by Calculated Risk on 2/11/2012 01:36:00 PM

Saturday, February 11, 2012

Schedule for Week of February 12th

Earlier:

• Summary for Week ending February 10th

The key reports this week are January retail sales on Tuesday, and January housing starts on Thursday. The NAHB builder confidence report for February will be released on Wednesday.

For manufacturing, the February NY Fed (Empire state) and Philly Fed surveys, and the January Industrial Production and Capacity Utilization report will be released this week.

On prices, the January Producer Price index (PPI) will be released Thursday, and CPI will be released on Friday.

No economic releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for January.

7:30 AM: NFIB Small Business Optimism Index for January. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 93.8 in December from 92.0 in November. That was the fourth increase in a row after declining for six consecutive months. The consensus is for an increase to 95.0.

8:30 AM: Retail Sales for January.

8:30 AM: Retail Sales for January. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 20.4% from the bottom, and now 5.9% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.7% in January, and for retail sales ex-autos to increase 0.5%.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for January (a measure of transportation).

10:00 AM: Manufacturing and Trade: Inventories and Sales for December (Business inventories). The consensus is for 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this does not include all the cash buyers.

8:30 AM ET: NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of +14.1, up from +13.5 in January (above zero is expansion).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for January. This shows industrial production since 1967. Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus is for a 0.6% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.6% (from 78.1%).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 26, up slightly from 25 in January. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

2:00 PM: FOMC Minutes, Meeting of January 24-25, 2010.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 365,000 from 358,000 last week.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years. Multi-family starts increased in 2011 - although from a very low level. Single family starts appear to be increasing lately, but are still mostly "moving sideways".

The consensus is for an increase in total housing starts to 670,000 (SAAR) from 657,000 (SAAR) in December.

8:30 AM: Producer Price Index for January. The consensus is for a 0.3% increase in producer prices (0.1% increase in core).

9:00 AM: Fed Chairman Ben Bernanke speaks: "Community Banking" At the FDIC Conference on the Future of Community Banking, Arlington, Virginia

10:00 AM: Philly Fed Survey for February. The consensus is for a reading of 8.4, up from 7.3 last month (above zero indicates expansion).

10:00 AM: Mortgage Bankers Association (MBA) 4th Quarter 2011 National Delinquency Survey (NDS).

This graph shows the percent of loans delinquent by days past due in Q3. Based on other data, the delinquency rate probably was unchanged or only declined slightly in Q4.

This graph shows the percent of loans delinquent by days past due in Q3. Based on other data, the delinquency rate probably was unchanged or only declined slightly in Q4.However the key problem is the large number of seriously delinquent loans (90+ days and in the foreclosure process). With the mortgage servicer settlement, the delinquency rate will probably start falling faster by mid-2012 (a combination of more modifications and more foreclosures).

8:30 AM: Consumer Price Index for January. The consensus is a 0.3% increase in prices. The consensus for core CPI to increase 0.2%.

10:00 AM: Conference Board Leading Indicators for January. The consensus is for a 0.5% increase in this index.

Summary for Week ending February 10th

by Calculated Risk on 2/11/2012 08:05:00 AM

This was a light week for economic data; however there were two significant economic developments: 1) the long awaited mortgage servicer settlement agreement was announced, and 2) there was some progress with the Greek debt discussions – although there is more drama ahead.

A key economic question is the impact of the settlement on delinquencies and foreclosure activity, and by extension, on housing and the economy. This settlement should lead to both more modifications and more foreclosures, and for a decline in the number of seriously delinquent mortgages. It isn't clear how many more REOs will be on the market this year, but I don't expect a flood of REOs as happened in late 2008 and early 2009.

The data was mixed last week. The trade deficit was higher than expected, consumer confidence fell a little more than expected, but initial weekly unemployment claims fell again – and the four week average declined to the lowest level since May 2008.

Next week will be busy!

Here is a summary in graphs:

• Trade Deficit increased in December to $48.8 Billion

The trade deficit was slightly above the consensus forecast of $48.5 billion.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the monthly U.S. exports and imports in dollars through November 2011. Both exports and imports increased in December. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 9% compared to December 2010; imports are up about 11% compared to December 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $104.13 per barrel in December. The trade deficit with China declined to $23 billion, but hit an annual record in 2011.

