the housing bust, confirm that housing is now contributing to theeconomy.'

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.0% from the peak, and up 0.6% in October (SA). The Composite 10 is up 4.8% from the post bubble low set in March (SA).

The Composite 20 index is off 30.3% from the peak, and up 0.7% (SA) in October. The Composite 20 is up 5.4% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 3.4% compared to October 2011.

The Composite 20 SA is up 4.3% compared to October 2011. This was the fifth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in October seasonally adjusted (also 12 of 20 cities increased NSA). Prices in Las Vegas are off 58.0% from the peak, and prices in Dallas only off 4.6% from the peak. Note that the red column (cumulative decline through October 2012) is above previous declines for all cities.This was slightly above the consensus forecast for a 4.1% YoY increase. I'll have more on prices later.

LPS: House Price Index increased 0.3% in October, Up 4.3% year-over-year

by Calculated Risk on 12/26/2012 08:39:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses October closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.3 Percent for the Month; Up 4.3 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on October 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 22.6% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 53.6% from the peak in Las Vegas, 45.5% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and barely off in Austin and Houston.

Looking at the year-over-year price change throughout the year - in May, the LPS HPI was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, 3.6% in September, and now 4.3% in October. This is steady improvement on a year-over-year basis. Note: Case-Shiller for October will be this morning.

Tuesday, December 25, 2012

Wednesday: Case-Shiller House Prices, Richmond Fed Manufacturing Survey

by Calculated Risk on 12/25/2012 07:33:00 PM

First a great story about Jack Klugman from Joshua Green at the WaPo: Jack Klugman’s secret, lifesaving legacy

And for those seeing Les Mis this week, here are couple of incredible performances of "I Dreamed a Dream", first by Ruthie Henshall at the 10th Anniversary and another by Lea Salonga at the 25th Anniversary Concert.

Wednesday economic releases:

• At 9:00 AM, the S&P/Case-Shiller House Price Index for October will be released. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for a 4.1% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 4.1% year-over-year, and for prices to increase 0.3% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for December will be released. The consensus is for a decrease to 6 for this survey from 9 in November (Above zero is expansion).

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

Two more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Private Investment and the Business Cycle

by Calculated Risk on 12/25/2012 01:01:00 PM

A little holiday cheer ...

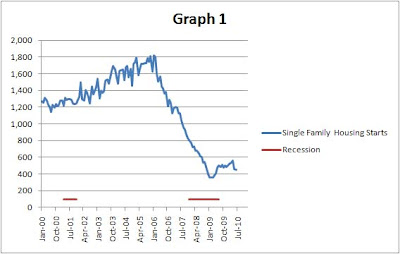

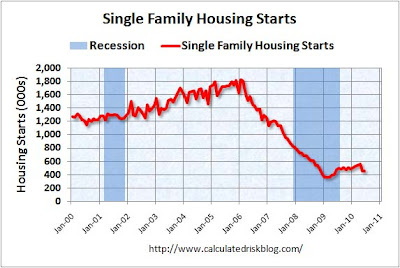

Discussions of the business cycle frequently focus on consumer spending (PCE: Personal consumption expenditures), but the key is to watch private domestic investment, especially residential investment. Even though private investment usually only accounts for around 15% of GDP, the swings for private investment are significantly larger than for PCE during the business cycle, so private investment has an outsized impact on GDP at transitions in the business cycle.

The first graph shows the real annualized change in GDP and private investment since 1960 (this is a 3 quarter centered average to smooth the graph).

GDP has fairly small annualized changes compared to the huge swings in investment, especially during and just following a recession. This is why investment is one of the keys to the business cycle.

Click on graph for larger image.

Click on graph for larger image.

Note that during the recent recession, the largest decline for GDP was in Q4 2008 (a 8.9% annualized rate of decline). On a three quarter center averaged basis (as presented on graph), the largest decline was 5.9% annualized.

However the largest decline for private investment was a 43% annualized rate! On a three quarter average basis (on graph), private investment declined at a 35% annualized rate.

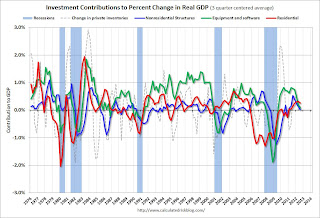

The second graph shows the contribution to GDP from the four categories of private investment: residential investment, equipment and software, nonresidential structures, and "Change in private inventories". Note: this is a 3 quarter centered average of the contribution to GDP.

This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment lags the business cycle. Red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, and blue.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish so far.

Residential investment finally turned positive during 2011 and made a positive contribution to GDP in 2012.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

The third graph shows residential investment as a percent of GDP. Residential investment as a percent of GDP is just above the record low, and it seems likely that residential investment as a percent of GDP will increase further in 2013.

The key downside risk for the US economy in 2013 is too much austerity, too quickly. However, barring a policy mistake (I expect a fiscal agreement), it seems unlikely there will be a sharp decline in private investment in 2013. This is because residential investment is already near record lows as a percent of GDP and will probably increase further in 2013, and that suggests the US will avoid a new recession in 2013.

Happy Holidays!

by Calculated Risk on 12/25/2012 09:01:00 AM

Happy Holidays and Merry Christmas to all!

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

And a repeat gift ... a common question, using excel, is how do you get from this:

Thanks to all. Happy Holidays!