by Calculated Risk on 11/03/2012 07:53:00 AM

Saturday, November 03, 2012

Schedule for Week of Nov 4th

Note: I'll post the weekly summary soon.

The most anticipated event this week will be the US election on Tuesday.

The key US report for this week will be the September trade balance report on Thursday.

Note: We might see some impact from Hurricane Sandy on weekly unemployment claims on Thursday.

10:00 AM: Trulia Price Rent Monitors for October. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

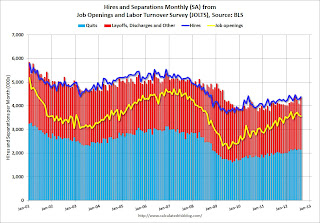

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

3:00 PM: Consumer Credit for September. The consensus is for credit to increase $10.2 billion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 363 thousand.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph is through August. Both exports and imports decreased in August. It appears that the global economic weakness is impacting both exports and imports.

The consensus is for the U.S. trade deficit to increase to $45.4 billion in August, up from from $44.2 billion in August. Export activity to Europe will be closely watched due to economic weakness.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for sentiment to increase slightly to 83.3.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.3% increase in inventories.

Friday, November 02, 2012

Bank Failures #48 and 49 in 2012

by Calculated Risk on 11/02/2012 06:32:00 PM

Our citizens heritage:

Unquenchable debt

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Heritage Bank of Florida, Lutz, Florida

As of September 30, 2012, Heritage Bank of Florida had approximately $225.5 million in total assets and $223.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $65.5 million. ... Heritage Bank of Florida is the 48th FDIC-insured institution to fail in the nation this year, and the eighth in Florida.And from the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Citizens First National Bank, Princeton, Illinois

As of September 30, 2012, Citizens First National Bank had approximately $924.0 million in total assets and $869.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45.2 million. ... Citizens First National Bank is the 49th FDIC-insured institution to fail in the nation this year, and the eighth in Illinois.It is Friday, Friday!

Here are the earlier employment posts (with graphs):

• October Employment Report: 171,000 Jobs, 7.9% Unemployment Rate

• Employment: An encouraging report (also more graphs)

• Solid Seasonal Retail Hiring, Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Solid Seasonal Retail Hiring, Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 11/02/2012 01:51:00 PM

Here are the earlier employment posts (with graphs):

• October Employment Report: 171,000 Jobs, 7.9% Unemployment Rate

• Employment: An encouraging report (also more graphs)

• Employment graph gallery

And a few more graphs ...

According to the BLS employment report, retailers hired seasonal workers at about the same level as last year.

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 130.1 thousand workers (NSA) net in October. This is slightly below the numbers in 2003 through 2006 and about the same as in 2011. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season. There is a decent correlation between retail hiring and retail sales, see: Retail: Seasonal Hiring vs. Retail Sales

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is at 3.2% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 60.7 in October, up from 56.4 in September. For manufacturing, the diffusion index increased to 56.8, up from 46.3 in September.

This is a little more technical. The BLS diffusion index for total private employment was at 60.7 in October, up from 56.4 in September. For manufacturing, the diffusion index increased to 56.8, up from 46.3 in September. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s. It appears job growth was spread across more industries in October, and that is good news.

Employment: An encouraging report (also more graphs)

by Calculated Risk on 11/02/2012 11:05:00 AM

This was another encouraging employment report. The 171,000 payroll jobs added in October, plus the 84,000 in upward revisions to the August and September reports, suggests decent job growth recently.

Some of this reported increase might be related to distorted seasonal factors (distorted by the severe recession). This was the third year in a row with weaker payroll growth in the summer, and it might be helpful to look at the year-over-year growth (year-over-year, payroll has increased close to 2 million jobs).

In a recent post, I highlighted Two Reasons to expect Economic Growth to Increase. The first reason was that we are nearing the end of the state and local government layoffs. Recent reports suggests we may be near the bottom (last graph).

