by Calculated Risk on 6/26/2012 09:00:00 AM

Tuesday, June 26, 2012

Case Shiller: House Prices increased in April

S&P/Case-Shiller released the monthly Home Price Indices for April (a 3 month average of February, March and April).

This release includes prices for 20 individual cities and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Rise in April 2012 According to the S&P/Case-Shiller Home Price Indices

Data through April 2012, released today by S&P Indices for its S&P/CaseShiller Home Price Indices ... showed that on average home prices increased 1.3% in the month of April for both the 10- and 20-City Composites. This comes after seven consecutive months of falling home prices as measured by both indices.

April’s data indicate that on an annual basis home prices fell by 2.2% for the 10-City Composite and by 1.9% for the 20-City Composites, versus April 2011. While still negative, this is an improvement over the annual rates of -2.9% and -2.6% recorded for the month of March 2012. Both Composites and 18 of the 20 MSAs saw increases in annual returns in April compared to those published for March; only Detroit and New York fared worse in April ...

...

“With April 2012 data, we finally saw some rising home prices,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “On a monthly basis, 19 of the 20 MSAs and both Composites rose in April over March. Detroit was the only city that saw prices fall, down 3.6%. In addition, 18 of the 20 MSAs and both Composites saw better annual rates of return. It has been a long time since we enjoyed such broadbased gains. While one month does not make a trend, particularly during seasonally strong buying months, the combination of rising positive monthly index levels and improving annual returns is a good sign.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.3% from the peak, and up 0.7% in April (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 33.0% from the peak, and up 0.7% (SA) in April. The Composite 20 is also up from the post-bubble low set in March (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.2% compared to April 2011.

The Composite 20 SA is down 1.9% compared to April 2011. This was a smaller year-over-year decline for both indexes than in March.

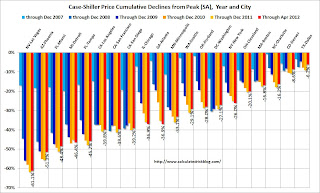

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in April seasonally adjusted (18 cities increased NSA). Prices in Las Vegas are off 61.1% from the peak, and prices in Dallas only off 6.2% from the peak. Note that the red column (cumulative decline through April 2012) is the lowest for only a couple of cities.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in April seasonally adjusted (18 cities increased NSA). Prices in Las Vegas are off 61.1% from the peak, and prices in Dallas only off 6.2% from the peak. Note that the red column (cumulative decline through April 2012) is the lowest for only a couple of cities.This was better than the consensus forecast, and the NSA indexes are above the post-bubble lows set last month (NSA). I'll have more on prices later.

Monday, June 25, 2012

Look Ahead: Case-Shiller House Prices

by Calculated Risk on 6/25/2012 09:31:00 PM

The key report tomorrow will be the Case-Shiller house price index for April. Of course most of the focus will be on Europe and the summit meeting later this week.

On Europe, the Financial Times reports: EU could rewrite eurozone budgets

The European Union would gain far-reaching powers to rewrite national budgets for eurozone countries that breach debt and deficit rules under proposals likely to be discussed at a summit this week, according to a draft report seen by the Financial Times.• At 9:00 AM ET, S&P/Case-Shiller House Price Index for April will be released. The consensus is for a 2.3% decrease year-over-year in Composite 20 prices (NSA) in April. I think the year-over-year decline will be smaller than the consensus.

The proposals are part of an ambitious plan to turn the eurozone into a closer fiscal union ...

Excerpt with permission

• At 10:00 AM, The Conference Board's consumer confidence index for June will be released. The consensus is for a decrease to 63.5 from 64.9 last month.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for June will be released. The consensus is for an increase to 5 for this survey from 4 in May (above zero is expansion). So far the NY Fed (Empire State) and Philly Fed surveys were lower than expected, but the Dallas Fed survey was above expectations.

When will the Case-Shiller house price index turn positive Year-over-year?

by Calculated Risk on 6/25/2012 06:43:00 PM

On Friday I posted Zillow's forecasts for the April Case-Shiller indexes to be released tomorrow. The year-over-year (YoY) decline in Case-Shiller prices has been getting smaller all year, and the Zillow forecast suggests the YoY decline will be smaller still in April - and be the smallest YoY decline since the expiration of the housing tax credit.