Exports to eurozone countries increased slightly in December after declining sharply in November.

• Weekly Initial Unemployment Claims decline to 358,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 366,250.

The 4-week moving average is at the lowest level since May 2008.

• BLS: Job Openings increased in December

From the BLS: Job Openings and Labor Turnover Summary

From the BLS: Job Openings and Labor Turnover Summary There were 3.4 million job openings on the last business day of December, up from 3.1 million in November, the U.S. Bureau of Labor Statistics reported today.This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the number of job openings has increased 39 percent since the end of the recession in June 2009.

Jobs openings increased in December, and the number of job openings (yellow) has generally been trending up, and are up about 15% year-over-year compared to December 2010.

Quits declined slightly in December, but have mostly been trending up - quits are now up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

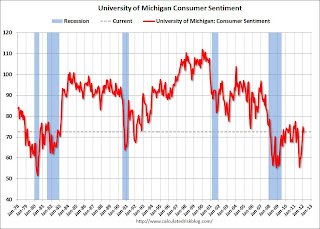

• Consumer Sentiment declines in February to 72.5

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer. This was below the consensus forecast of a decline to 74.3.

• Other Economic Stories ...

• Hotels: RevPAR increases 8.7% compared to same week in 2011

• MBA: Refinance activity increases as mortgage rates fall to record low

• Goldman: No Labor Force Participation Rebound in Sight

• Housing: The Two Bottoms

Friday, February 10, 2012

Late Night Reading: Greek Agreement with Troika

by Calculated Risk on 2/10/2012 11:13:00 PM

For insomniacs, here is the 51 page Memorandum of Understanding on Specific Economic Policy Conditionality between Greece and the troika.

Enjoy.

Bank Failures #8 &9 in 2012: Illinois and Indiana

by Calculated Risk on 2/10/2012 06:21:00 PM

Forest Lake Friday failure

A quickening pace.

by Soylent Green is People

From the FDIC: Barrington Bank & Trust Company, National Association, Barrington, Illinois, Assumes All of the Deposits of Charter National Bank and Trust, Hoffman Estates, Illinois

As of December 31, 2011, Charter National Bank and Trust had approximately $93.9 million in total assets and $89.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.4 million. ... Charter National Bank and Trust is the eighth FDIC-insured institution to fail in the nation this year, and the first in IllinoisFrom the FDIC: First Merchants Bank, National Association, Muncie, Indiana, Assumes All of the Deposits of SCB Bank, Shelbyville, Indiana

As of December 31, 2011, SCB Bank had approximately $182.6 million in total assets and $171.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... SCB Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Indiana.It is Friday.

The pace of closures has slowed. At this point in 2010 and 2011, there were 16 and 14 failures already, respectively.

Greece Update: More Delays and Demonstrations

by Calculated Risk on 2/10/2012 03:52:00 PM

Update: from CNBC: Greek Cabinet Approves Reform Bill; Parliament Expected to Vote on Sunday

From the NY Times: Greece Plunged Into Political Turmoil Over Austerity Measures

Political turmoil deepened here Friday as Prime Minister Lucas Papademos threatened to eject from his fragile interim coalition government any ministers who objected to the country’s new austerity deal withFrom the Athens News: Parties delay crisis meetings, but Venizelos meets minister

“It goes without saying that whoever disagrees and does not vote for the new program cannot stay in the government,” he said in a televised speech to his cabinet following the resignation of several ministers and their deputies.

...

According to local news media outlets, Mr. Papademos plans to announce a reshuffled cabinet on Monday, putting in doubt a parliamentary vote on the new measures that was scheduled for Sunday.

Pasok and New Democracy pushed crisis meetings at their parties back by a day to Saturday, as the coalition government grappled with cabinet resignations and a fierce backlash against minimum wage cuts and other new austerity measures.

...

The finance minister got a hostile reception in Brussels on Thursday, when top eurozone officials told Greece to finalize austerity measures, provide written commitments from the three coalition parties, and push the new measures through parliament before the 130bn deal is approved.