by Calculated Risk on 11/15/2012 11:13:00 AM

Thursday, November 15, 2012

Q3 MBA National Delinquency Survey Graph and Comments

A few comments from Mike Fratantoni, MBA’s Vice President of Research and Economics, on the Q3 MBA National Delinquency Survey conference call.

• Significant drop in "shadow inventory" with the declines in the 90+ day delinquency and in foreclosure categories.

• This was the largest decline in foreclosure inventory ever recorded.

• Significant difference between judicial and non-judicial states. The judicial foreclosure inventory was at 6.61%, and the non-judicial inventory was at 2.42%. Both are now declining.

• There has been "dramatic" improvement in California and Arizona. Overall there is continued improvement, "perhaps more quickly than expected".

• There has been some improvement in FHA delinquencies because of the strong credit quality of recent originations. Most of the delinquent loans are from the 2008 and 2009 vintages.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

As Fratantoni noted, California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: "MBA’s National Delinquency Survey covers 41.8 million loans on one-to-four-unit residential properties, representing approximately 88 percent of all “first-lien” residential mortgage loans outstanding in the United States. This quarter’s loan count saw a decrease of about 733,000 loans from the previous quarter, and a decrease of 1,752,000 loans from one year ago. Loans surveyed were reported by approximately 120 lenders, including mortgage banks, commercial banks and thrifts."

MBA: Mortgage Delinquencies decreased in Q3

by Calculated Risk on 11/15/2012 10:00:00 AM

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the third quarter of 2012, a decrease of 18 basis points from the second quarter of 2012, and a decrease of 59 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 7.40% (SA) and 4.07% equals 11.47%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. ... The percentage of loans in the foreclosure process at the end of the third quarter was 4.07 percent, down 20 basis points from the second quarter and 36 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.03 percent, a decrease of 28 basis points from last quarter, and a decrease of 86 basis points from the third quarter of last year.

...

“Mortgage delinquencies decreased compared to last quarter overall, driven mainly by a decline in loans that are 90 days or more delinquent,” observed Mike Fratantoni, MBA’s Vice President of Research and Economics. “The 90 day delinquency rate is at its lowest level since 2008, and together with the decline in the percentage of loans in foreclosure, this indicates a significant drop in the shadow inventory of distressed loans-a real positive for the housing market. The 30 day delinquency rate increased slightly, but remains close to the long-term average for this metric. Given the weak economic and job growth in third quarter, it is not surprising that this metric has not improved. ”

“The improvement in total delinquency rates was accompanied by a further drop in the foreclosure starts rate, which hit its lowest level since 2007. Moreover, the foreclosure inventory rate decreased by 20 basis points over the quarter, the largest quarterly drop in the history of the survey. The level however, is still roughly four times the long-run average for this series as we continue to see back logs of loans in the foreclosure process in states with a judicial foreclosure system. The foreclosure rate for judicial states decreased slightly to 6.6 percent and the foreclosure rate for non-judicial states showed a steeper drop to 2.4 percent. The difference in the foreclosure rates of the two regimes is at its widest since we started tracking this metric in 2006."

I'll have more (and graphs) later after the conference call this morning.

Weekly Initial Unemployment Claims increased sharply to 439,000

by Calculated Risk on 11/15/2012 08:30:00 AM

The DOL reports:

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000. The 4-week moving average was 383,750, an increase of 11,750 from the previous week's revised average of 372,000.The previous week was revised up from 355,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year ...

Zillow: 1.3 million fewer U.S. homeowners were in negative equity in Q3

by Calculated Risk on 11/15/2012 12:01:00 AM

From Zillow: Negative Equity Recedes in Third Quarter; Fewer than 30% of Homeowners with Mortgages Now Underwater

Negative equity fell in the third quarter, with 28.2 percent of all homeowners with mortgages underwater, down from 30.9 percent in the second quarter, according to the third quarter Zillow® Negative Equity Report. ...According to Zillow, 1.7 homeowners have moved out of negative equity over the least two quarters.

Slightly more than 14 million U.S. homeowners with a mortgage were in negative equity, or underwater, in the quarter, owing more on their mortgages than their homes are worth. That was down from 15.3 million in the second quarter.

Much of the decline in negative equity can be attributed to U.S. home values rising 1.3 percent in the third quarter compared to the second quarter ...

“The fall in negative equity rates means homeowners have additional options for refinancing or selling their homes,” said Zillow Chief Economist Dr. Stan Humphries. “But while we’re moving in the right direction, a substantial number of homes are still locked up in negative equity, unable to enter the existing re-sale market despite the desires of their owner. The housing market has found real momentum of its own, but is not immune from shocks to the broader economy. If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Click on graph for larger image.

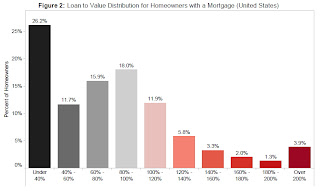

Click on graph for larger image.Zillow provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage.

The homeowners with a little negative equity are probably at low risk of foreclosure, but at the far right - like the 3.9% who owe more than double what their homes are worth - are clearly at risk.

Here is an interactive map of Zillow's negative equity data.

Wednesday, November 14, 2012

Thursday: Unemployment Claims, CPI, MBA Mortgage Delinquency Survey, Bernanke and much more

by Calculated Risk on 11/14/2012 08:01:00 PM

November 15th is Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 376 thousand from 355 thousand. Note: Claims are expected to increase following Hurricane Sandy.

• Also at 8:30 AM, the Consumer Price Index for October will be released. The consensus is for CPI to increase 0.1% in October and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of minus 5, up from minus 6.2 in October (below zero is contraction). I'm expecting a decline due to Hurricane Sandy.

• At 10:00 AM, MBA's 3rd Quarter 2012 National Delinquency Survey. As usual, I will be on the conference call and take notes.

• Also at 10:00 AM, the Philly Fed Survey for November. The consensus is for a reading of minus 4.5, down from 5.7 last month (above zero indicates expansion).

• At 1:20 PM, Fed Chairman Ben Bernanke will speak, Housing and Mortgage Markets, At the HOPE Global Financial Dignity Summit, Atlanta, Georgia.