This raises the question: When will the Case-Shiller indexes turn positive year-over-year?

I looked at the recent improvement in prices (comparing the month-to-month changes for the NSA index to last year). At the current pace of improvement, it looks like the YoY change will turn positive in either the August or September reports.

It is important to remember that most of the sales that will be included in the August report have already been signed. The August Case-Shiller report will be a 3 month average of closing prices for June, July and August - and the contracts are usually signed 45 to 60 days before closing. So just about all of the contracts that will close in July have been signed, and probably many of the contracts that will close in August have already been signed.

So any increase in inventory will probably not impact the August Case-Shiller house price report. Note: we haven't seen any increase yet through June, and I don't expect a huge surge in inventory - but others do.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of the YoY change in the Case-Shiller Composite 10 and 20 indexes. In March, the indexes were down 2.8% and 2.6%, respectively.

Zillow is forecasting the Composite 10 index will be down 2.4% YoY in April, and the Composite 20 index will be down 1.9%.

Earlier this year, when I argued prices were near the bottom for the Not Seasonally Adjusted (NSA) repeat sales indexes, I thought the year-over-year change would turn positive late this year or early in 2013. Right now it looks like August or September of this year.

Dallas Fed: Regional Manufacturing Activity "Surges" in June

by Calculated Risk on 6/25/2012 02:52:00 PM

Here is a bit of an outlier this month ... earlier from the Dallas Fed: Texas Manufacturing Activity Surges but Outlook Largely Unchanged

Texas factory activity surged in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.5 to 15.5, posting its strongest reading in 15 months.This was above expectations of a zero reading for the general business activity index.

Other measures of current manufacturing conditions also indicated strengthening activity in June. The new orders index rose to 7.9, following three readings around zero, suggesting demand finally grew after staying flat since February. ... The general business activity index had been negative in April and May but increased to 5.8 this month.

...

Labor market indicators reflected stronger labor demand growth and steady workweeks. Employment grew at a faster pace in June, with the index rising from 8.5 to 13.7. Twenty-one percent of firms reported hiring new workers, while 8 percent reported layoffs. The hours worked index was 1, suggesting little change in workweek length.

There are two more regional surveys to be released this week, and the ISM index for June will be released Monday, July 2nd.

Earlier on New Home Sales:

• New Home Sales increase in May to 369,000 Annual Rate

• Home Sales Reports: What Matters

• New Home Sales graphs

Home Sales Reports: What Matters

by Calculated Risk on 6/25/2012 12:18:00 PM

After the existing home sales report for May was released last week, I saw several cautionary comments focused on the decline in sales in May (from 4.62 million in April to 4.55 million in May). The key number in the existing home sales report is not sales, but inventory. It is visible inventory that impacts prices (although the "shadow" inventory will keep prices from rising).

When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales.

However, for the new home sales report, the key number is sales! An increase in sales adds to both GDP and employment (completed inventory is at record lows, so any increase in sales will translate to more single family starts).

It might be hard to believe, but earlier this year there was a debate on whether housing had bottomed. That debate is over - clearly new home sales have bottomed – and the debate is now about the strength of the recovery. Although sales are still historically very weak, sales are up 35% from the low, and up about 24% from the May 2010 through September 2011 average.

Some people think housing will recover rapidly to the 1.2+ million rate we saw in 2004 and 2005. I think that is incorrect for two reasons. First, I think the recovery will be sluggish - 2012 will probably be the third worst year ever. Second, the 1.2 million in annual sales was due to an increasing homeownership rate and speculative buying. With a stable homeownerhip rate, and little speculative buying, sales will probably only rise to around 800 thousand at full recovery.

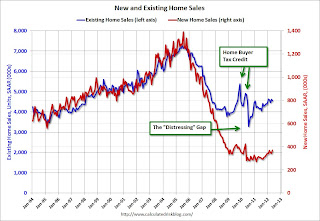

With existing home sales around 5 million per year, and new home sales around 800 thousand per year, the “distressing gap” in the graph below will be closed.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through May. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

This gap will eventually close, but it will probably take a number of years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales increase in May to 369,000 Annual Rate

• New Home Sales graphs