by Calculated Risk on 11/02/2011 07:24:00 AM

Wednesday, November 02, 2011

MBA: Mortgage Purchase Application Index increased slightly

From Reuters: Mortgage applications barely up last week: MBA

The MBA's seasonally adjusted gauge of loan requests for home purchases rose 1.8 percent, while the index of refinancing applications was off 0.2 percent.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

Fixed 30-year mortgage rates averaged 4.31 percent, down 2 basis points from 4.33 percent.

Click on graph for larger image.

Click on graph for larger image.The purchase index is at about the same level as in 1996, and the 4-week average is at the lowest level this year. This does not include cash buyers, but this suggests weaker home sales in November and December.

Tuesday, November 01, 2011

Greece: Who knows?

by Calculated Risk on 11/01/2011 10:32:00 PM

Looks the referendum is back on ... but who knows?

From Reuters: Greece Says Vote on Bailout Is Still On

"The referendum will be a clear mandate and a clear message in and outside Greece on our European course and participation in the euro," [Prime Minister George Papandreou] said, according to a statement released by his office. "No one will be able to doubt Greece's course within the euro."And from the WSJ: Greek Premier Faces Revolt

Papandreou said Greece's partners will support its policies and urged a meeting of G20 leaders this week in Cannes to agree policies that "make sure democracy is above market appetites."

By Tuesday evening, Mr. Papandreou appeared to lack enough support in Parliament to hold a referendum on the rescue package for Greece that European leaders agreed on last week. But while prospects for his high-risk referendum receded, he was also fighting to hold on to power, leaving Europe fretting about the political instability in the country at the heart of the euro-zone crisis.And from the Financial Times: Leaders race to save eurozone deal

Indeed, Mr. Papandreou in a statement issued around 1 a.m. Wednesday in Athens insisted that the referendum would go ahead and would give his economic overhauls a strong mandate.

... Angela Merkel, Germany’s chancellor, and Nicolas Sarkozy, France’s president, summoned George Papandreou, Greek prime minister, to emergency talks in Cannes on Wednesday ... In a joint communiqué, the French and German leaders said they were “determined to ensure the implementation without delay of the decisions adopted at the eurozone summit”, saying they were “more necessary than ever today”.Earlier:

excerpt with permission

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September

• U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

LPS: Foreclosure timelines increase, Mortgage delinquency rate declines slightly in September

by Calculated Risk on 11/01/2011 05:57:00 PM

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Significant Difference in Inventories, Timelines Between Judicial and Non-Judicial States

The September Mortgage Monitor report released by Lender Processing Services, Inc. continues to show significant differences between states that process foreclosures following a judicial vs. non-judicial foreclosure process. ... The time from last payment to foreclosure sale in judicial states is 761 days, which is six months longer than in non-judicial states.According to LPS, 8.09% of mortgages were delinquent in September, down from 8.13% in August, and down from 9.27% in September 2010.

...

Overall, foreclosure starts in September were slightly below the three-year average. Foreclosure timelines continue to increase across the board – almost 40 percent of loans in foreclosure have not made a payment in two years, and 72 percent have not made a payment in a year or more. New problem loan rates increased sharply over the last two months, with 1.6 percent of loans that were current six months ago now 60 or more days delinquent or in foreclosure.

LPS reports that 4.18% of mortgages were in the foreclosure process, up from 4.11% in August, and up from 3.84% in September 2010. This gives a total of 12.27% delinquent or in foreclosure. It breaks down as:

• 2.36 million loans less than 90 days delinquent.

• 1.84 million loans 90+ days delinquent.

• 2.17 million loans in foreclosure process.

For a total of 6.37 million loans delinquent or in foreclosure in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.09% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.18% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.17 million) - and, for judicial states, the average loan in foreclosure has been delinquent for 761 days (six months less for non-judicial states).

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.The total number of loans 90+ delinquent is back to 2008 levels. Most people focus on the GSE seriously delinquent loans, but the private and portfolio loans have much high delinquency rates.

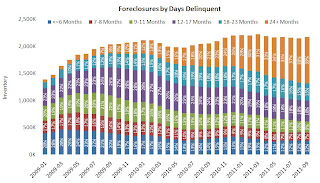

The third graph shows the number of loans in foreclosure by duration of delinquency.

The third graph shows the number of loans in foreclosure by duration of delinquency.There are 2.17 million loans in the foreclosure process and about 39% have been delinquent for more than 2 years, and another 33% have been delinquent for 1 to 2 years. Many of these loans are still in process review.

Although the delinquency rate is trending down slowly, the percent of loans in the foreclosure process seems stuck at a very high level.

Earlier:

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September

• U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

by Calculated Risk on 11/01/2011 04:35:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.26 million SAAR in October. That is up 9.2% from October 2010, and up 1.7% from the sales rate last month (13.04 million SAAR in Sept 2011).

This was slightly above the consensus forecast of 13.2 million SAAR.

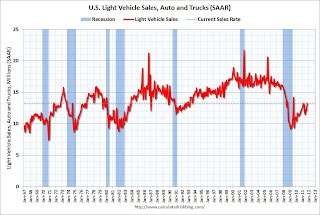

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 13.26 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was just above the February sales and the highest sales rate since August 2009 ("Cash-for-clunkers")

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and if November and December are at the October rate, sales will be up 6.5% in Q4 over Q3.

Preliminary Vehicle Sales for October

by Calculated Risk on 11/01/2011 02:30:00 PM

Note: DJ is quoting an unnamed Greek official saying the referendum is "basically dead".

The early auto sales reports are a little mixed, but it appears sales will be over 13 million SAAR (the consensus is for 13.2 million SAAR). The high for the year was 13.2 million SAAR in February.

I'll post a graph of October auto sales around 4 PM ET.

From the WSJ: October U.S. Auto Sales Hit Yearly Peak

U.S. auto sales surged in October to their fastest pace of year ... GM sales analyst Don Johnson said he expects the sales pace to remain above 13 million vehicles in the final two months of 2011, and to move higher next year.From Bloomberg: Big Three Auto Sales Rise Less Than Estimates

General Motors Co. (GM) and Ford Motor Co. (F) said U.S. deliveries increased less than analysts’ estimates that called for the best sales month since February.Earlier:

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September