by Calculated Risk on 10/14/2011 01:25:00 PM

Friday, October 14, 2011

See-Saw Economy or a Series of Shocks?

Kelly Evans at the WSJ makes an interesting observation: Economy in Full Swing (Watch Your Head)

So far, incoming September economic reports have been surprisingly firm. Auto sales rebounded to their highest level since April. Chain-store sales posted year-on-year growth of 5.5%. The economy added 103,000 jobs, and manufacturing sentiment improved a bit. [Retail sales increased 1.1% in September]

...Monthly GDP isn't released by the Bureau of Economic Analysis (BEA). Evans is using an estimate from Macroeconomic Advisers.

If this feels like a 180-degree turn from August, that's because it basically is. It would be one thing if this were a special case, or a broad turning point in the economy. But, in fact, this kind of volatility, these jerky swings in growth, have become the norm. Consider what has happened so far this year: Real gross domestic product shrank in January and February, according to tracking firm Macroeconomic Advisers. Then it surged by more than 1% in March. It contracted again in May and June—only to jump by more than 1% again in July.

This isn't typical. Since 1992, monthly GDP has fallen about a third of the time when the economy hasn't been in recession. This year, even assuming a small gain in August, monthly GDP has fallen about half the time.

The BEA does release monthly Personal Consumption Expenditures (PCE) data, and the following graph shows the monthly change in real PCE back to 1995.

Click on graph for larger image.

Click on graph for larger image.Real PCE has declined in three months this year through August (September will be positive based on the retail report). We have seen multiple declines in a year before - outside of a recession - like in 1995 and 2005. Many of the monthly declines were during recessions, but many monthly declines were event driven (like hurricanes Katrina and Rita in 2005). The sharp decline in September 2009 was due to the end of "cash-for-clunkers" (another event).

Although growth is sluggish - due to the significant slack in the system (excess capacity, lack of demand) and also high levels of household debt, I think the volatility this year can be blamed on a series of events including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August.

Also the ongoing European financial crisis keeps flaring up and impacting the U.S. economy.

Yes, the economy is very sluggish - 103,000 jobs was a weak report, just better than low expectations - but I think the economic volatility is related to events and hopefully not some new normal.

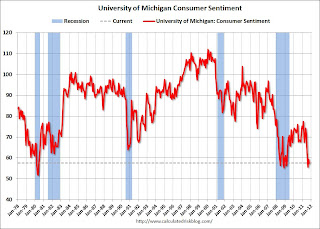

Consumer Sentiment declines in October

by Calculated Risk on 10/14/2011 09:55:00 AM

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.

Click on graph for larger image in graph gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate. History suggests it usually takes 2 to 4 months to bounce back from an event (If we can call the threat of default an "event"). So sentiment might increase over the next couple of months.

And, of course, any bounce back from the debt ceiling debate would be to an already weak reading.

This was very weak, and below the consensus forecast of 60.0.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/14/2011 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted, after revisions), and sales were up 7.9% from September 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $395.5 billion, an increase of 1.1 percent (±0.5%) from the previous month and 7.9 percent (±0.7%) above September 2010. Total sales for the July through September 2011 period were up 8.0 percent (±0.7%) from the same period a year ago. The July to August 2011 percent change was revised from virtually unchanged (±0.5%)* to +0.3 percent (±0.2%).Retail sales excluding autos increased 0.6% in September. Sales for August were revised up to a 0.3% increase.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 18.9% from the bottom, and now 4.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales).

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales). The consensus was for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto.

This was a strong report, especially with the upward revisions to both July and August.

Europe: Spain debt downgraded, Deadline for European Banks to raise capital

by Calculated Risk on 10/14/2011 12:02:00 AM

A few articles on Europe ...

From the Financial Times: S&P cuts Spain’s sovereign debt rating

[S&P] knocked Spain’s rating down one notch from double A ... to double A minus. It also kept the ... negative outlook.From the WSJ: Spain Deficit Raises EU Risks

S&P’s statement said ...there were “heightened risks to Spain’s growth prospects” due to high unemployment, tighter financial conditions, a high level of debt and a broader eurozone slowdown.

excerpt with permission

From the NY Times: European Banks Face Deadline to Raise Capital Levels

Europe’s banks face a deadline of three to six months to strengthen their balance sheets and to compensate for the decline in value of Greek and other south European sovereign debt, European officials said Thursday.

Thursday, October 13, 2011

DataQuick: SoCal Home sales increase slightly year-over-year in Sept

by Calculated Risk on 10/13/2011 07:30:00 PM

Existing home sales for September will be released on Thursday Oct 20th.

From DataQuick: Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

A total of 18,149 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in September. That was down 7.7 percent from 19,654 in August and up 0.3 percent from 18,091 in September 2010, according to San Diego-based DataQuick.So 32.3 percent were foreclosure resales and 18.5 percent were short sales - over 50% were distressed sales in September.

It’s normal for home sales to drop between August and September, partly because many home buyers try to close their deals before school starts in late summer.

...

Last month’s sales were 25.3 percent below the September average of 24,310 transactions since 1988.

...

“Last month’s Southland sales weren’t great but, like some other economic indicators of late, they came in a bit higher than some might have expected. Holding steady with a year ago isn’t so bad when you consider the hits the housing market has taken in recent months ...” said John Walsh, DataQuick president.

...

Foreclosure resales – properties foreclosed on in the prior 12 months – made up 32.3 percent of the Southland resale market in September, down from 32.4 percent in August and 33.6 percent a year earlier. Last month’s figure was the lowest since January 2008, when foreclosure resales were 28.6 percent. They peaked at 56.7 percent in February 2009.

Short sales, where the sale price fell short of what was owed on the property, made up an estimated 18.5 percent of Southland resales last month. That was up from 17.5 percent in August and 16.1 percent a year ago. Two years ago the estimate was 15.3 percent.

...

Southland buyers paying cash accounted for 28.5 percent of total September home sales, paying a median $210,000.