The second reason was a pickup in residential investment. This report showed an increase of 17 thousand construction jobs, however I think the BLS is under counting construction jobs at the turn. The preliminary benchmark revision showed an upward revision of 386,000 payroll jobs as of March (this is an annual revision bench marked to state tax records). A fairly large portion of the upward revision was for construction workers (85,000 more jobs added), and I suspect that the BLS statistical model that estimates new company formation (the Birth/Death model) is currently underestimating the formation of small construction companies.

Not all the news is good. U-6, an alternate measure of unemployment, only declined slightly to 14.6%. The average workweek was unchanged and average hourly earnings decreased slightly. "In October, the average workweek for all employees on private nonfarm payrolls was 34.4 hours for the fourth consecutive month. ... In October, average hourly earnings for all employees on private nonfarm payrolls edged down by 1 cent to $23.58. Over the past 12 months, average hourly earnings have risen by 1.6 percent. This is sluggish earnings growth.

The economy has only added 1.55 million private sector payroll jobs over the first nine months of the year. At this pace, the economy would only add 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011.

Overall this employment report was an improvement over recent reports, especially with the upward revisions. Here are a few more graphs...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio was unchanged in October at 76.0%, the highest level since early 2009 - but there is still a long ways to go.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 269,000 to 8.3 million in October, partially offsetting an increase of 582,000 in September. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in October to 8.34 millon from 8.61 million in September.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.6% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.00 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 4.84 million in September. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, although state and local government fell by 7,000 in October.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, although state and local government fell by 7,000 in October.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing. Overall government employment has seen an unprecedented decline over the last 3+ years (not seen since the Depression).

Overall this was a somewhat encouraging report.

October Employment Report: 171,000 Jobs, 7.9% Unemployment Rate

by Calculated Risk on 11/02/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 171,000 in October, and the unemployment rate was essentially unchanged at 7.9 percent, the U.S. Bureau of Labor Statistics reported today.

...

[Household survey] The civilian labor force rose by 578,000 to 155.6 million in October, and the labor force participation rate edged up to 63.8 percent. Total employment rose by 410,000 over the month. The employment-population ratio was essentially unchanged at 58.8 percent, following an increase of 0.4 percentage point in September.

...

The change in total nonfarm payroll employment for August was revised from +142,000 to +192,000, and the change for September was revised from +114,000 to +148,000.

Click on graph for larger image.

Click on graph for larger image.With 171,000 payroll jobs added, and the upward revisions to the August and September reports, this was a solid report. And that doesn't include the annual benchmark revision to be released early next year that will also show more jobs.

This was above expectations of 125,000 payroll jobs added.

The second graph shows the unemployment rate. The unemployment rate increased slightly to 7.9%.

The unemployment rate is from the household report, and that report showed another month of strong job growth. The unemployment rate increased because of the significant increase in the labor force (and the increase in the labor force participation rate).

The unemployment rate is from the household report, and that report showed another month of strong job growth. The unemployment rate increased because of the significant increase in the labor force (and the increase in the labor force participation rate).The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 63.8% in October (blue line. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 63.8% in October (blue line. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio increased to 58.8% in October (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

The fifth graph shows the job losses from the start of the employment recession, in percentage terms compared to other financial crisis (including the Great Depression).

This is an update to a graph by economist Josh Lehner (ht Josh for the data):

This is an update to a graph by economist Josh Lehner (ht Josh for the data): [I]n the context of the Big 5 financial crises, the current U.S. cycle suddenly does not look quite as dire. Notice how the x-axis, how long it takes to return to peak levels of employment, is measured in years(!) not months like the first graph.Including the upward revisions, this was a much stronger report than for recent months. I'll have much more later ...

...

[T]he U.S. labor market has performed better than 4 of the previous Big 5 crises, as identified by Reinhart and Rogoff, in terms of job loss and the return to peak time line.