by Calculated Risk on 12/20/2012 10:00:00 AM

Thursday, December 20, 2012

Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

The NAR reports: November Existing-Home Sales and Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 5.9 percent to a seasonally adjusted annual rate of 5.04 million in November from a downwardly revised 4.76 million in October, and are 14.5 percent higher than the 4.40 million-unit pace in November 2011. Sales are at the highest level since November 2009 when the annual pace spiked at 5.44 million.

...

Total housing inventory at the end of November fell 3.8 percent to 2.03 million existing homes available for sale, which represents a 4.8-month supply 4 at the current sales pace; it was 5.3 months in October, and is the lowest housing supply since September of 2005 when it was 4.6 months.

Listed inventory is 22.5 percent below a year ago when there was a 7.1-month supply. Raw unsold inventory is now at the lowest level since December 2001 when there were 1.89 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2012 (5.04 million SAAR) were 5.9% higher than last month, and were 14.5% above the November 2011 rate.

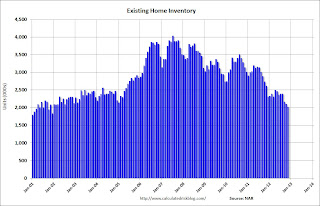

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

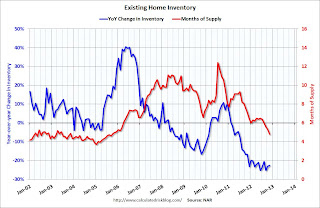

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.Months of supply declined to 4.8 months in November.

This was above expectations of sales of 4.90 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Weekly Initial Unemployment Claims at 361,000

by Calculated Risk on 12/20/2012 08:30:00 AM

The DOL reports:

In the week ending December 15, the advance figure for seasonally adjusted initial claims was 361,000, an increase of 17,000 from the previous week's revised figure of 344,000. The 4-week moving average was 367,750, a decrease of 13,750 from the previous week's unrevised average of 381,500.The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,750.

The recent spike in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is back to the pre-storm level.

Weekly claims were slightly higher than the 359,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline again next week, perhaps to a new low for the year. The low for the year is 363,000.

Wednesday, December 19, 2012

Thursday: Existing Home Sales, Q3 GDP, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/19/2012 09:23:00 PM

First, Stan Collender reviews his budget predictions for 2012 and offers five predictions for 2013: Beyond The Fiscal Cliff: My Budget Crystal Ball For 2013. One of his 2012 predictions is still open:

The one prediction whose fate is still unknown is that I told readers not to be shocked if the only thing that happens in a lame-duck session is a deal that both extends the tax cuts and delays the sequester spending cuts until June 30, 2013, or beyond. We should know in a few weeks whether that happens.My guess is some sort of deal will be worked out in early January, but Collender might be correct and everything could get extended for six months.

Wednesday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 343 thousand last week. If correct, this would put the 4-week just above the low for the year.

• Also at 8:30 AM, the third estimate of Q3 GDP from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, up slightly from the 2.7% second estimate.

• At 10:00 AM, Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in October 2012 were 4.79 million SAAR. Economist Tom Lawler estimates the NAR will report sales at 5.10 million SAAR.

• Also at 10:00 AM, the Philly Fed Manufacturing Survey for December. The consensus is for a reading of minus 2.0, up from minus 10.7 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for November. The consensus is for a 0.2% decrease in this index.

• Also at 10:00 AM, FHFA House Price Index for October 2012. This was originally a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.3% increase in house prices.

Another question for the December economic prediction contest (Note: You can use Facebook, Twitter, or OpenID to log in).

2013 Housing Forecasts

by Calculated Risk on 12/19/2012 06:57:00 PM

Towards the end of each year I collect some housing forecasts for the following year.

Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 370 thousand this year, and total starts around 770 thousand or so. Tom Lawler, John Burns and David Crowe (NAHB) were all very close on New Home sales for 2012. Lawler was the closest on housing starts.

