by Calculated Risk on 7/30/2012 04:51:00 PM

Monday, July 30, 2012

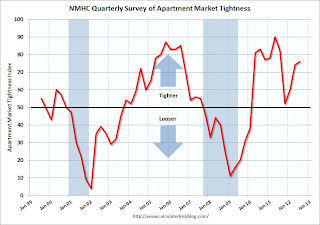

NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues

For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter.

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

...

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q2 2012 to 4.7%, down from 4.9% in Q1 2012, and down from 9.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

This survey indicates demand for apartments is still strong. And even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be more completions in 2012 than in 2011, but it looks like another strong year for the apartment industry.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Lawler on Manufactured Housing

by Calculated Risk on 7/30/2012 01:47:00 PM

From Tom Lawler:

The Commerce Department estimated that manufactured housing shipments ran at a seasonally adjusted annual rate of 54,000 in June, down from 56,000 in May. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 57,000, up from 51,600 in 2011 but just a fraction of the pace prior to last decade’s collapse.

The Commerce Department also estimated that manufactured housing placements ran at a SAAR of 47,000 in May, down from 51,000 in April. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 52,200, up from 47,000 in 2011.

| Manufactured Housing Shipments (Annual Average, 000's) | |

|---|---|

| 1961-1970 | 255.6 |

| 1971-1980 | 348.5 |

| 1981-1990 | 243.7 |

| 1991-2000 | 296.8 |

| 2001-2006 | 154 |

| 2006-2010 | 78.9 |

| 2011 | 51.6 |

| 2012YTD | 57 |

Click on graph for larger image.

Click on graph for larger image.Here is a graph from Lawler showing the annual manufactured housing shipments since 1959. The column for 2012 is the annual sales rate for the first six months of the year.

Although sales are running at about a 10% increase over last year, shipments in 2012 will still be the fourth lowest on record behind only 2009, 2010, and 2011.

Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

by Calculated Risk on 7/30/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth Amid Weaker View of General Business Activity

Texas factory activity continued to increase in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 15.5 to 12, suggesting slightly slower output growth.This was below expectations of a 2.5 reading for the general business activity index.

The new orders index was positive for the second month in a row, although it moved down from 7.9 to 1.4. Similarly, the shipments index posted its second consecutive positive reading but edged down from 9.6 to 7.4. ... The general business activity plummeted to -13.2 after climbing into positive territory in June. Nearly 30 percent of manufacturers noted a worsening in the level of business activity in July, pushing the index to its lowest reading in 10 months.

...

Labor market indicators reflected stronger labor demand. Employment growth continued in July, although the index edged down from 13.7 to 11.8. ... The hours worked index was 4.1, up slightly from its June reading.

The regional manufacturing surveys were mostly weak in July. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The ISM index for July will be released Wednesday, August 1st, and these surveys suggest another weak reading. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).

Europe Update

by Calculated Risk on 7/30/2012 09:10:00 AM

Spanish 10 year bond yields are down to 6.61% this morning. Italian yields are at 6.03%.

A few articles and comments on Europe, first from Tim Duy: Fed Watch: The Euromess Continues

Excitement is almost guaranteed this week, with both the Federal Reserve and the European Central Bank pondering their next moves. At the moment, I am more fascinated with the latter, as it represents the more fast moving policy failure for the moment. In response to that disaster to date, it is now widely expected that the ECB will deliver a significant policy expansion, possibly accepting its responsibility of lender of last resort for sovereign debt in the Eurozone. I think it is widely believed that this will be the turning point in Europe. In some ways, yes, as it would keep the threat of imminent dissolution at bay. But the Eurozone will still be fundamentally hobbled by a devotion to re-balancing via austerity-driven internal devaluation. This does not offer a promising long-run outcome.From Paul Krugman: Crash of the Bumblebee

First of all, Europe’s single currency is a deeply flawed construction. And Mr. Draghi, to his credit, actually acknowledged that. “The euro is like a bumblebee,” he declared. “This is a mystery of nature because it shouldn’t fly but instead it does. So the euro was a bumblebee that flew very well for several years.” But now it has stopped flying. What can be done? The answer, he suggested, is “to graduate to a real bee.”From Reuters: Euro zone crisis heads for September crunch

Never mind the dubious biology, we get the point. In the long run, the euro will be workable only if the European Union becomes much more like a unified country.

...

But the creation of a United States of Europe won’t happen soon, if ever, while the crisis of the euro is now. So what can be done to save the currency?

Over the past couple of years, Europe has muddled through a long series of crunch moments in its debt crisis, but this September is shaping up as a "make-or-break" month as policymakers run desperately short of options to save the common currency.From the WSJ: Greece Seen Facing €30 Billion Shortfall

Crisis or no crisis, many European policymakers will take their summer holidays in August. When they return, a number of crucial events, decisions and deadlines will be waiting.

Greece's chronic recession and the receding hope of an economic recovery in the next two years have blown a hole of at least 30 billion euros ($36.85 billion) in its financial rescue plan, officials familiar with the situation said.

The officials argued that the findings indicate a need for official creditors to write down their claims by at least that amount if they want to keep Greece in the euro zone, as well as finding new money to fund the country for longer. The officials represented two of four parties to the talks: the Greek government and the "troika" of the European Union, European Central Bank and International Monetary Fund.

...

"The haircut on private holders has proved not to be enough," said one official involved in the next round of talks.

Sunday, July 29, 2012

Monday: Dallas Fed Manufacturing Survey

by Calculated Risk on 7/29/2012 09:51:00 PM

This will be a busy week with the two day FOMC meeting ending on Wednesday, the ECB meeting in Europe on Thursday, and several key economic releases including the July employment report on Friday.

First from Reuters: Juncker: Euro zone leaders, ECB to act on euro - paper

[Eurogroup head Jean-Claude] Juncker told Germany's Sueddeutsche Zeitung and France's Le Figaro in reports made available on Sunday that leaders would decide in the next few days what measures to take to tackle Spanish bond yields which last week touched euro-era highs. They had "no time to lose," he said.• On Monday, at 10:30 AM ET, the Dallas Fed Manufacturing Survey for July will be released. This is the last of regional surveys for July. The consensus is for 2.5 for the general business activity index, down from 5.8 in June.

The Asian markets are green tonight, with the Nikkei up 0.8% and the Shanghai Composite up 0.1%. Check out the chart for the Shanghai composite - the index has been drifting down for 2+ years and is at the levels of early 2009.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 5, and the DOW futures down about 30.

Oil: WTI futures are at $90.04(this is down from $109.77 in February, but up last week) and Brent is at $106.51 per barrel.

Yesterday:

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

And the final question for the July economic contest: