by Calculated Risk on 10/15/2012 10:57:00 AM

Monday, October 15, 2012

FNC: Residential Property Values increased 0.3% in August

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.3% in August compared to July (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.5% and 0.8% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since this index is NSA, the month-to-month changes will probably turn negative in September or October. The key then will be to watch the year-over-year change and also to compare the month-to-month change to previous years. This was the first month-to-month increase for the month of August since 2005.

The year-over-year trends continued to show improvement in August, with the 100-MSA composite up 1.5% compared to August 2011. The FNC index turned positive on a year-over-year basis last month - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through August 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Some of the month-to-month gain is seasonal since this index is NSA. The key is the indexes are now showing a year-over-year increase.

The August Case-Shiller index will be released in two weeks, on Tuesday, October 30th.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/15/2012 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted), and sales were up 5.4% from September 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $412.9 billion, an increase of 1.1 percent from the previous month and 5.4 percent above September 2011.. ... The July to August 2012 percent change was revised from 0.9 percent to 1.2 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for August were revised up to a 1.2% increase (from 0.9% increase).

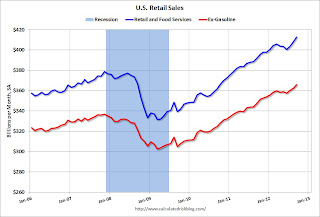

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.6% from the bottom, and now 9.0% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.

The second graph shows the same data, but just since 2006 (to show the recent changes). This shows that retail sales ex-gasoline are increasing, but that gasoline prices have boosted retails sales over the last two months.Excluding gasoline, retail sales are up 20.9% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.3% on a YoY basis (5.4% for all retail sales). Retail sales ex-autos increased 1.1% in September.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.7% increase in September, and above the consensus for a 0.5% increase ex-auto.

Sunday, October 14, 2012

Monday: Retail Sales, Empire State Mfg Survey

by Calculated Risk on 10/14/2012 09:25:00 PM

This is something I wrote about last year, from the WSJ: Buyers Back After Foreclosure

Millions of families lost their homes to foreclosure after the housing crash hit six years ago. Now, some of those families are back in the housing market. Call them the "boomerang" buyers.They're back!

...

On a recent conference call with investors, Stuart Miller, chief executive of Miami-based home builder Lennar Corp., said the company was seeing more people "coming out of the penalty box." At Cornerstone Communities, a San Diego home builder, roughly 20 of the 110 closings they have had this year came from buyers who have been through a foreclosure or short sale, estimates Ure Kretowicz, the company's chief executive.

...

Using the three-year benchmark it takes to get an FHA-guaranteed loan, in this year's second quarter there were 729,000 households that were foreclosed upon during the bust that are now eligible to apply for an FHA mortgage, up from 285,000 in the second quarter of 2011, according to an analysis of foreclosure data by Moody's Analytics. The company projects that number will grow to 1.5 million by the first quarter of 2014.

On Monday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for retail sales to increase 0.7% in September, and for retail sales ex-autos to increase 0.5%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for October will be released. The consensus is for a reading of minus 3, up from minus 10.4 in September (below zero is contraction).

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales report for August (Business inventories) will be released. The consensus is for 0.5% increase in inventories.

Note: Also on Monday, several regional Fed presidents will speak including NY Fed president William Dudley in the morning.

The Asian markets are mixed tonight, with the Hang Seng up slightly, and the Nikkei down 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3, and the DOW futures are down 22.

Oil prices are down with WTI futures down to $91.86 and Brent down at $113.80 per barrel.

Weekend:

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

• Zillow Housing Forum and The Bearish View

Five more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

The recovery in U.S. Heavy Truck Sales

by Calculated Risk on 10/14/2012 05:01:00 PM

The following article inspired me to look up some data today on heavy truck sales in the US.

Neil Irwin wrote in the WaPo on Friday: What cars and big rigs say about the economy

Less trucking activity, of course, means less demand for trucks. That is ... evident from this week’s earnings. Cummins, an Indiana company that makes truck engines, said it will cut up to 1,500 jobs by the end of the year amid weakening demand. “As a result of the heightened uncertainty, end customers are delaying capital expenditures in a number of markets, lowering demand for our products,” Cummins chief executive Tom Linebarger said in a statement Tuesday.I think the key quote is truck sales are "down compared to the view that we had in the first quarter" - actually heavy truck sales are up, and at the highest level since April 2007.

And Alcoa, the giant aluminum company, cited less demand from the trucking industry as it downgraded its forecasts. “Heavy trucks and trailer,” Alcoa chief executive Klaus Kleinfeld said in a conference call with analysts Tuesday, is “down compared to the view that we had in the first quarter. North America is really driving it. We believe that heavy truck production will slow down in the second half of the year.”

emphasis added

Click on graph for larger image.

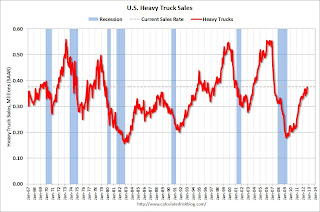

Click on graph for larger image.This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have doubled and hit 376 thousand SAAR in September 2012.

This is up 12% from September 2011, and the highest level since April 2007 (over 5 years ago). That is pretty strong growth, but I guess Alcoa was expecting more.

Earlier:

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

• Zillow Housing Forum and The Bearish View

Zillow Housing Forum and The Bearish View

by Calculated Risk on 10/14/2012 12:28:00 PM

I attended the Zillow housing forum in San Francisco on Friday. The first panel discussed "Is it a Good Time to Buy in California?: The Housing Market’s New Normal".

The participants were John Burns, CEO, John Burns Real Estate Consulting, Bert Selva, President and CEO, Shea Homes, Eric Gutshall, President and COO, Haven Realty Capital and Mark Hanson, Mark Hanson Advisors. And the moderator was Colleen Edwards, Owner, EMC Creative.

John Burns has turned positive on housing (he commented that some of his colleagues have been calling him a "raging bull"). Bert Selva said that sales are up about 40% this year for Shea Homes the year, and Eric Gutshall talked about their single family rental program (REO-to-rental) and also that they've seen house price increases in the markets where they are active.

Note: I had an offline discussion with Bert Selva and John Burns, and I asked about the possibility that some new home builders will be land constrained next year (that they may not have enough finished lots to meet demand in some locations). Selva said it probably depended on the builder, but there could be a period next year were sales are limited by lack of lot supply - although he seemed to think that would be resolved by 2014. John Burns shared his 2013 new home sales forecast with me, and it was around 450 thousand (he was close for 2012).

I was very interested in the comments of Mark Hanson since he has a different view on housing than me (I think prices bottomed earlier this year and that residential investment will continue to increase). Hanson thinks we are just seeing a stimulus bounce and that prices will start falling again. Here are a few of Hanson's comments (from notes and memory - Zillow will have a video of the forum available this week).

Hanson argued there is a substantial "shadow inventory" that will come on the market. He talked about the number of homes with negative equity (CoreLogic puts the number at 10.8 million, Zillow put the number at 15.1 million). Hanson also mentioned 6 million delinquent mortgages (LPS puts the number of properties delinquent or in foreclosure at 5.45 million).

And Hanson also mentioned the 6 million recent modifications (he called modified loans the "new subprime" because he thought a large number would default again). Hanson talked about the high "Back-End Debt-to-Income Ratio" even after modification. What Hanson was referring to was the HAMP programs were the borrowers have substantial debt payments in addition to their mortgage payment (student loan, car, other installment loans). In the most recent HAMP report, the back-end DTI was 53.6% after modification, and the front end DTI (principal, interest, taxes, insurance and homeowners association and/or condo fees) was 31%. With these high back-end ratios, Hanson argued many of these people would default (that is why he called it the "new subprime").

Hanson also discussed low mortgage rates (he called "stimulus"), and asked what would happen when mortgage rates increase.

Let's take a deep breathe.

Hanson mentioned several big numbers: 15 million with negative equity, 6 million modifications (more counting other retention programs), 6 million properties currently delinquent. No question there are significant issues for borrowers with negative equity, as an example they will have difficulty moving for a new job, and, as Hanson noted this limits the move-up market. But we can't add these numbers together because that would mostly be double counting. Most (but not all) of the seriously delinquent borrowers have negative equity - and if they don't, they can sell their homes and avoid foreclosure.

And most of the modifications have negative equity. And probably all of the listed (visible inventory) contingent short sales have negative equity. So when we are talking about unlisted inventory that will be forced on the market over the next 2 to 3 years, we can mostly ignore negative equity and focus on current and expected delinquencies.

As far as modifications, Hanson focused on the HAMP data (about 1.08 total permanent modifications so far, and about 23% have defaulted). And I agree that many more of these HAMP modifications will default over the next couple years. But there are another 4.6 million proprietary modification programs completed too (these are lender specific programs). Some of this data is available from Hope Now. The lenders also offered additional retention plans. (removed) These borrowers may redefault when the mortgage rates adjust, but that is several years from now - so this isn't imminent forced inventory on the market.

Update: HAMP modifications have performed better than private mods according to data from the OCC:

HAMP modifications perform better than other modifications. Of the 565,751 HAMP modifications implemented since the third quarter of 2009, 68.2 percent remained current, compared with 53.4 percent of other modifications implemented during the same period(end update)

The most important short term numbers are the 2.02 million properties currently in foreclosure pre-sale inventory (in the foreclosure process) and the 1.52 million properties that are 90 or more days delinquent, but not currently in foreclosure. Many of these properties will be sold as short sales (many are already listed as "short sale contingent"). A large number of these properties that are in foreclosure are located in judicial states, and that means there will not be a huge wave of foreclosures, but a steady stream in those states as the foreclosures work through the courts (and that could keep house prices from increasing).

Two months ago I wrote: House Prices and a Foreclosure Supply Shock. In that post I argued the peak of the foreclosure supply shock is behind us, and that suggests prices have probably bottomed. I think the coming modification redefaults and current delinquencies will keep prices from rising quickly, but I don't think this will push house prices to new lows. There are still large problems to work through, but nothing in Hanson's discussion changed my views on housing.