by Calculated Risk on 7/08/2012 10:26:00 PM

Sunday, July 08, 2012

Monday: LPS Mortgage Delinquency Report, Consumer Credit

This will be a light week for economic data.

• At 8:45 AM ET, the LPS Mortgage Monitor for May will be released. This report provides monthly data on the mortgage market, especially on delinquencies.

• At 3:00 PM, the consumer credit report for June will be released. The consensus is for credit to increase $8.5 billion..

Also, at 11:55 AM, San Francisco Fed President John Williams will speak on the economic outlook.

The Asian markets are red tonight. The Nikkei is off 0.75%, and the Shanghai Composite is off 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the US futures are mostly flat.

Oil: WTI futures are up to $84.89 (this is down from $109.77 in February, but up last week) and Brent is at $97.69 per barrel. According to a formula from Professor Hamilton, the price of Brent would suggest gasoline at around $3.28 per gallon (the current national average price is $3.36) so gasoline prices might fall a little further.

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

A couple of questions for the July contest (to be released later in the week):

Fed Speak and a few Key Fed Dates

by Calculated Risk on 7/08/2012 06:22:00 PM

There is a renewed focus on the Fed following the weak employment report for June.

First, on Friday, Jon Hilsenrath wrote at the WSJ: Weak Report Lifts Chance of Fed Action

Friday's disappointing jobs report increases the likelihood that the Federal Reserve will launch a new bond-buying program to boost economic growth, though it doesn't ensure such a move.Dennis Lockhart is a voting member of the FOMC and he speaks this week to the Mississippi Economic Council on Friday at 1:20 PM ET. As Hilsenrath notes, Lockhart is in the "middle", and his speech will be analyzed to see if he is moving towards QE3.

...

The central bank's more activist camp believes more action is already justified because the economy isn't making progress toward reducing unemployment and inflation is low. Its hawkish wing, which worries more about inflation and which has been skeptical of the central bank's responses to financial crisis and recession, accepts that more action might be needed but wants to hold it in reserve for serious threats like recession or deflation.

Some Fed officials in the middle don't have as high a bar to action as the hawks but are waiting to see if the outlook deteriorates anymore. "I am more leaning toward the view further action would be a response to deteriorating conditions and a deteriorating outlook," Atlanta Fed president Dennis Lockhart said in an interview with Dow Jones Newswires last month.

Note: On Monday, FOMC voting member San Francisco Fed President John Willams will speak at 11:55 AM in Idaho, and on Wednesday the minutes from the FOMC meeting of June 19-20, 2012 will be released.

The following week, on July 17th, Fed Chairman Ben Bernanke will testify before the Senate Banking Committee, and on July 18th he will testify House Financial Services Committee. The next FOMC meeting is on July 31st and August 1st.

The key piece of economic data to be released before the next FOMC meeting is the Q2 advance GDP report on Friday, July 27th. Right now this report is expected to show GDP growth of around 1.5% annualized in Q2.

Some analysts think the Fed will wait for more data, so they think August 1st is too soon for QE3. Still the debate about QE3 will pickup over the next few weeks.

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

And on Employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• Percent Job Losses: Great Recession and Great Depression

• All Employment Graphs

Employment Report Graphs: Participation Rate, Duration of Unemployment and Diffusion Indexes

by Calculated Risk on 7/08/2012 11:24:00 AM

Below are three more graphs based on the June employment report.

For more employment graphs and analysis, see:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• Percent Job Losses: Great Recession and Great Depression

• All Employment Graphs

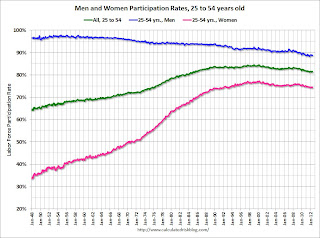

The following graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The participation rate for women increased significantly from the mid 30s to the mid 70s. This rate was at 75.5% prior to the recession, and declined to a post-recession low of 74.3%. There has been almost no recovery in the participation rate for prime working age women. This rate has mostly flattened out this year, and was still near the low in June at 74.4%.

The participation rate for men has decreased from the high 90s a few decades ago, to a low of 88.3% after the recession. This rate has increased a little and was at 88.8% in June.

There might be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

For more on this, see The Declining Participation Rate.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down, but there was an increase in the less than 5 week category in June. The other categories remain elevated.

Unfortunately the long term unemployed remains very high at 3.5% of the labor force in June.

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 57.9 in June, down from 59.8 in May. For manufacturing, the diffusion index declined to 51.2 from 53.7 in May.

Even though job growth was weak in June, job growth was still somewhat widespread across industries (a small positive).

Yesterday:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

Saturday, July 07, 2012

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 7/07/2012 10:04:00 PM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

Back in February I posted a graph based on some rough annual data.

In April, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

Here is that graph (I've added a couple of dots to update the current recession).

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

For reference, the second graph shows the job losses from the start of the employment recession, in percentage terms, compared to other post WWII recessions.

For reference, the second graph shows the job losses from the start of the employment recession, in percentage terms, compared to other post WWII recessions.

Earlier:

• Summary for Week Ending July 6th

• Schedule for Week of July 8th

Unofficial Problem Bank list declines to 913 Institutions

by Calculated Risk on 7/07/2012 06:32:00 PM

Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

So this is an unofficial list of Problem Banks compiled only from public sources. (And only US banks).

Here is the unofficial problem bank list for July 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Changes to the Unofficial Problem Bank List this week were limited to four removals. Afterward, the list holds 913 institutions with assets of $353.4 billion. A year ago, the list hit its high at 1,004 institutions with assets of $418.8 billion.Earlier:

There were three action terminations -- First Community Bank, National Association, Lexington, SC ($602 million Ticker: FCCO); Profinium Financial, Inc., Truman, MN ($307 million); and Solera National Bank, Lakewood, CO ($146 million Ticker: SLRK).

The other removal was the failed Montgomery Bank & Trust, Ailey, GA ($174 million), which is the 80th bank to fail in Georgia since August 2008. This failure was costly as FDIC estimated the loss at 75.2 million or 43.3 percent of MB&T's assets. There is some intrigue with the failure as a director apparently has gone missing with $17 million of the bank's monies according to the Wall Street JournalOn Tuesday, the U.S. attorney's office in New York announced that missing director Aubrey Lee Price has been charged with wire fraud involving the embezzlement of $17 million from the bank. After telling upper management that he was investing in U.S. Treasury securities, Mr. Price wired bank funds to accounts he controlled and prepared falsified statements to cover his tracks, the federal complaint said. The banker has been missing since at least June 16. He vanished after writing friends to tell them he had lost large amounts of client funds on trades and wanted to kill himself, authorities said. Investigators say Mr. Price, 46 years old, was last seen boarding a ferry in Key West, Fla., bound for Fort Myers, Fla. He had "previously stated that he owns real estate in Venezuela" and "may own a boat that would be large enough to travel to Venezuela from Florida," the complaint says.There are 67 banks in Georgia still on the Unofficial Problem Bank List, so there is a good chance the state could experience 100 failures during this banking crisis. Next week, we anticipate the OCC will release its enforcement actions through mid-June 2012.

• Summary for Week Ending July 6th

• Schedule for Week of July 8th