The table below shows several forecasts for 2013. (several analysts were kind enough to share their forecasts - thanks!)

From Fannie Mae: Housing Forecast: November 2012

From NAHB: Housing and Interest Rate Forecast, 11/29/2012 (excel)

I haven't worked up a forecast yet for 2013. I've heard there are some lot issues for some of the builders (not improved until 2014), and that might limit supply. In general I expect prices to increase around the rate of inflation, and to see another solid increase in 2013 for new home sales and housing starts.

| Housing Forecasts for 2013 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| NAHB | 447 | 641 | 910 | 1.6% |

| Fannie Mae | 452 | 659 | 936 | 1.6%2 |

| Merrill Lynch | 466 | 976 | 2.6% | |

| Barclays | 424 | 988 | 4.8%3 | |

| Wells Fargo | 460 | 680 | 990 | 2.6% |

| Moody's Analytics | 500 | 820 | 1190 | 1.4% |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3Corelogic | ||||

| 2011 Actual | 306 | 431 | 609 | -4.0% |

| 2012 Estimate | 370 | 535 | 770 | 6.0% |

Lawler: Updated Outlook on November Existing Home Sales: Expect 5.1 Million (SAAR)

by Calculated Risk on 12/19/2012 04:48:00 PM

From economist Tom Lawler:

"Based on realtor/MLS reports released through today, I have increased my estimate of November existing home sales (as measured by the National Association of Realtors) to a seasonally adjusted annual rate of 5.10 million, up 6.5% from October’s pace, and up 15.9% from last November’s pace."

CR Note: The NAR will report November existing home sales tomorrow, Thursday, Dec 20th. The consensus is the NAR will report sales of 4.85 million.

Based on Lawler's estimates, the NAR will report inventory around 2.05 million units for November, and months-of-supply might be under 5 months. This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since 2005.

Tom Lawler also sent me some distressed sales data for a few more cities in November.

One of the key changes this year has been the dramatic decline in distressed sales. As the table shows, distressed sales are down everywhere (Chicago is close), foreclosure sales are down everywhere, and short sales are mixed (there is a clear shift from foreclosures to short sales).

The decline in the percent distressed means conventional sales are up even more than total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Nov | 11-Nov | 12-Nov | 11-Nov | 12-Nov | 11-Nov | |

| Las Vegas | 41.2% | 26.8% | 10.7% | 46.0% | 51.9% | 72.8% |

| Reno | 41.0% | 36.0% | 9.0% | 35.0% | 50.0% | 71.0% |

| Phoenix | 23.2% | 29.6% | 12.9% | 29.8% | 36.1% | 59.4% |

| Sacramento | 36.1% | 29.8% | 11.5% | 34.3% | 47.6% | 64.1% |

| Minneapolis | 11.2% | 13.8% | 24.6% | 34.8% | 35.8% | 48.7% |

| Mid-Atlantic (MRIS) | 11.9% | 13.7% | 8.7% | 14.2% | 20.6% | 27.9% |

| Orlando | 29.0% | 37.2% | 20.9% | 22.8% | 49.9% | 60.0% |

| California (DQ)* | 26.3% | 24.9% | 16.9% | 32.9% | 43.2% | 57.8% |

| So. California (DQ)* | 26.6% | 25.4% | 15.3% | 31.6% | 41.9% | 57.0% |

| Hampton Roads VA | 28.3% | 33.0% | ||||

| Northeast Florida | 42.2% | 48.0% | ||||

| Chicago | 43.0% | 43.1% | ||||

| Charlotte | 13.3% | 18.3% | ||||

| Atlanta | 30.0% | 46.0% | ||||

| Houston | 15.0% | 20.2% | ||||

| Spokane | 9.2% | 22.4% | ||||

| Memphis* | 24.3% | 31.3% | ||||

| Birmingham AL | 26.5% | 34.5% | ||||

| Metro Detroit | 33.6% | 38.7% | ||||

| *share of existing home sales, based on property records | ||||||